Question: Please calculate the basic and diluted EPS: TJX, Inc., an apparel retailer, reported net income (amounts in thousands) of $609,699 for Year 4. The weighted

Please calculate the basic and diluted EPS:

TJX, Inc., an apparel retailer, reported net income (amounts in thousands) of $609,699 for Year 4. The weighted average of common shares outstanding during Year 4 was 488,809 shares. TJX, Inc., subtracted interest expense net of tax saving on convertible debt of $4,482. If the convertible debt had been converted into common stock, it would have increased the weighted-average common shares outstanding by 16,905 shares. TJX, Inc., has outstanding stock options that, if exercised, would increase the weighted average of common shares outstanding by 6,935 shares. Compute basic and diluted earnings per share for Year 4, showing supporting computations.

please calculate using these formulas below:

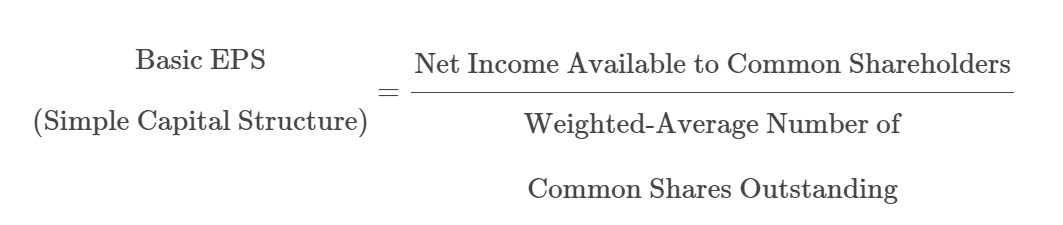

Basic Eps

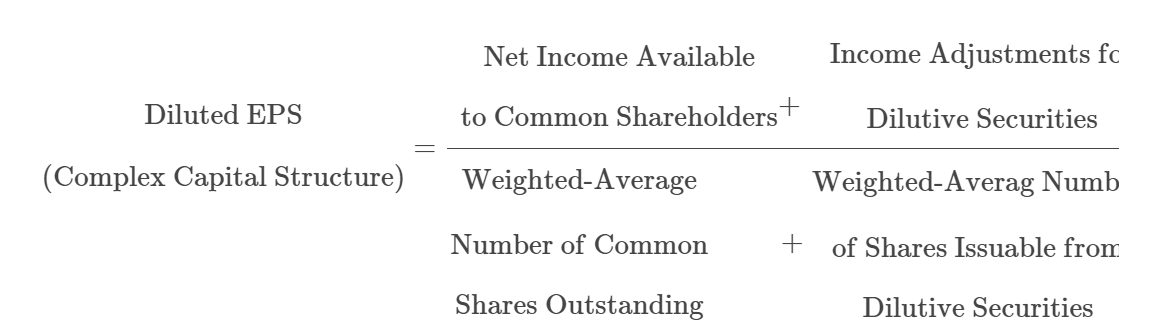

Diluted Eps

help me with these formulas to solve the problem.

\begin{tabular}{|c|c|c|} \hline & Net Income Available & Income Adjustments fo \\ \hline Diluted EPS & to Common Shareholders & Dilutive Securities \\ \hline Complex Capital Structure) & Weighted-Average & Weighted-Averag Numb \\ \hline & Number of Common & + of Shares Issuable from \\ \hline & Shares Outstanding & Dilutive Securities \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts