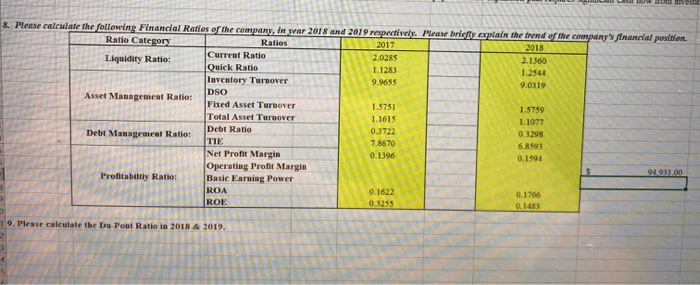

Question: please calculate DSO, Opersting profit margin, basic earning power womes 8. Please calculate the following Financial Ratios of the company, in pear 2018 and 2010

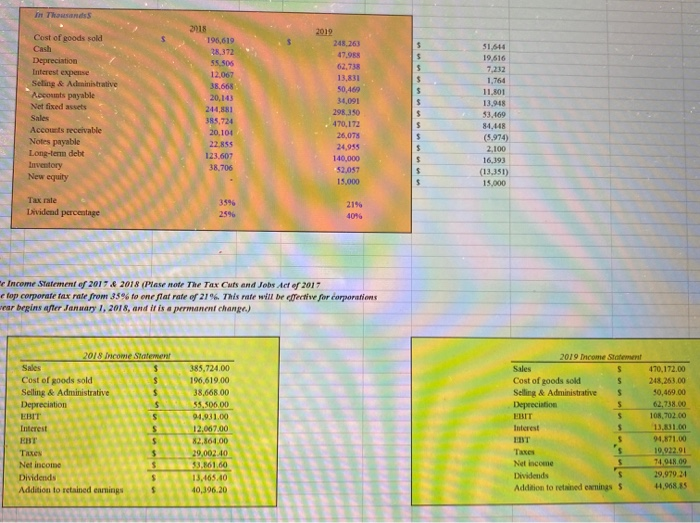

womes 8. Please calculate the following Financial Ratios of the company, in pear 2018 and 2010 respectively. Please briefly explain the trend of the company's financial position Ratio Category Ratios 2017 2018 Liquidity Ratio: Current Ratio 2.0285 2.1360 Quick Ratio 1.1283 1.2544 Inventory Turnover 9.9655 9.0319 Asset Management Ratio: DSO Fixed Asset Turnover 1.5751 1.5759 Total Asset Turnover 1.1615 1.1077 Debt Ratio 0.3722 Debt Management Ratio: 0.3298 TIE 7.8670 6.8593 Net Profit Margin 0.1396 0.1594 Operating Profit Margin 91.031.00 Profitability Ratio: Basic Earning Power ROA 0.1622 0.1766 ROE 0.3255 0.143 19. Please calculate the DuPont Ratio in 2018 2019. 4 in Thassan Cost of goods sold Cash Depreciation Interest expense Seling & Administrative Accounts payable Net fixed assets Sales Accounts receivable Notes payable Long-ten debt Inventory New equity 2018 196,619 28,372 55,505 12.067 38.663 20.143 244,881 385,724 20.101 22.85$ 123,607 38,706 2012 248,263 47.988 62.738 13,831 50,469 314,091 298,350 470,172 26,073 24,955 140,000 52,057 15.000 $ $ $ $ $ $ $ $ $ $ 51.544 19.516 7,232 1.764 11.501 13.948 53.169 84.448 (5.974) 2.100 16,393 (13,351) 15.000 $ $ Tax rate Lxvidend percentage 3596 2596 2196 4096 c Income Statement of 2017.6 2018 (Plase mofe The Tax Cuts and Jobs Act of 2017 elop corporate fax rate from 35% to one flat rate of 21%. This rate will be rectiwe for corporations var begins after January 1, 2018, and it is a permanent change) 470,172.00 248,263.00 50,469.00 108,702.00 2018 Income Statement Sales Cost of goods sold S Selling & Administrative $ Depreciation $ EBIT S Interest S $ Taxes Net Income $ Dividends $ Addition to retained earnings 385,724.00 196,619.00 38.668.00 55.506,00 94,931.00 12.067.00 82.864.00 29,002.40 33.861.60 13,465.40 40.396.20 2019 Income Statement Sales Cost of goods sold S Selling & Administrative s Depreciation $ $ Interest $ FIT $ Taxes Net Income S Dividends $ Addition to reminderings $ 94,871.00 19.932.91 74.911 09 19.979.24 44.968.85

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts