Question: Please break down the solutions, I'm not understanding these questions (a-d). Thank you for your help! On January 1, 2024, the general ledger of 3D

Please break down the solutions, I'm not understanding these questions (a-d). Thank you for your help!

Please break down the solutions, I'm not understanding these questions (a-d). Thank you for your help!

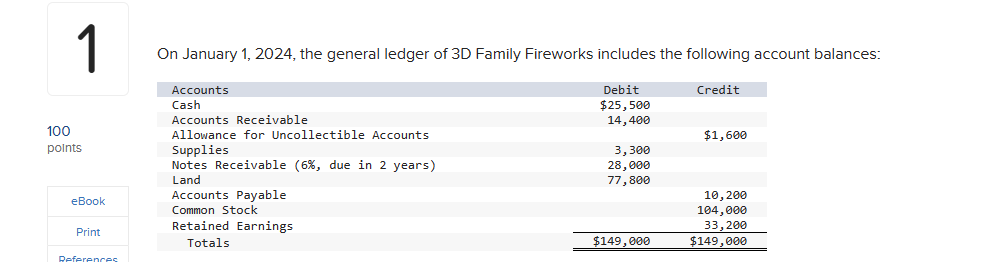

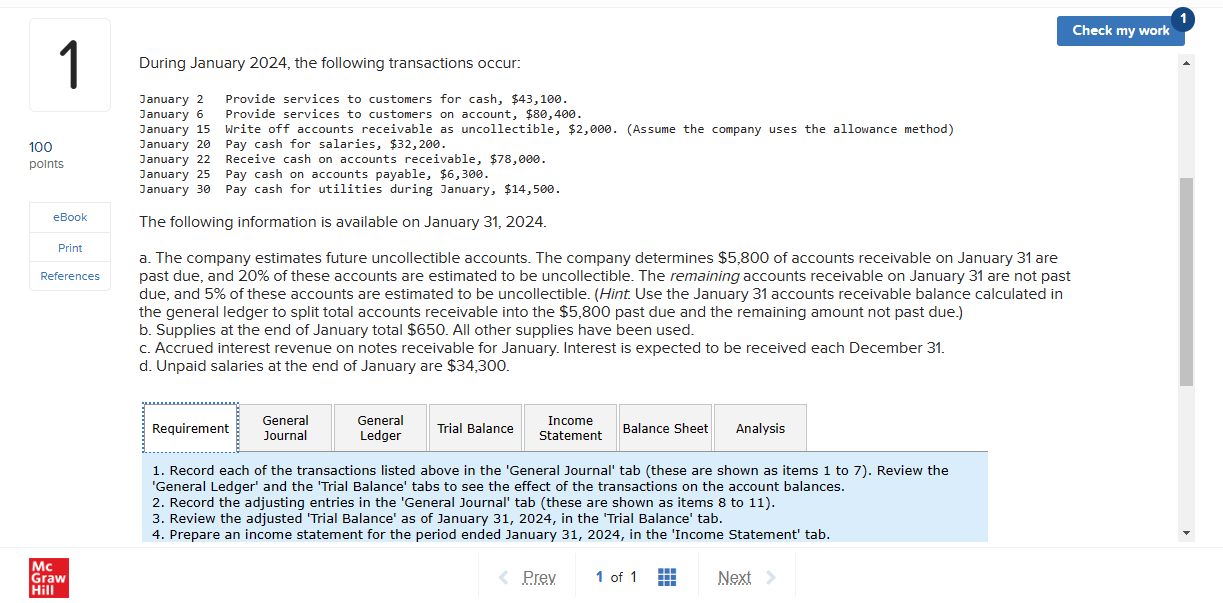

On January 1, 2024, the general ledger of 3D Family Fireworks includes the following account balances: During January 2024 , the following transactions occur: January 2 Provide services to customers for cash, $43,100. January 6 Provide services to customers on account, $80,400. January 15 Write off accounts receivable as uncollectible, $2,000. (Assume the company uses the allowance method) January 20 Pay cash for salaries, $32,200. January 22 Receive cash on accounts receivable, $78,000. January 25 Pay cash on accounts payable, $6,300. January 30 Pay cash for utilities during January, $14,500. The following information is available on January 31, 2024. a. The company estimates future uncollectible accounts. The company determines $5,800 of accounts receivable on January 31 are past due, and 20% of these accounts are estimated to be uncollectible. The remaining accounts receivable on January 31 are not past due, and 5% of these accounts are estimated to be uncollectible. (Hint. Use the January 31 accounts receivable balance calculated in the general ledger to split total accounts receivable into the $5,800 past due and the remaining amount not past due.) b. Supplies at the end of January total $650. All other supplies have been used. c. Accrued interest revenue on notes receivable for January. Interest is expected to be received each December 31 . d. Unpaid salaries at the end of January are $34,300. 1. Record each of the transactions listed above in the 'General Journal' tab (these are shown as items 1 to 7 ). Review the 'General Ledger' and the 'Trial Balance' tabs to see the effect of the transactions on the account balances. 2. Record the adjusting entries in the 'General Journal' tab (these are shown as items 8 to 11 ). 3. Review the adjusted 'Trial Balance' as of January 31,2024 , in the 'Trial Balance' tab. 4. Prepare an income statement for the period ended January 31,2024 , in the 'Income Statement' tab. On January 1, 2024, the general ledger of 3D Family Fireworks includes the following account balances: During January 2024 , the following transactions occur: January 2 Provide services to customers for cash, $43,100. January 6 Provide services to customers on account, $80,400. January 15 Write off accounts receivable as uncollectible, $2,000. (Assume the company uses the allowance method) January 20 Pay cash for salaries, $32,200. January 22 Receive cash on accounts receivable, $78,000. January 25 Pay cash on accounts payable, $6,300. January 30 Pay cash for utilities during January, $14,500. The following information is available on January 31, 2024. a. The company estimates future uncollectible accounts. The company determines $5,800 of accounts receivable on January 31 are past due, and 20% of these accounts are estimated to be uncollectible. The remaining accounts receivable on January 31 are not past due, and 5% of these accounts are estimated to be uncollectible. (Hint. Use the January 31 accounts receivable balance calculated in the general ledger to split total accounts receivable into the $5,800 past due and the remaining amount not past due.) b. Supplies at the end of January total $650. All other supplies have been used. c. Accrued interest revenue on notes receivable for January. Interest is expected to be received each December 31 . d. Unpaid salaries at the end of January are $34,300. 1. Record each of the transactions listed above in the 'General Journal' tab (these are shown as items 1 to 7 ). Review the 'General Ledger' and the 'Trial Balance' tabs to see the effect of the transactions on the account balances. 2. Record the adjusting entries in the 'General Journal' tab (these are shown as items 8 to 11 ). 3. Review the adjusted 'Trial Balance' as of January 31,2024 , in the 'Trial Balance' tab. 4. Prepare an income statement for the period ended January 31,2024 , in the 'Income Statement' tab

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts