Question: **PLEASE CALCUALTE AND SHOW WORK. THE AMOUNTS IN THE BOXES (763,000 & 160,230) ARE WRONG. Shimmer Inc. is a calendar-year-end, accrual-method corporation. This year, it

**PLEASE CALCUALTE AND SHOW WORK. THE AMOUNTS IN THE BOXES (763,000 & 160,230) ARE WRONG.

**PLEASE CALCUALTE AND SHOW WORK. THE AMOUNTS IN THE BOXES (763,000 & 160,230) ARE WRONG.

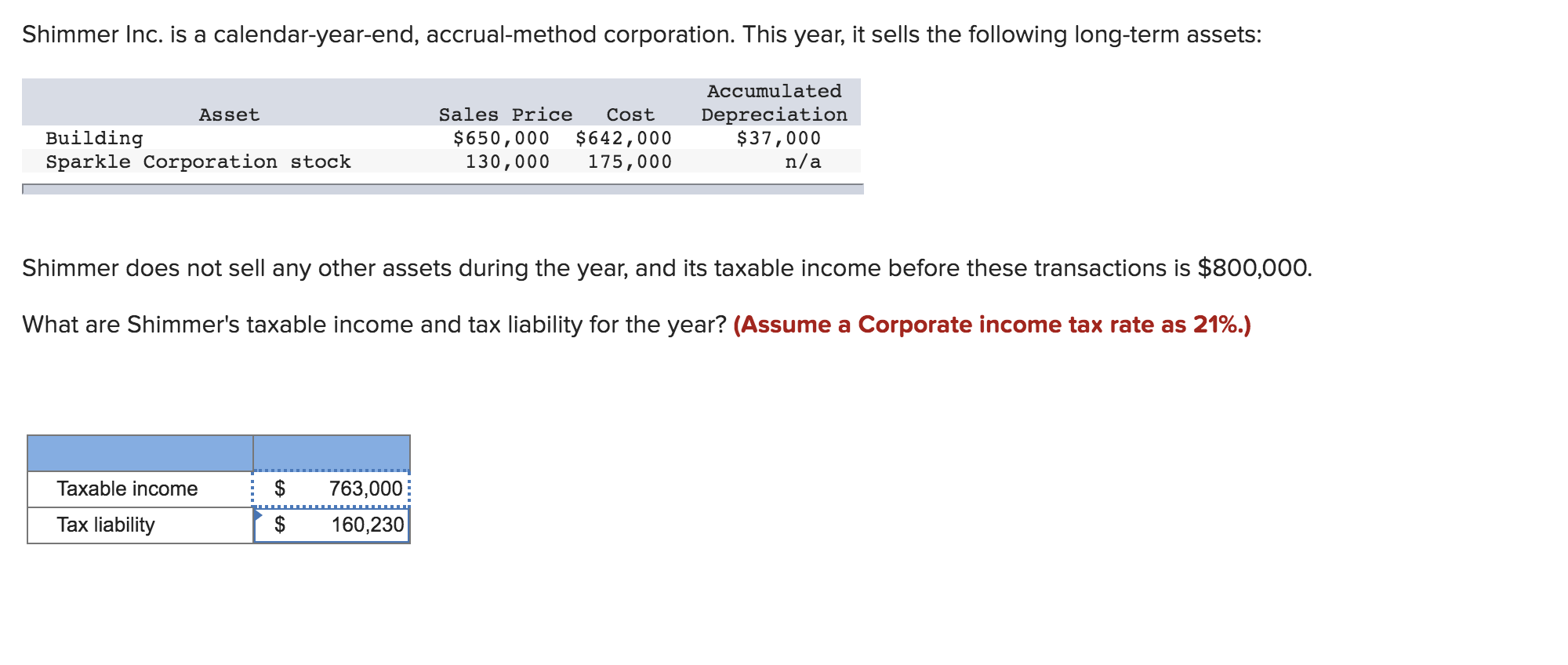

Shimmer Inc. is a calendar-year-end, accrual-method corporation. This year, it sells the following long-term assets: Asset Building Sparkle Corporation stock Sales Price Cost $ 650,000 $642,000 130,000 175,000 Accumulated Depreciation $37,000 n/a Shimmer does not sell any other assets during the year, and its taxable income before these transactions is $800,000. What are Shimmer's taxable income and tax liability for the year? (Assume a Corporate income tax rate as 21%.) Taxable income Tax liability $ $ 763,000 160,230

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock