Question: Please calculate part b) based off the info in part a) which is correct. Complete the aging schedule and calculate the total estimated uncollectible accounts

Please calculate part b) based off the info in part a) which is correct.

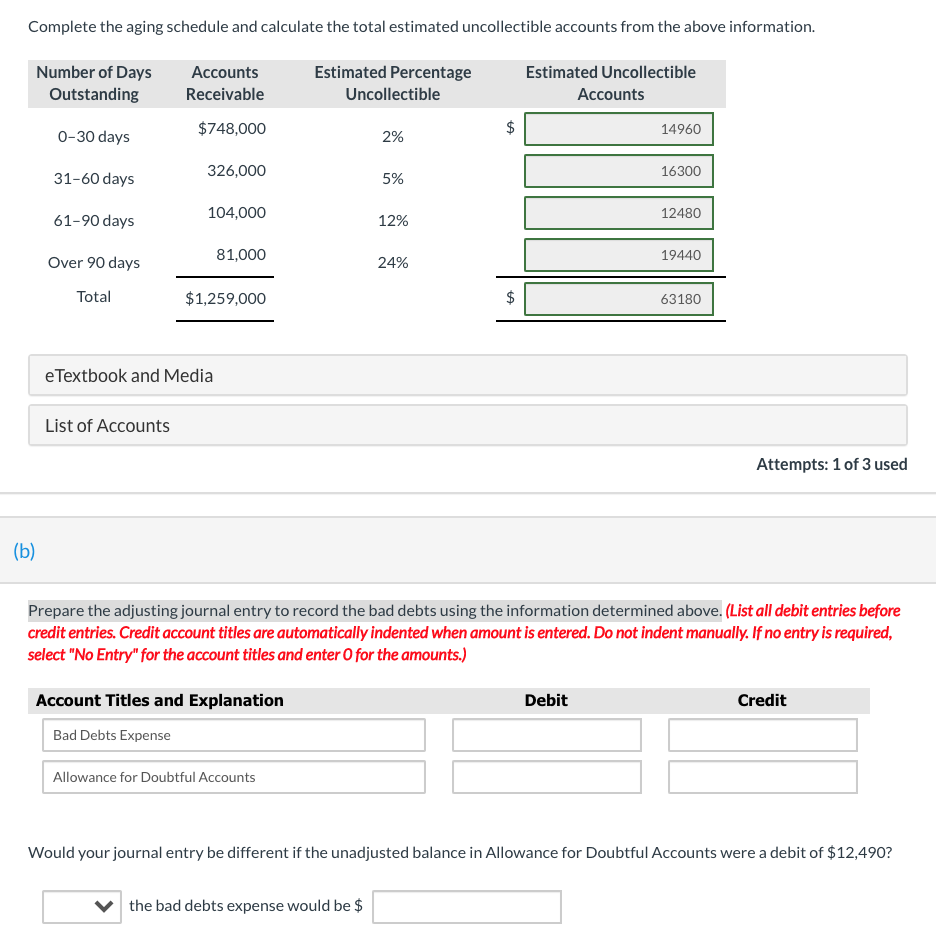

Complete the aging schedule and calculate the total estimated uncollectible accounts from the above information. Number of Days Outstanding Accounts Receivable $748,000 Estimated Percentage Uncollectible Estimated Uncollectible Accounts $ 0-30 days 2% 14960 31-60 days 326,000 16300 5% 104,000 61-90 days 12% 12480 81,000 19440 Over 90 days 24% Total $1,259,000 $ 63180 e Textbook and Media List of Accounts Attempts: 1 of 3 used (b) Prepare the adjusting journal entry to record the bad debts using the information determined above. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Debit Credit Account Titles and Explanation Bad Debts Expense Allowance for Doubtful Accounts Would your journal entry be different if the unadjusted balance in Allowance for Doubtful Accounts were a debit of $12,490? the bad debts expense would be $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts