Question: Please calculate it manually step by step. Thank you. 4. Given the following information regarding an income producing property, determine the unlevered internal rate of

Please calculate it manually step by step. Thank you.

Please calculate it manually step by step. Thank you.

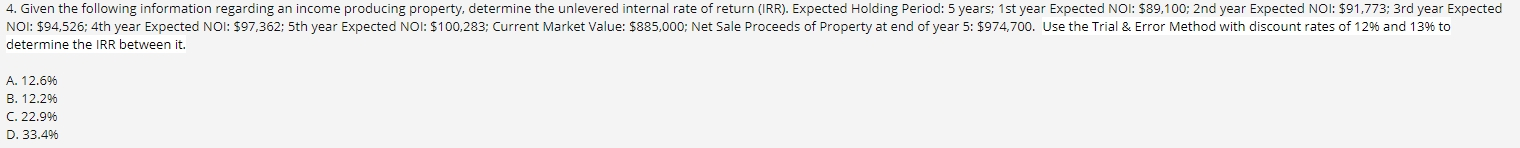

4. Given the following information regarding an income producing property, determine the unlevered internal rate of return (IRR). Expected Holding Period: 5 years: 1st year Expected NOI: $89,100; 2nd year Expected NOI: $91,773; 3rd year Expected NOI: $94,526; 4th year Expected NOI: $97,362; 5th year Expected NOI: $100,283; Current Market Value: $885,000; Net Sale Proceeds of Property at end of year 5: $974,700. Use the Trial & Error Method with discount rates of 12% and 13% to determine the IRR between it A. 12.696 B. 12.296 C. 22.9% D. 33.4%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts