Question: please break down how to do number 5 and explain exactly how the expected price and rate of returns were calculated. Idk where the 1.05,1.06,1.07

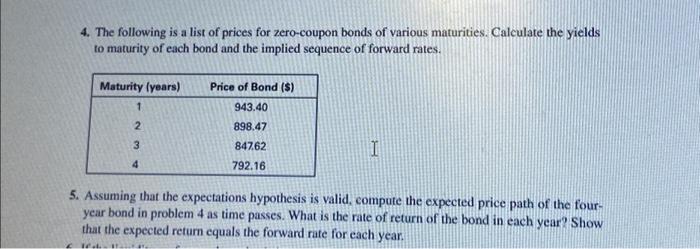

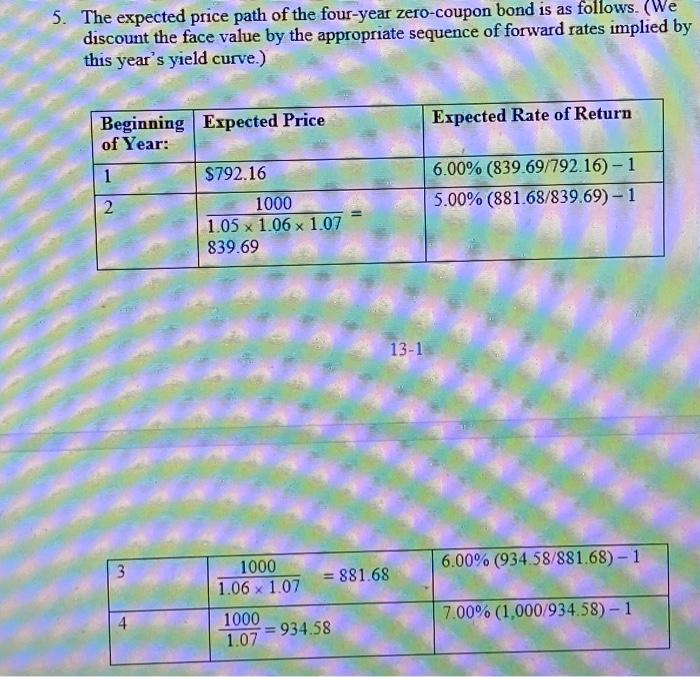

4. The following is a list of prices for zero-coupon bonds of various maturities. Calculate the yields to maturity of each bond and the implied sequence of forward rates. 5. Assuming that the expectations hypothesis is valid, compute the expected price path of the fouryear bond in problem 4 as time passes. What is the rate of return of the bond in each year? Show that the expected return equals the forward rate for each year. The expected price path of the four-year zero-coupon bond is as follows. (We discount the face value by the appropriate sequence of forward rates implied by this year's yield curve.) 131

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts