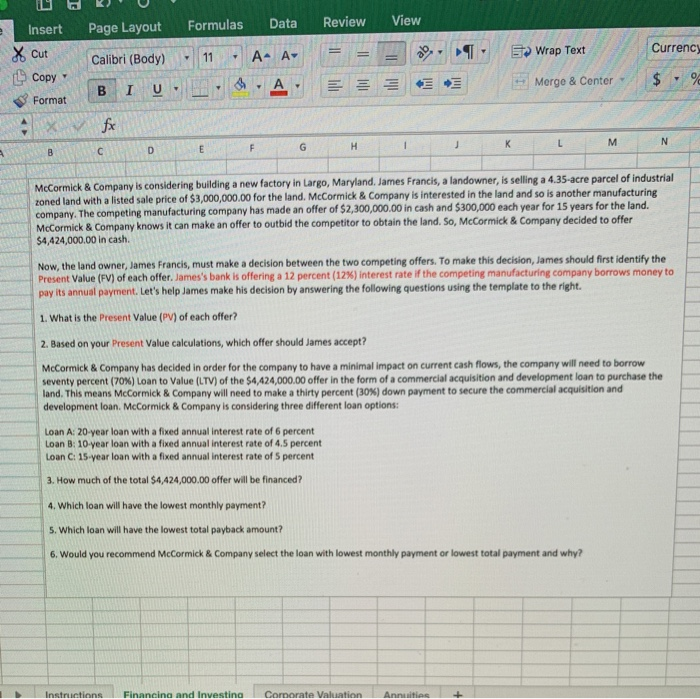

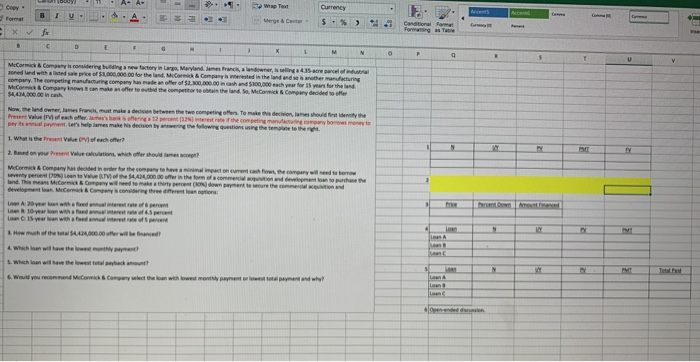

Question: please calculate and answer all the questions below. Formulas for calculations are needed as well. i made it bigger, hopefully it's clear Calibri (Body 11

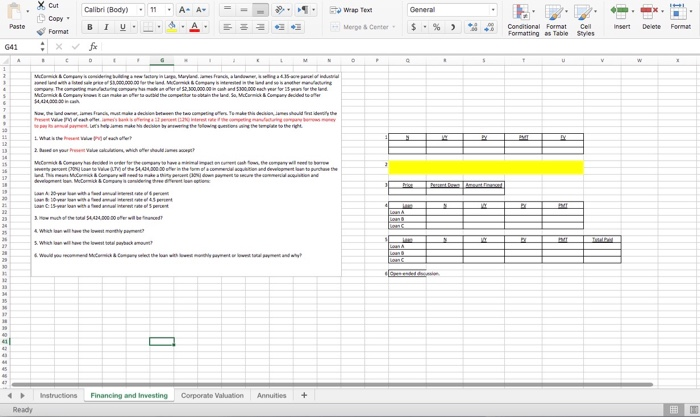

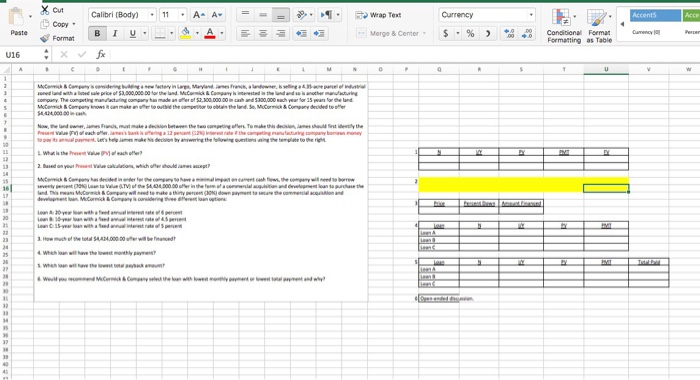

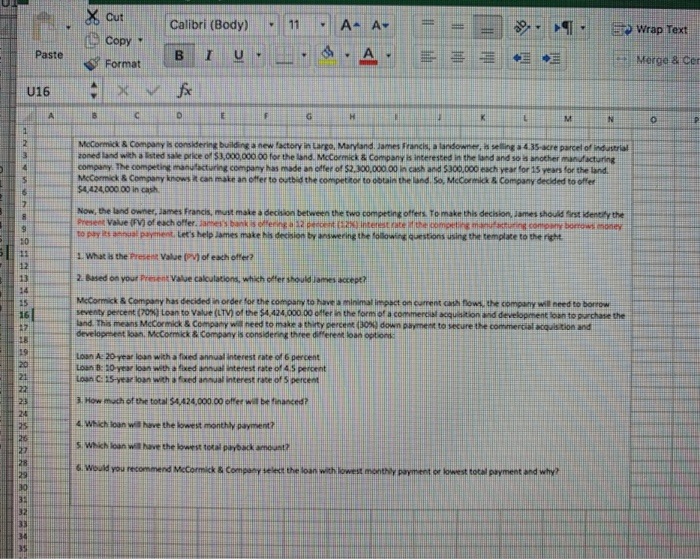

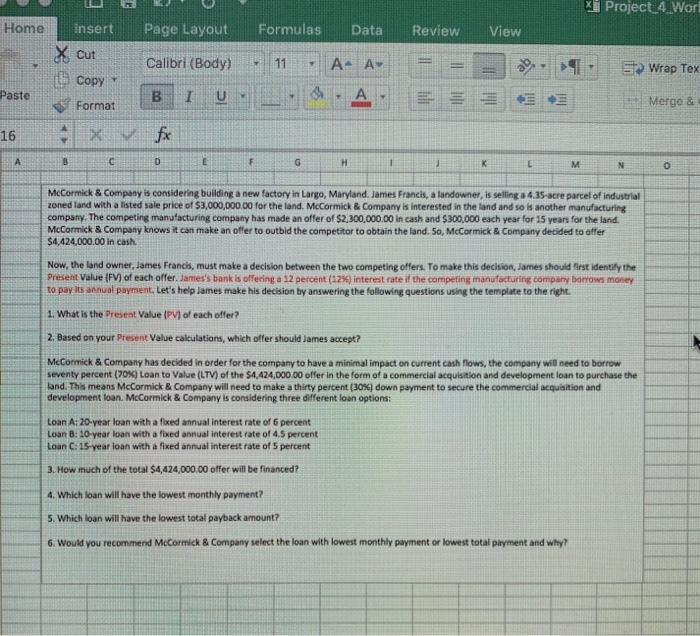

Calibri (Body 11 A A Wrap Text General Paste X Cut Copy Format X B 1 More & Center $ - % ) Conditional Format Cell Formatting as Table Styles Insert Delente Format G41 fx A 5 T u V w . Marmid Acompany.codering water in Maryland Franck, anders gerald compare the competing during my teade ner 2.300,000.00 cub wd 5.800.000 a year for the land. Mommy oferta taid the competitor tabtain the land. So, McCarnic Company decided to her M/ 30 36 Trontolan to Viette 16.000 fer in the form of a commande quite and development un to purchase the wed. This means.com Company wed to make down to the common Part la 15-marion with an interest rate percent RE 22 LA 25 36 RI 20 Loan Von > 38 2 Instructions Financing and Investing Corporate Valuation Annuities Ready Cut Calibri (Body 11 A. A Wrap Text Currency Accents Asce Copy Paste B 1 U- Merge Center $ - % 2 Currency Format Conditional Format Formatting as Table U16 A 5 1 U V w 1 2 6 Mick & Company widering stay in Larp, Maytenderes kandowner, Welling. W word and with a le price of 5.000.000 for the und. M.Carmid I company interested in the land and to another maracturing company. The competing and acturing company has made ter 2.200.000.0 inch 300,000 each year for en freund Por our own can now where we come. Mormos como de ore Now, the land owner, mens ande, mast make a decision teen the two coreeting etters. To make the decision, ames should be lifesty the we wachten bunker 1 percent (1799 tert rate the competing the many browney soment teams makes decision by were the following overstong the temple to the right 10 2. Band on your own we callation, which offer should met? Curry decided here the commitment how they were borrow teret Lanta Vale of the 54.04.2000 offer in the commercial and relation to purchase the und Taman MCA Company will need to make thiny Dr Odown payment to see the corner on and 20 23 Love with a few were Love with two Low: 15-year loan with and were rate of per 1. How much of the total SAAM,000.00 will be named TA 23 20 28 20 20 12 11 13 18 4 X cut 9 Copy Calibri (Body) 11 . 5 Wrap Text Paste B I U A. Format Merge & cer U16 f A B C 0 E - G H K E M N 1 2 3 4 $ McCormick & Company is considering building a new factory in targo, Maryland, James Francis, landowne, selling 435-re parcel of industrial zoned and with a sted sale price of $3,000,000.00 for the land. McCormick & Company is interested in the land and so another manufacturing company. The competing manufactu company has made an offer of 2.200,000.00 in cash and $300.000 each year for 15 years for the land McCormick & Company knows it can make an offer to outbid the competitor to obtain the land so, McCormick & Company decided to offer $4424,000.00 in cash 2 Now, the land owner, James Francis, must make a decision between the two competing offers. To make this decision James should fit identify the Present Valve (FV) of each offer sofern interested the competing facturing commoner TO payment Let's help james make his decision by answering the following questions using the template to the right 1. What is the Present Value of each offer? 2. Based on your Present Value calculations, which offer should accept? McCormick & Company has decided in order for the company to have minimal impact on current cow, the company will need to borrow seventy percent (70) Loan to Value (LTV) of the $4.424.000,00 offer in the form of a commercial acquisition development loan to purchase the land. This means McCormick & Company will need to make a thirty percent (e down payment to secure the commercial acquisition and development in McCormick & Company is considering three different loan option 9 10 11 12 13 14 15 16 AZ 18 19 20 20 22 23 24 25 26 27 28 29 30 3 32 LA 20 year loan with a fixed annual interest rate of 6 percent Li: Dy loan with a fixed annual interest rate of 45 percent LC5-year loan with a fod annual interest rate of percent How much of the total 54.424,000.00 offer will be financed? Which loan will have the lowest monthly payment? S whicloan wil have the lowest to payback amount? Would you recommend McCormick & Company set the loan with lowest monthly payment or lowest total payment and why? * Project_4_Wor Home Page Layout Formulas Data Review View Insert X Cut Copy Calibri (Body) 11 A4 Av Wrap Tex Paste B 1 U . Format Merge & 16 fx A B c D E F G H K L M N 0 McCormick & Company is considering building a new factory in Largo, Maryland. James Francis, a landowner, is selling a 4. 35-acre parcel of industrial zoned land with a listed sale price of $3,000,000.00 for the land. McCormick & Company is interested in the land and so is another manufacturing company. The competing manufacturing company has made an offer of $2,300,000.00 in cash and $300,000 each year for 15 years for the land. McCormick & Company knows it can make an offer to outbid the competitor to obtain land. So, McCormick & Company decided to offer $4,424,000.00 in cash Now, the land owner, James Francis, must make a decision between the two competing offers. To make this decision, James should first identify the Present Value (FV) of each offer. James's bank is offering a 12 percent (12%) interest rate if the competing manufacturing company borrows money to pay its annual payment. Let's help lames make his decision by answering the following questions using the template to the right 1. What is the Present Value (PV) of each offer? 2. Based on your Present Value cakulations, which offer should James accept? McCormick & Company has decided in order for the company to have a minimal impact on current cash flows, the company will need to borrow seventy percent (70%) Loan to Value (LTV) of the 54,424,000.00 offer in the form of a commercial acquisition and development loan to purchase the land. This means McCormick & Company will need to make a thirty percent (30%) down payment to secure the commercial acquisition and development loan. MeCormick & Company is considering three different loan options: Loan A: 20-year loan with a fixed annual interest rate of 6 percent Loan B: 10-year loan with a fixed annual interest rate of 4.5 percent Loan C: 15-year loan with a fixed annual interest rate of 5 percent 3. How much of the total $4,424,000.00 offer will be financed? 4. Which loan will have the lowest monthly payment? 5. Which loan will have the lowest total payback amount? 6. Would you recommend McCormick & Company select the loan with lowest monthly payment or lowest total payment and why? Data Formulas Review View Page Layout Insert X Cut Currency Wrap Text Calibri (Body) 11 A- A+ Copy A Merge & Center $ % B I U Format fx K M L N F C D E B McCormick & Company is considering building a new factory in Largo, Maryland, James Francis, a landowner, is selling a 4.35-acre parcel of industrial zoned land with a listed sale price of $3,000,000.00 for the land. McCormick & Company is interested in the land and so is another manufacturing company. The competing manufacturing company has made an offer of $2,300,000.00 in cash and $300,000 each year for 15 years for the land. McCormick & Company knows it can make an offer to outbid the competitor to obtain the land. So, McCormick & Company decided to offer $4,424,000.00 in cash. Now, the land owner, James Francis, must make a decision between the two competing offers. To make this decision, James should first identify the Present Value (FV) of each offer. James's bank is offering a 12 percent (12%) interest rate if the competing manufacturing company borrows money to pay its annual payment. Let's help James make his decision by answering the following questions using the template to the right. 1. What is the Present Value (PV) of each offer? 2. Based on your Present Value calculations, which offer should James accept? McCormick & Company has decided in order for the company to have a minimal impact on current cash flows, the company will need to borrow seventy percent (70%) Loan to Value (LTV) of the $4,424,000.00 offer in the form of a commercial acquisition and development loan to purchase the land. This means McCormick & Company will need to make a thirty percent (30%) down payment to secure the commercial acquisition and development loan. McCormick & Company is considering three different loan options: Loan A: 20-year loan with a fixed annual interest rate of 6 percent Loan B: 10-year loan with a fixed annual interest rate of 4.5 percent Loan C: 15-year loan with a fixed annual interest rate of 5 percent 3. How much of the total $4,424,000.00 offer will be financed? 4. Which loan will have the lowest monthly payment? 5. Which loan will have the lowest total payback amount? 6. Would you recommend McCormick & Company select the loan with lowest monthly payment or lowest total payment and why? Instructions Financing and Investing Corporate Valuation Annuiting boy A Wrap Text Currency 2 copy Format BI U Acco erge Center $ - % > x Conditional format Formatges Table D E F G H O P $ U McCormick & Company contering building a new factory in Large, Maryland, lames Franca, ludowner, ein 435 acre parcela oned and with ale sale price of $1,000,000 for the land. Men Company is rested in the land and so other manufacturing company. The competing mang company has made of $200,000.00 in cash and $100.000 each year for 15 years for the end MC & Company news can make an offer to vtid the competitor to obtain the land, McCormick Company decided to offer SU000.00 inch Now, the land owner, James Franck, must make decision between the two competing others. To make a decision, one should feel the Present of the banks og 12 perc) werest the competing manufactura browser to Dysment. Let's helplanes make his decision by the following questions in the template to the 1. What is the present Value of each offer 2. Bonus Valeation, which offer should lames McCormick Company has decided in order for the company to have concurrent cash flows, the company will need to borrow wenty percent posten to of the 544,000.00 offer in the form of a commercialisti and development loan to purchase the land. That means M.Carme Company will need to make thirty percent down payment to see the commentioned development Mecom & Camcordering the different lantion Loan Ayears with a free of Low 15 year with a few of 3. How much of the 444,000.00 ter wille financed IY 2 lo N WY PVT & Would you recommend Comic & Company select the loan with my mentor lowest opened why? LA Onderson

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts