Question: Please calculate a modified IRR for this project assuming a discount and compounding rate of 10.1% Using the MIRR and a cost of capital at

Please calculate a modified IRR for this project assuming a discount and compounding rate of 10.1%

Using the MIRR and a cost of capital at 10.1%, would you take the project?

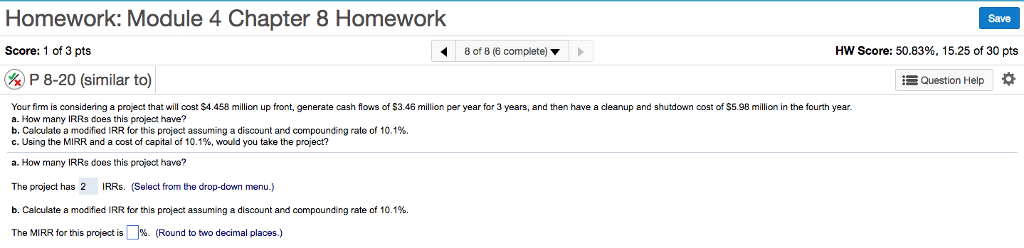

Homework: Module 4 Chapter 8 Homework Save Score: 1 of 3 pts 8of8(6 complete) > HW Score: 50.83%, 15.25 of 30 pts 8-20 (similar to) Question Help Your firm is considering a project that will cost $4.458 million up front, generate cash flows of $3.46 illion per year for 3 years, and then have a cleanup and shutdown cost of $5.98 million in the fourth year. a. How many IRRs does this project have? b. Calculate a modified IRR for this project assuming a discount and compounding rate of 10.1%. c. Using the MIRR and a cost of capital of 10.1%, would you take the project? a. How many IRRs does this project have? The project has 2 IRRs. (Select from the drop-down menu.) b. Calculate a modified IRR for this project assuming a discount and compounding rate of 10.1% The MIRR for this project is (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts