Question: please calculate it by steps Question 5: Consider Al Mazoon dairy, an all-equity firm that is considering going into debt (Maybe some of the original

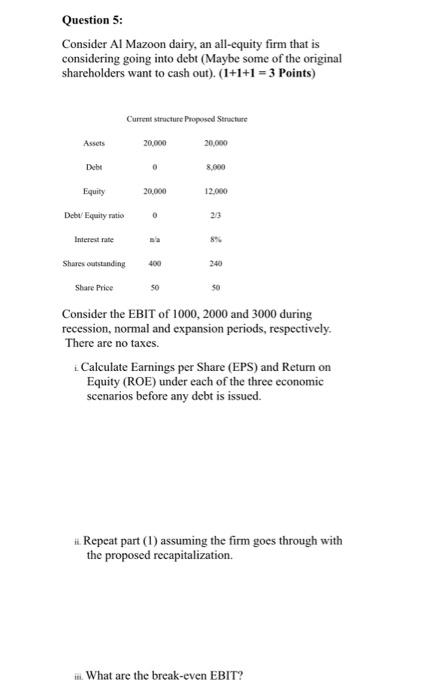

Question 5: Consider Al Mazoon dairy, an all-equity firm that is considering going into debt (Maybe some of the original shareholders want to cash out). (1+1+1 = 3 Points) Current structure proposed Structure Assets 20.000 20,000 Dobi 0 8.000 Equity 20,000 12.000 Debt/Equity ratio 0 0 2/3 Interest rate 400 240 50 50 Shares outstanding Share Price Consider the EBIT of 1000, 2000 and 3000 during recession, normal and expansion periods, respectively. There are no taxes. Calculate Earnings per Share (EPS) and Return on Equity (ROE) under each of the three economic scenarios before any debt is issued. . Repeat part (1) assuming the firm goes through with the proposed recapitalization. in. What are the break-even EBIT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts