Question: *please briefly explain your answer as well. Thanks* For simplicity, assume that customers never pay in advance. A company booked $100 in sales revenue in

*please briefly explain your answer as well. Thanks*

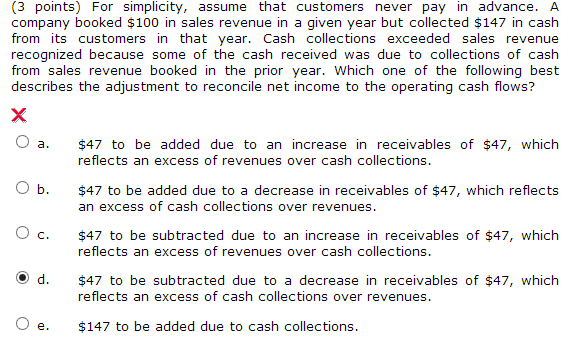

For simplicity, assume that customers never pay in advance. A company booked $100 in sales revenue in a given year but collected $147 in cash from its customers in that year. Cash collections exceeded sales revenue recognized because some o f the cash received was due to collections of cash from sales revenue booked in the prior year. Which one o f the following best describes the adjustment to reconcile net income to the operating cash flows? $47 to be added due to an increase in receivables of $47, which reflects an excess o f revenues over cash collections. $47 to be added due to a decrease in receivables of $47, which reflects an excess o f cash collections over revenues. $47 to be subtracted due to an increase in receivables of $47, which reflects an excess of revenues over cash collections. $47 to be subtracted due to a decrease in receivables of $47, which reflects an excess of cash collections over revenues. $147 to be added due to cash collections

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts