Question: Please calculate all a, b, c, d, e, f and g. C project A and E both projects are especially difficult for me. Thank you

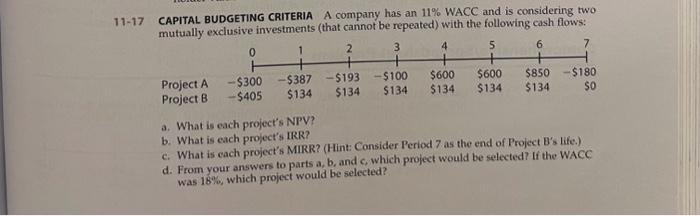

-17 CAPITAL BUDGETING CRITERIA A company has an 11% WACC and is considering two mutuallv exclusive investments (that cannot be repeated) with the following cash flows: a. What is each project's NPV? b. What is each project's IRR? c. What is each project's MIRR? (Hint: Consider Period 7 as the end of Project B's life.) d. From your answers to parts a, b, and c, which project would be selected? If the WACC was 18%, which project would be selected? e. Construct NPV profiles for Projects A and B. f. Calculate the crossover rate where the two projects' NPVs are equal. g. What is each project's MIRR at a WACC of 18%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts