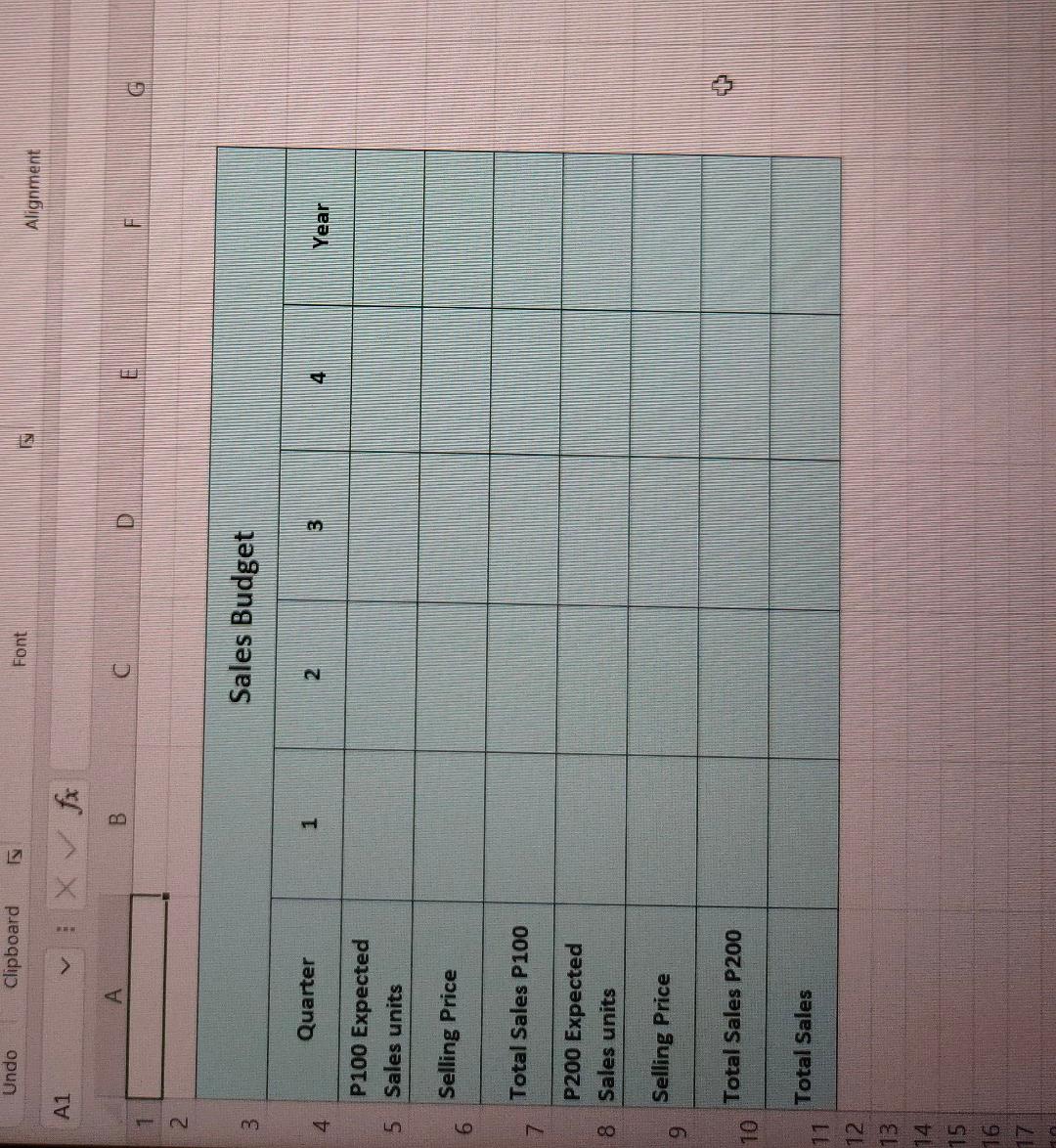

Question: please calculate the below tables, information for the calculation is provided in the last three pictures, thank you. Alignment: A1 A 3 Sales Budget 4

please calculate the below tables, information for the calculation is provided in the last three pictures, thank you.

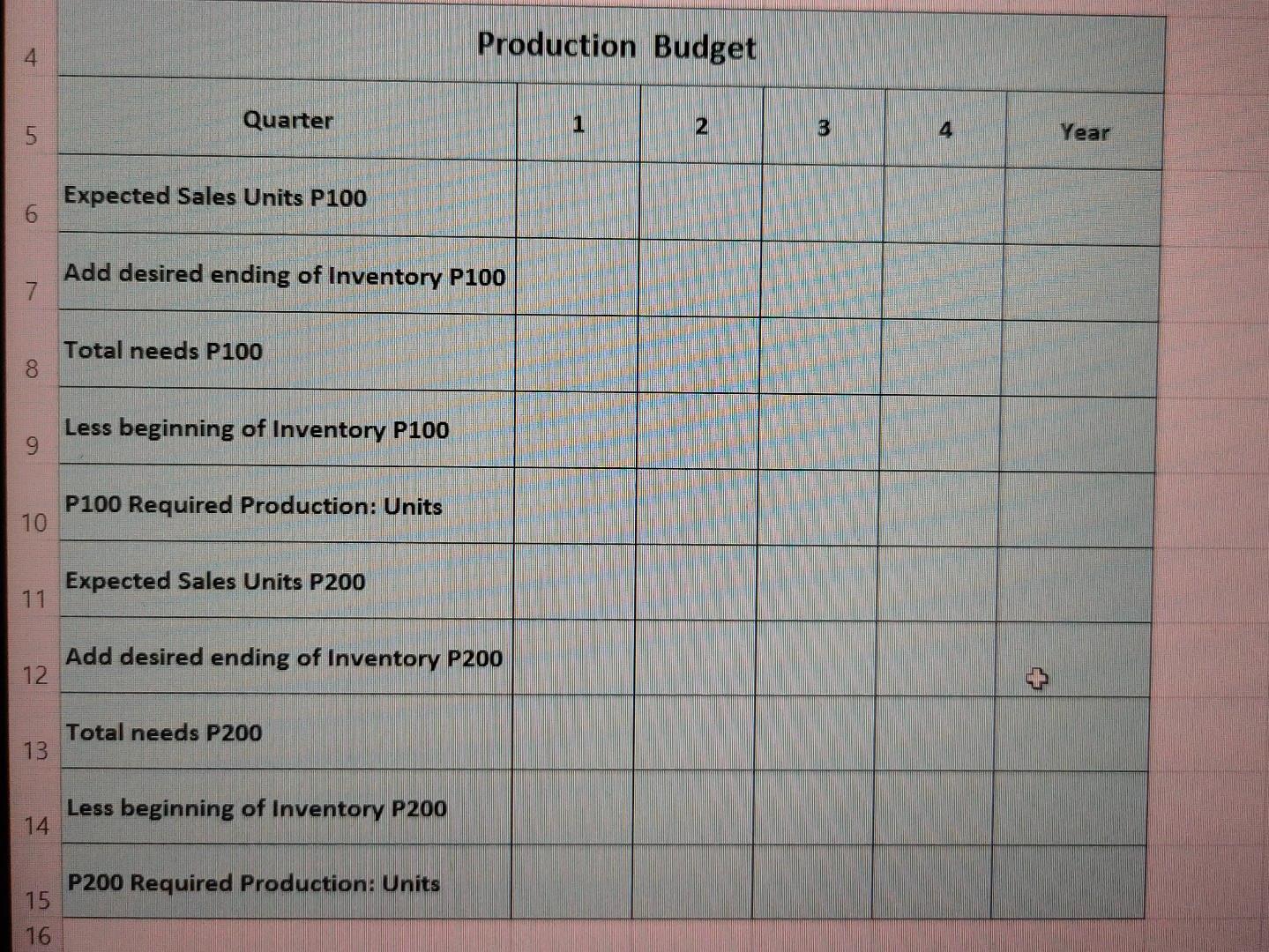

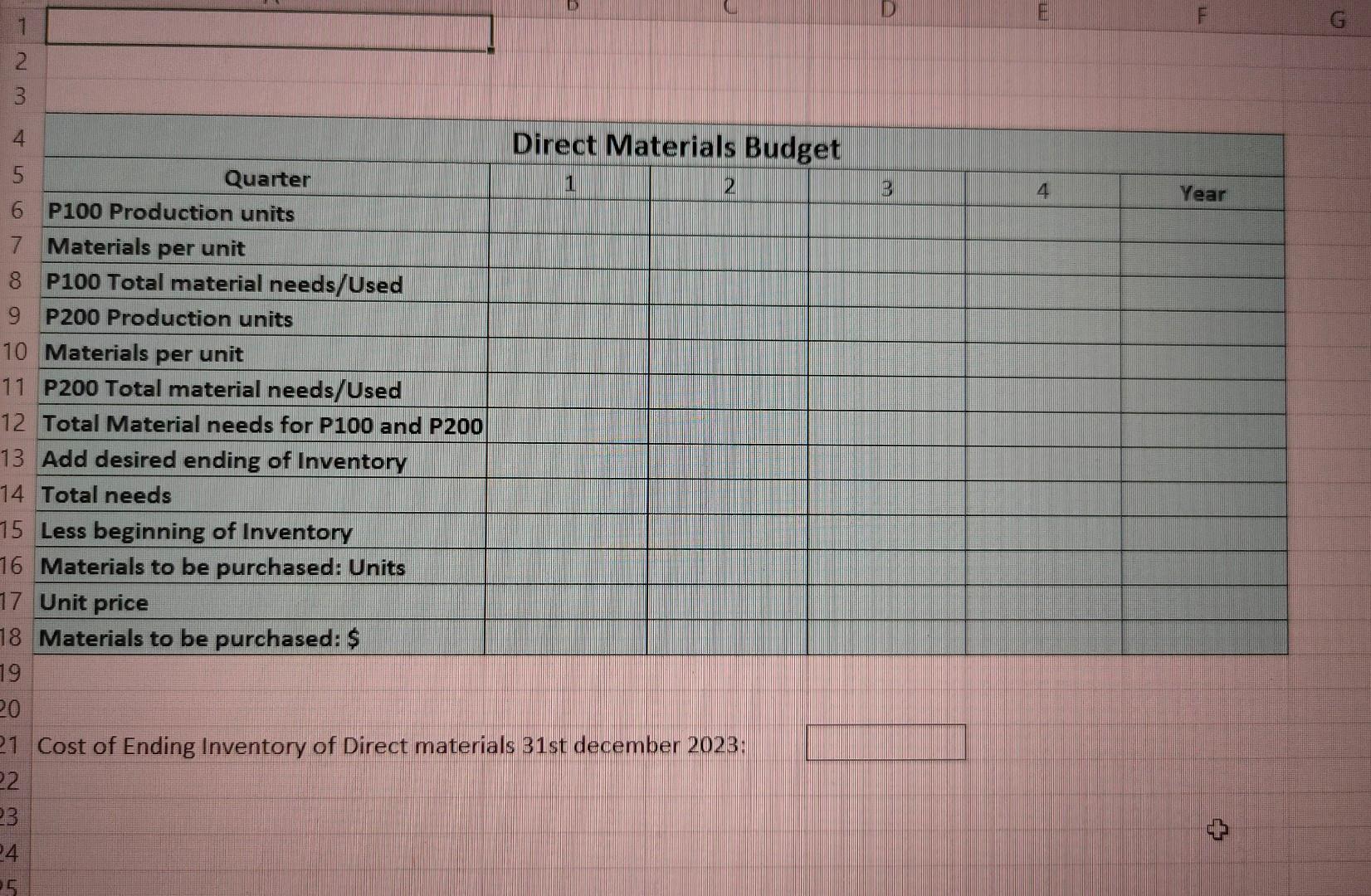

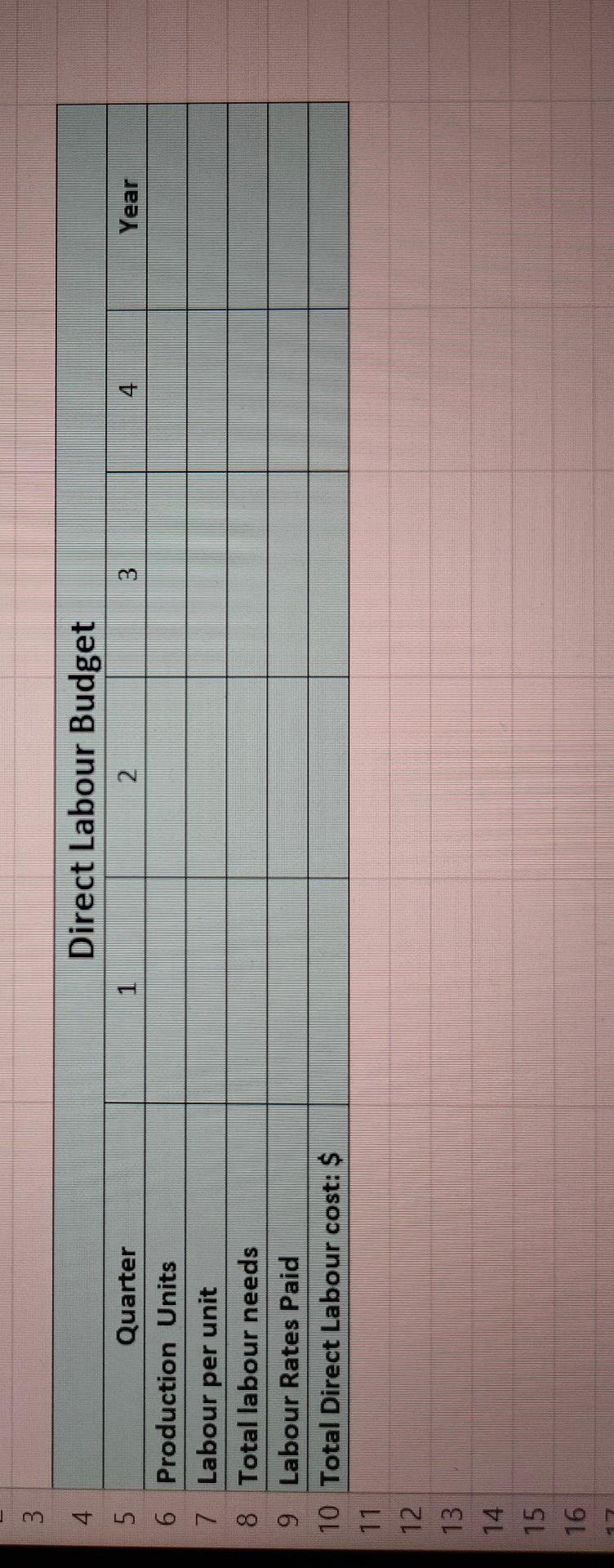

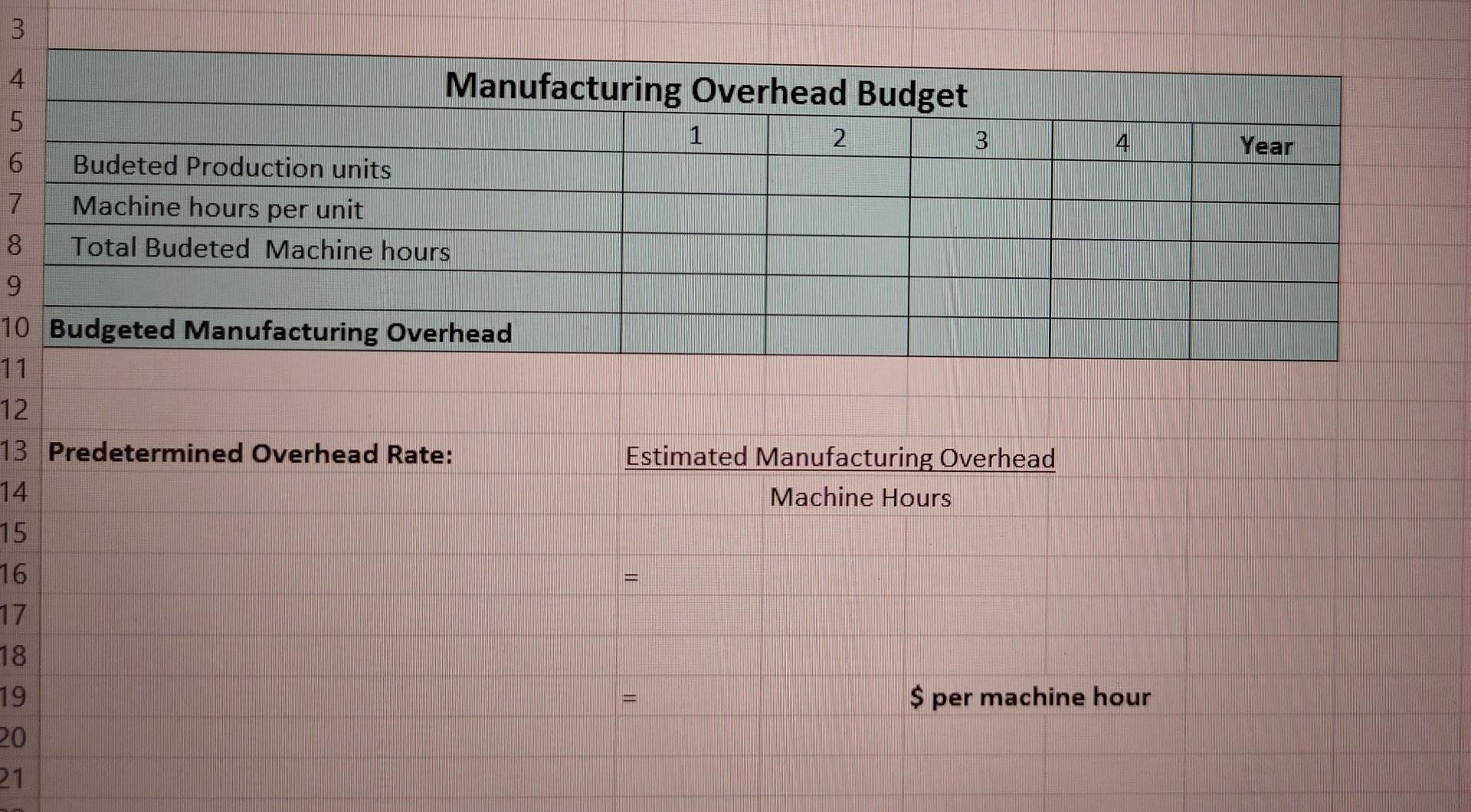

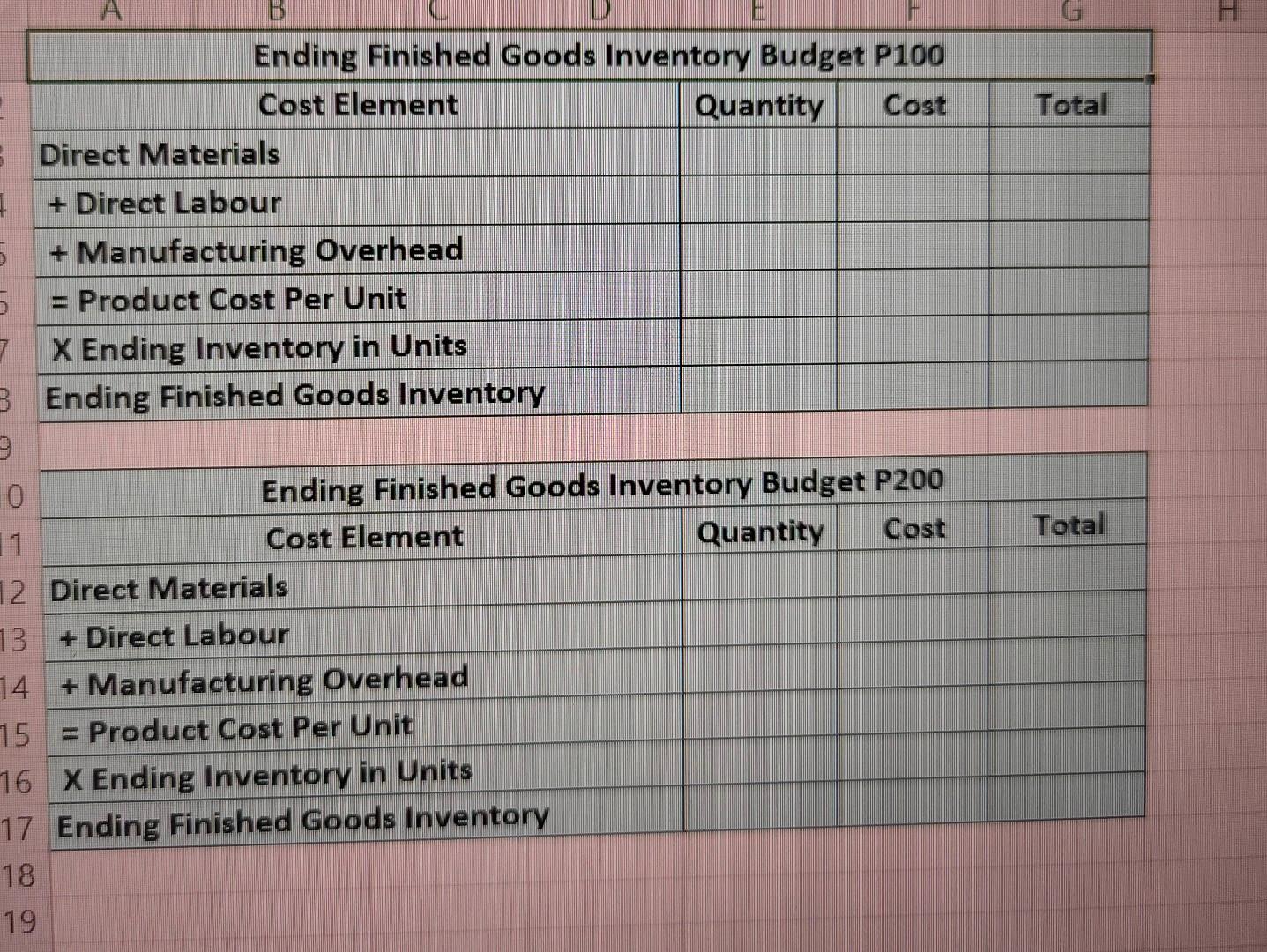

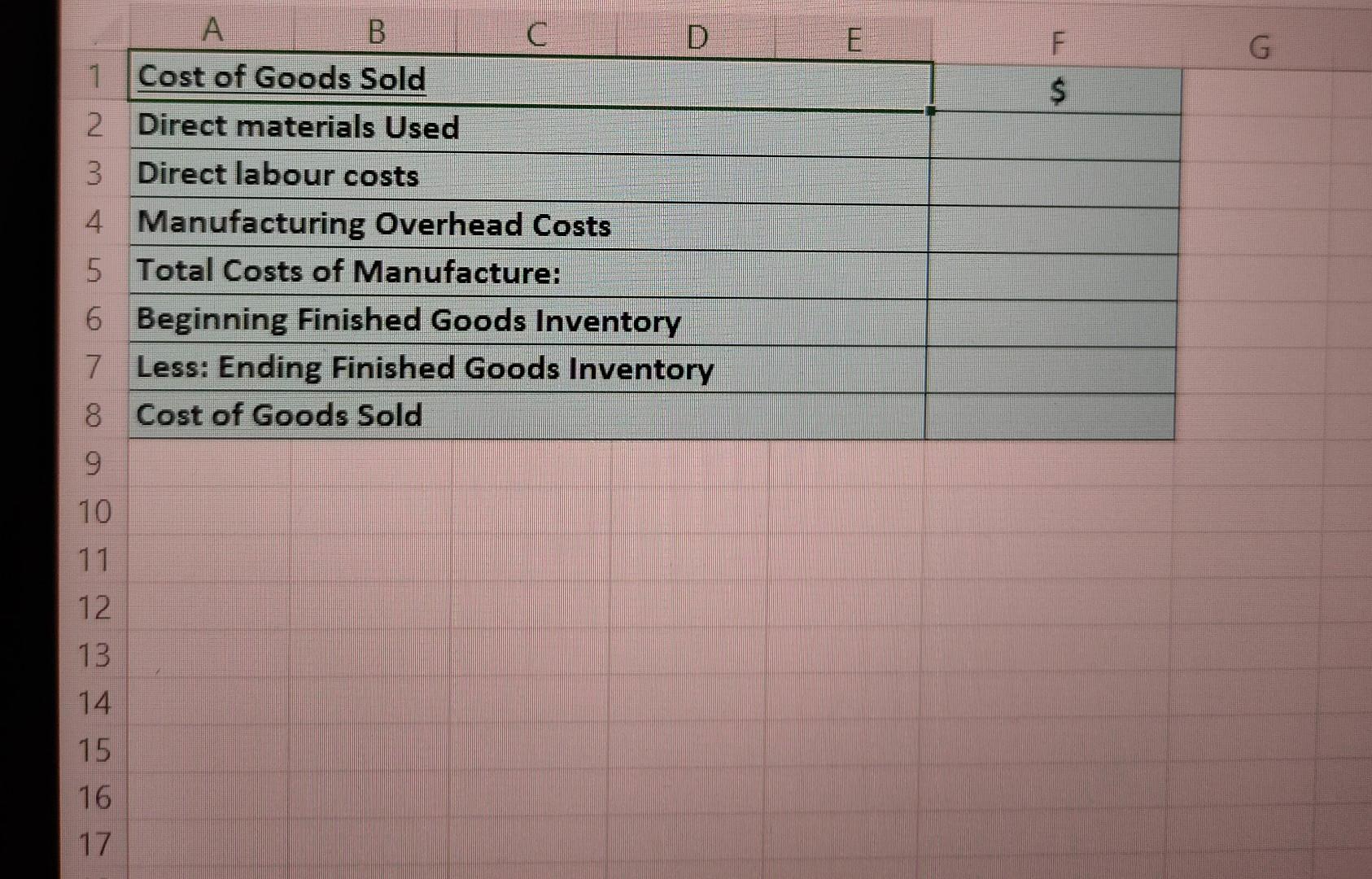

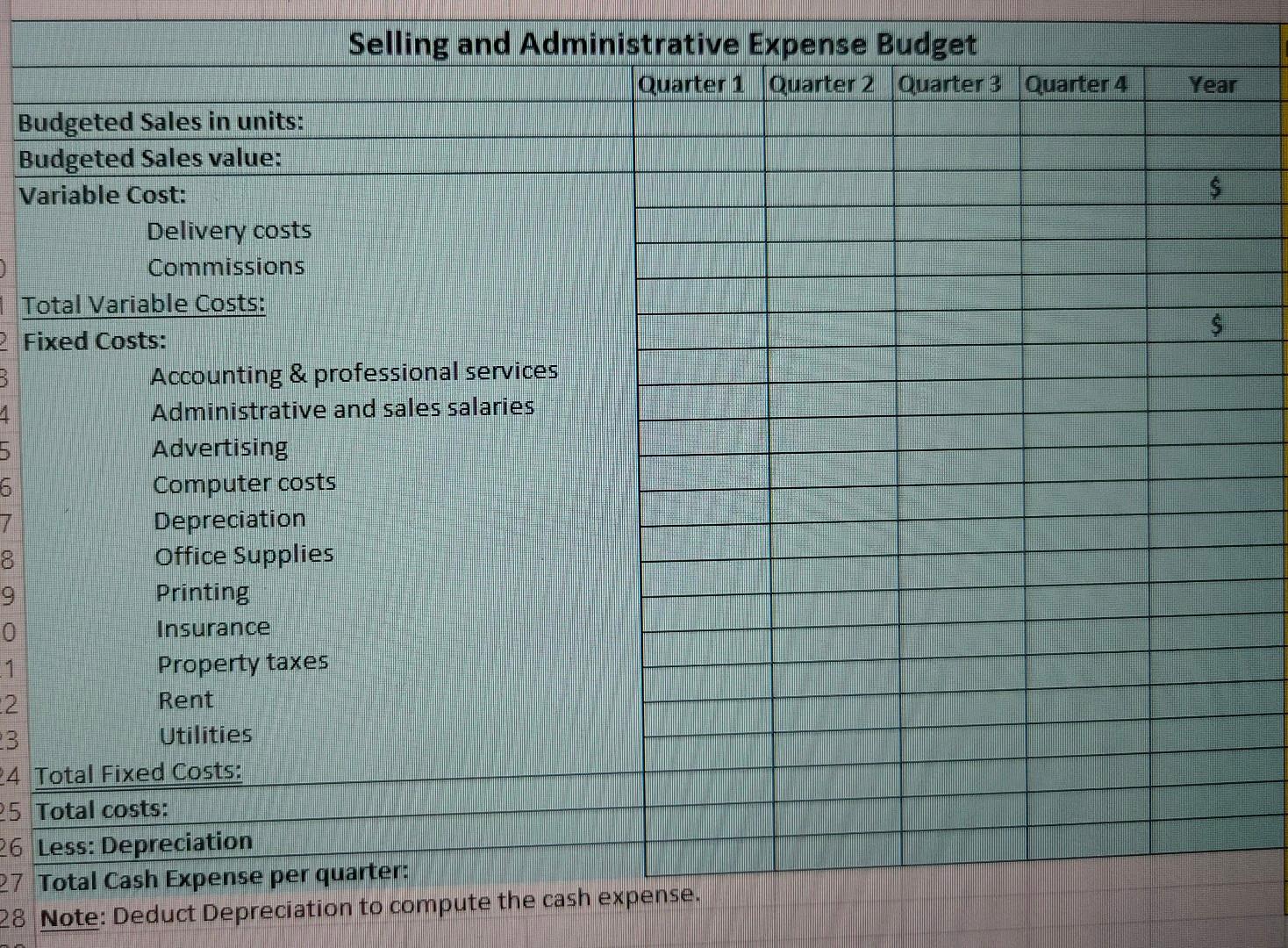

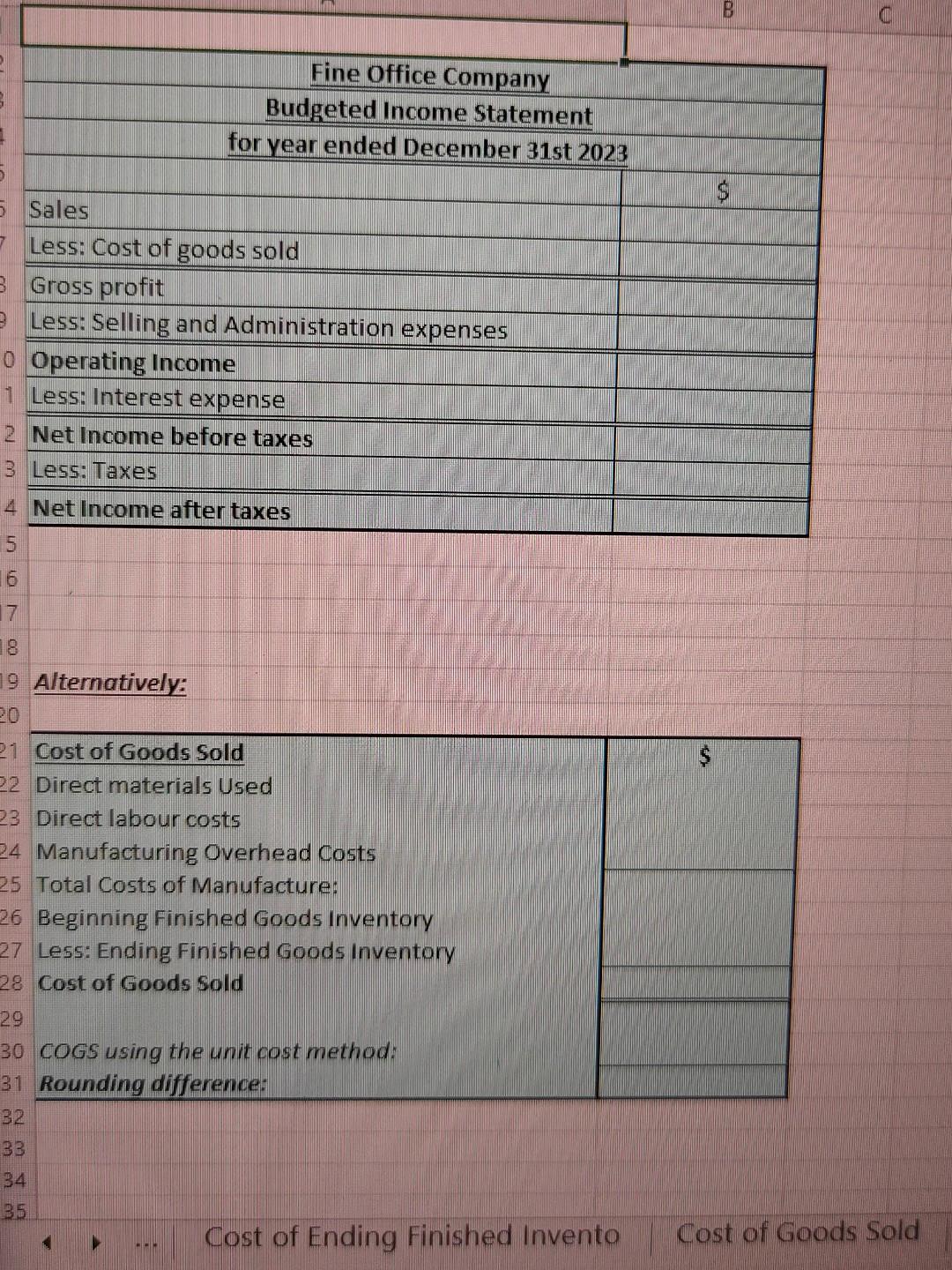

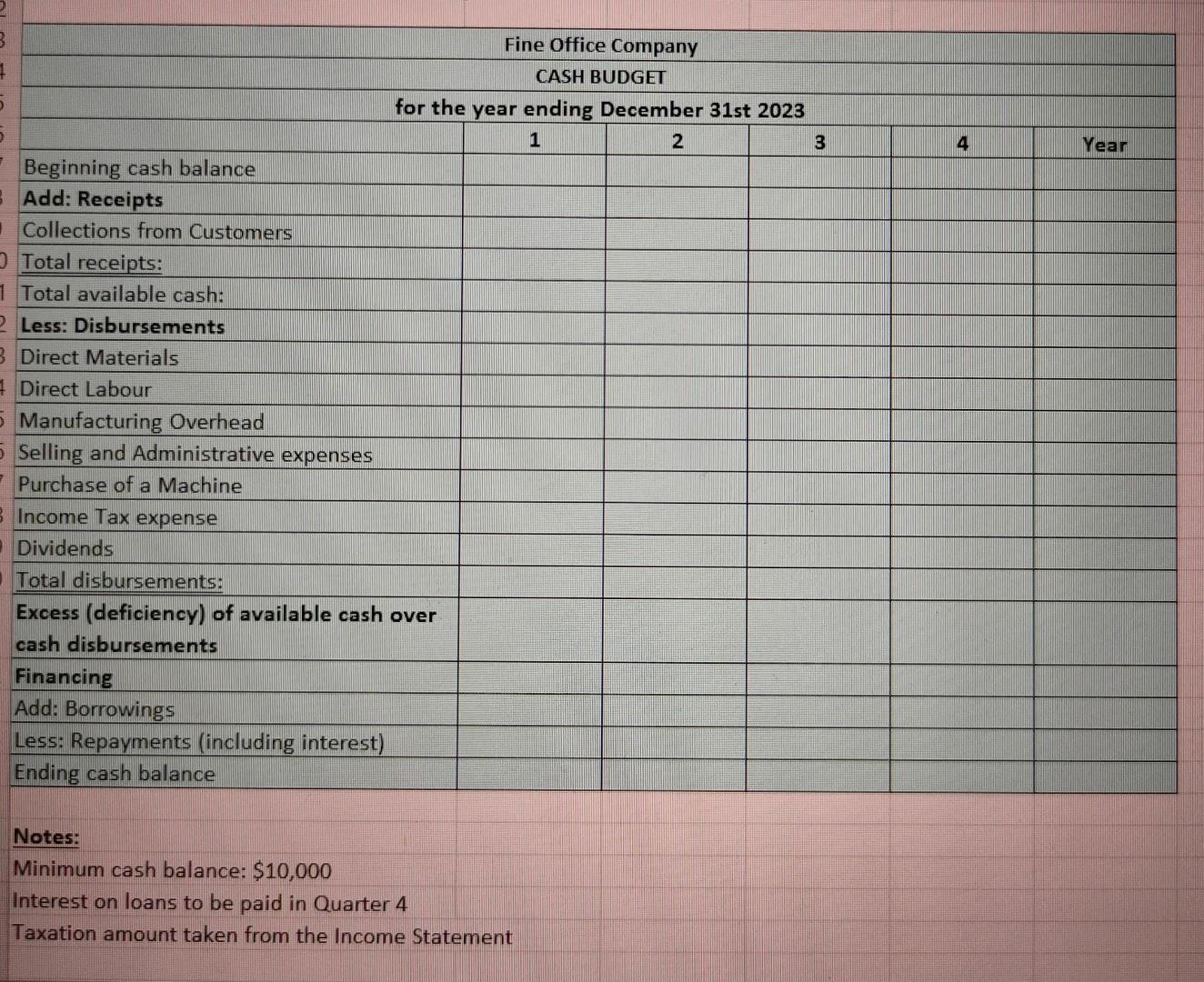

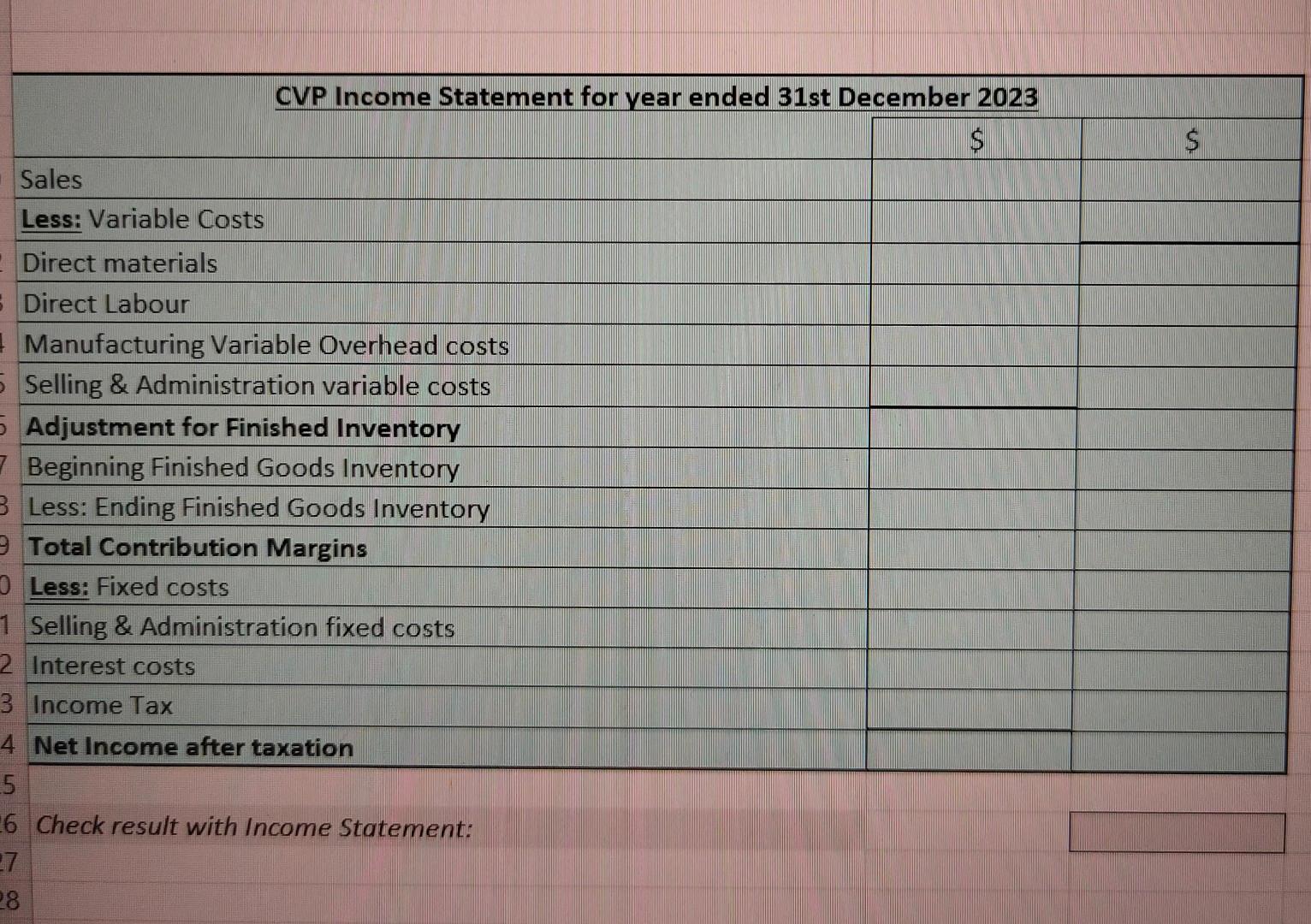

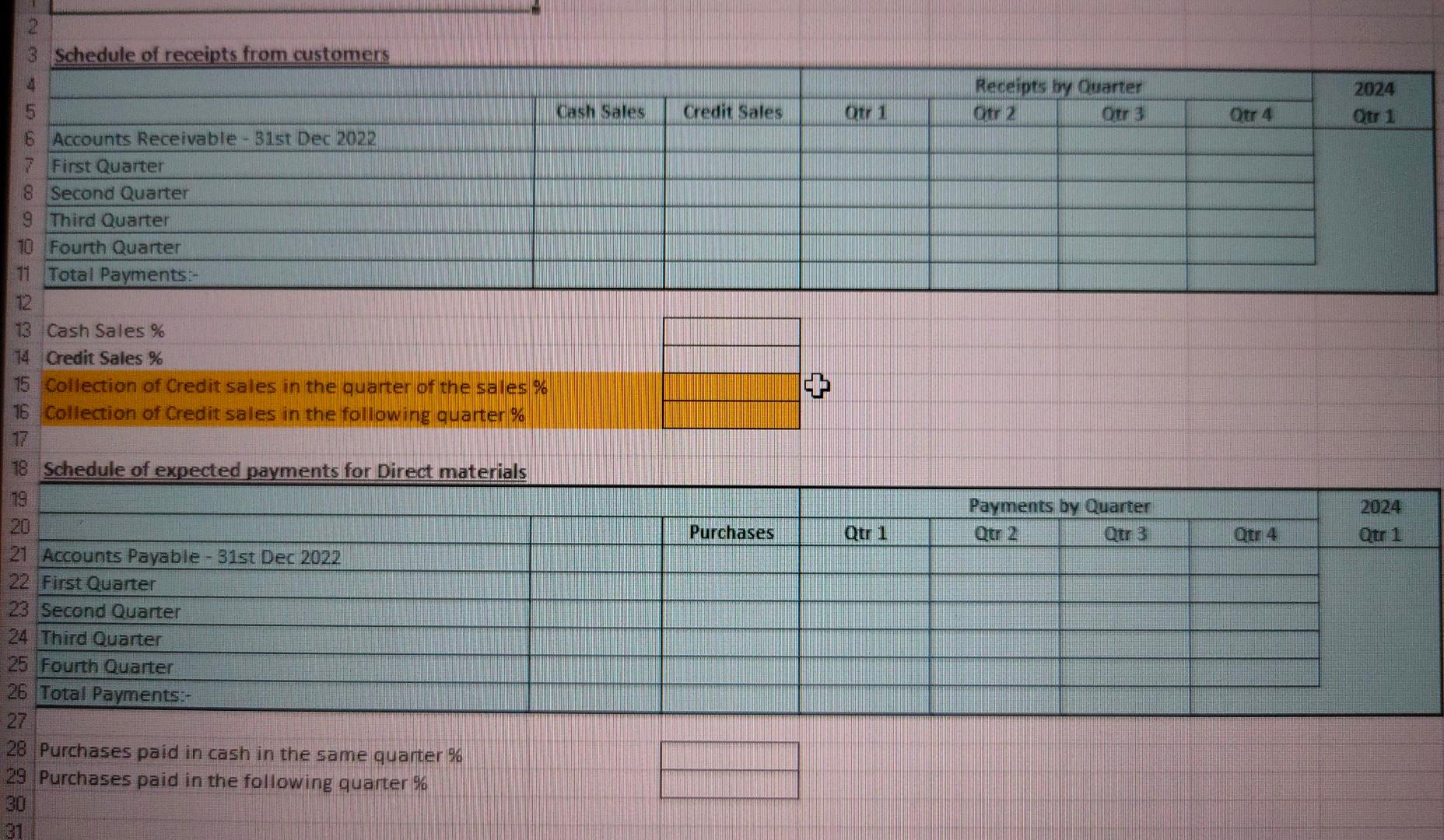

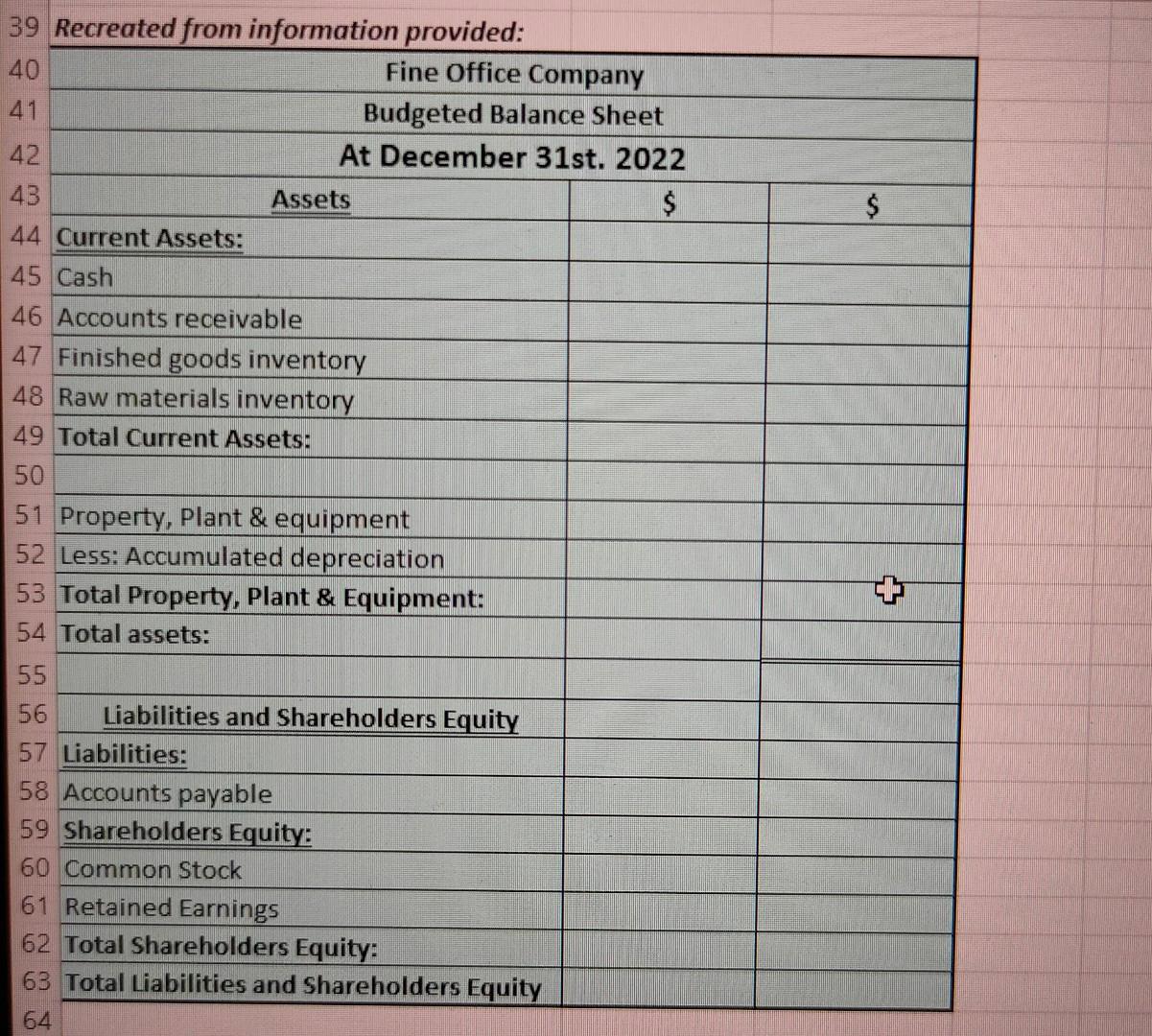

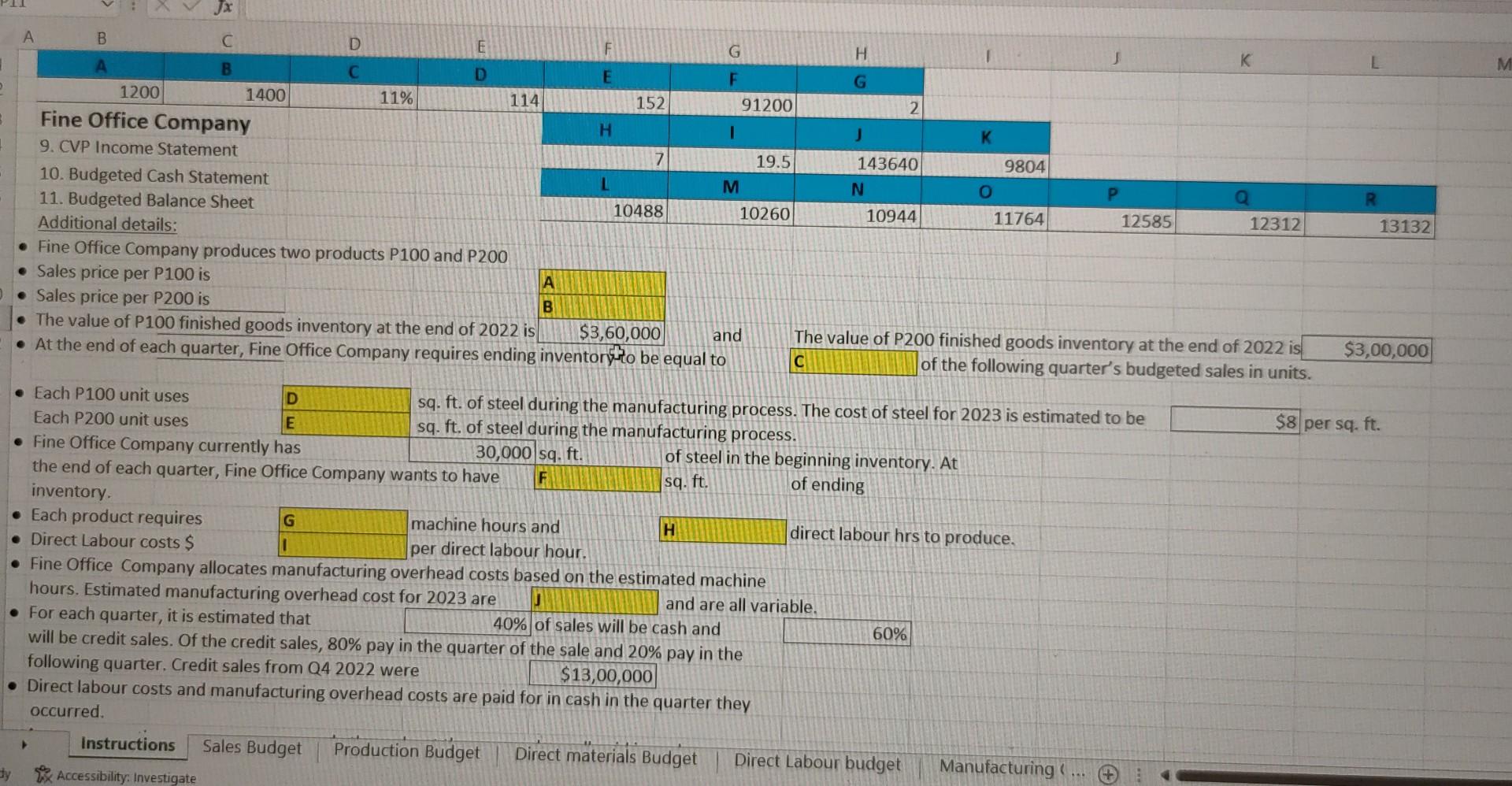

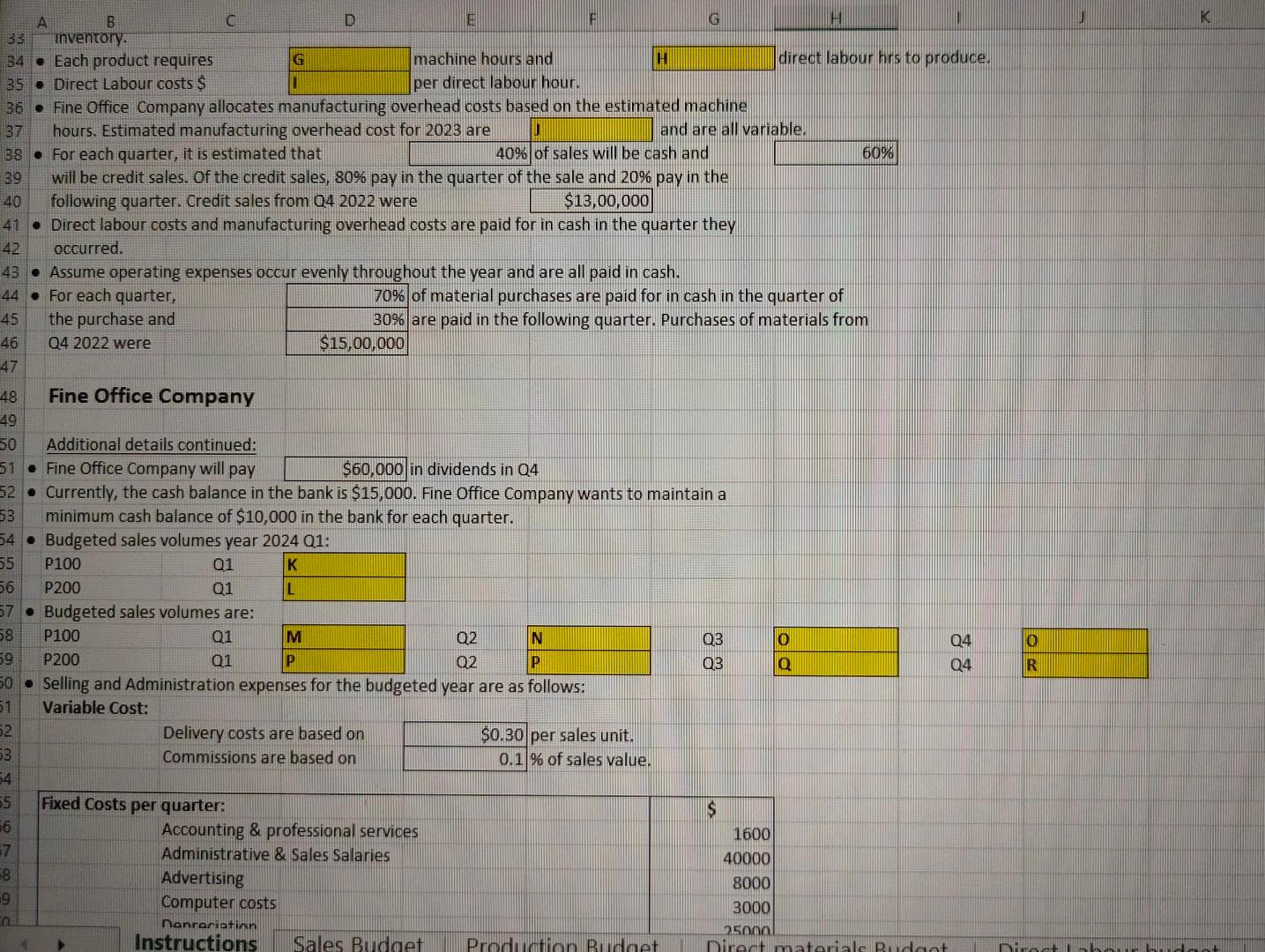

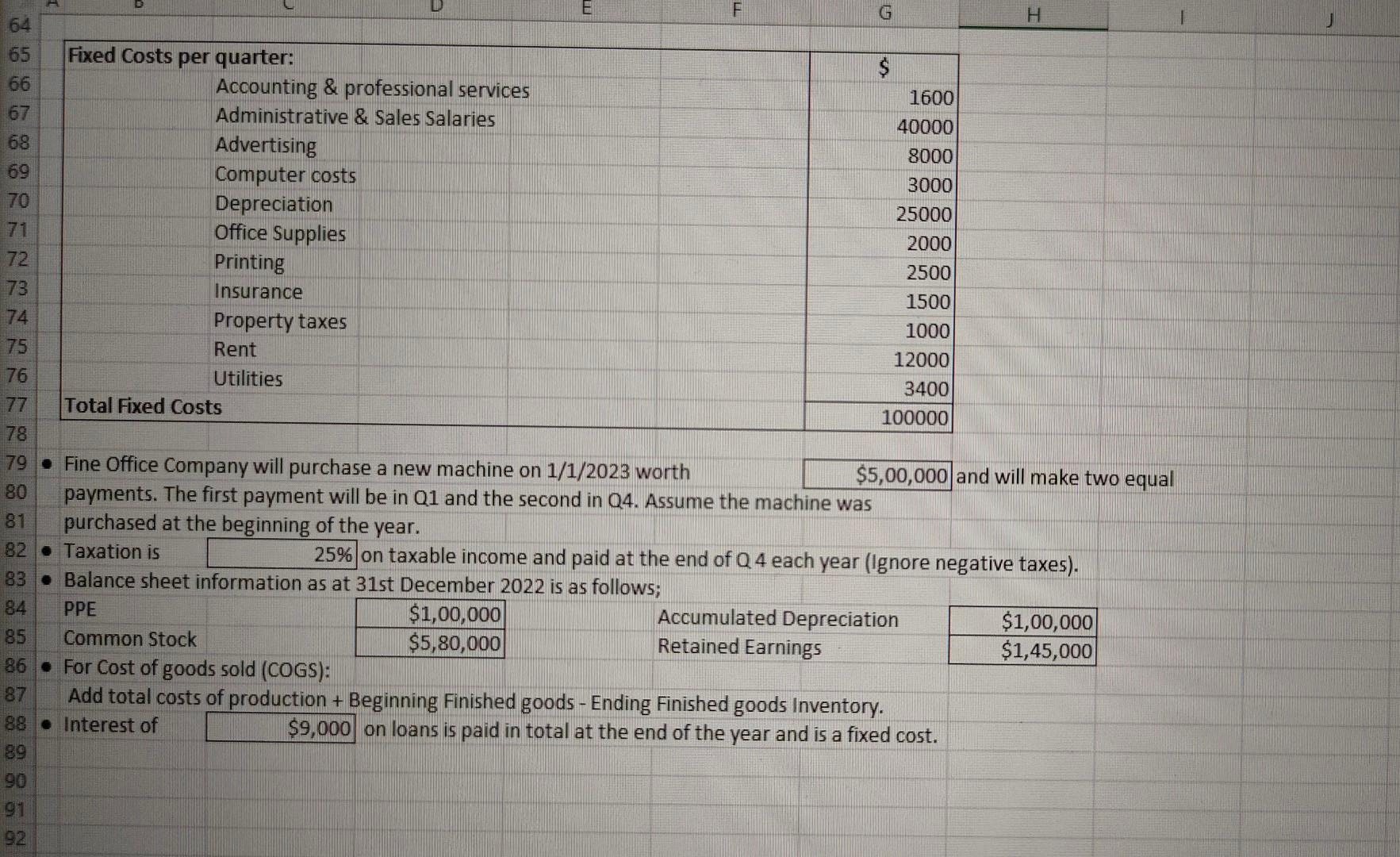

Alignment: A1 A 3 Sales Budget 4 Production Budget Cost of Ending Inventory of Direct materials 31st december 2023: \begin{tabular}{|c|l|l|l|l|l|l|} 4 & \multicolumn{3}{|c|}{ Direct Labour Budget } \\ \cline { 3 - 6 } 5 & \multicolumn{1}{|c|}{ Quarter } & 1 & 2 & 3 & 4 & \multicolumn{1}{|c|}{ Year } \\ \hline 6 & Production Units & & & \\ 7 & Labour per unit & & & \\ 8 & Total labour needs & & & \\ 9 & Labour Rates Paid & & & \\ 10 & Total Direct Labour cost: $ & & & \\ 11 & & & & \\ 12 & & & & \\ \hline \end{tabular} 12 13 14 15 16 \begin{tabular}{c|l|l|l|l|l|l|} \hline 4 & \multicolumn{5}{c|}{ Manufacturing Overhead Budget } \\ \cline { 2 - 7 } 5 & & 1 & 2 & 3 & 4 & Year \\ \hline 6 & Budeted Production units & & & & & \\ \hline 7 & Machine hours per unit & & & & & \\ \hline 8 & Total Budeted Machine hours & & & & & \\ \hline & & & & & & \\ \hline 10 & Budgeted Manufacturing Overhead & & & & & \\ \hline \end{tabular} Predetermined Overhead Rate: Estimated Manufacturing Overhead Machine Hours = =$ per machine hour \begin{tabular}{|l|l|l|l|} \hline \multicolumn{1}{|c|}{ Ending Finished Goods Inventory Budget P100 } \\ \hline \multicolumn{1}{|c|}{ Cost Element } & Quantity & Cost & Total \\ \hline Direct Materials & & & \\ \hline + Direct Labour & & & \\ \hline + Manufacturing Overhead & & & \\ \hline = Product Cost Per Unit & & & \\ \hline X Ending Inventory in Units & & & \\ \hline Ending Finished Goods Inventory & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|} \hline \multicolumn{3}{|c|}{ Ending Finished Goods Inventory Budget P200 } \\ \hline 1 & \multicolumn{1}{|c|}{ Cost Element } & Quantity & Cost & Total \\ \hline 2 & Direct Materials & & \\ \hline 13 & + Direct Labour & & \\ \hline 14 & + Manufacturing Overhead & & \\ \hline 15 & = Product Cost Per Unit & & \\ \hline 16 & X Ending Inventory in Units & & \\ \hline & Ending Finished Goods Inventory & & \\ \hline \end{tabular} 18 19 \begin{tabular}{|l|l|l|} \hline 1 & \multicolumn{1}{c|}{ A } & \multicolumn{1}{c|}{ Cost of Goods Sold } \\ \hline 2 & Direct materials Used \\ 3 & Direct labour costs \\ \hline 4 & Manufacturing Overhead Costs \\ 5 & Total Costs of Manufacture: \\ 6 & Beginning Finished Goods Inventory \\ 7 & Less: Ending Finished Goods Inventory \\ 8 & Cost of Goods Sold \\ 9 & \\ 10 & \\ 11 & \\ 12 & \\ 13 & \\ 14 & \\ 15 & \\ 16 & \\ 17 & \end{tabular} Selling and Administrative Expense Budget Total Cash Expense per quarter: Note: Deduct Depreciation to compute the cash expense. Alternatively: . ... Cost of Ending Finished Invento Cost of Goods Sold Notes: Minimum cash balance: $10,000 Interest on loans to be paid in Quarter 4 Taxation amount taken from the Income Statement Check result with Income Statement: Schedule of receipts from customers \begin{tabular}{l} 13 Cash Sales \% \\ 14 Credit Sales \% \\ 15 Collection of Credit sales in the quarter of the sales \\ 16 Collection of Credit sales in the following quarter \% \\ 17 Schedule of expected payments for Direct materials \\ \hline 18 \end{tabular} 28 Purchases paid in cash in the same quarter \% 29 Purchases paid in the following quarter \% 39 Recreated from information provided: - Fine Office Company produces two products P100 and P200 - Sales price per P100 is - Sales price per P200 is - Direct Labour costs \$ machine hours and - Fine Office Company allocates manufacturing overhead costs based on the estimated machine - For each quarter, it is estimated that of sales will be cash and will be credit sales. Of the credit sales, 80% pay in the quarter of the sale and 20% pay in the following quarter. Credit sales from Q4 2022 were $13,00,000 - Direct labour costs and manufacturing overhead costs are paid for in cash in the quarter they occurred. - Each product requires machine hours and per direct labour hour. - Fine Office Company allocates manufacturing overhead costs based on the estimated machine hours. Estimated manufacturing overhead cost for 2023 are ___ and are all variable. - For each quarter, it is estimated that bof sales will be cash and will be credit sales. Of the credit sales, 80% pay in the quarter of the sale and 20% pay in the following quarter. Credit sales from 042022 were - Direct labour costs and manufacturing overhead costs are paid for in cash in the quarter they occurred. - Assume operating expenses occur evenly throughout the year and are all paid in cash. - For each quarter, the purchase and \begin{tabular}{|r|l} \hline 70% & of material purchases are paid for in cash in the quarter of \\ \hline 30% & are paid in the following quarter. Purchases of materials from \\ \cline { 1 - 2 } & $15,00,000 \\ \hline \end{tabular} Q4 2022 were - Fine Office Company will purchase a new machine on 1/1/2023 worth and will make two equal payments. The first payment will be in Q1 and the second in Q4. Assume the machine was purchased at the beginning of the year. - Taxation is on taxable income and paid at the end of Q4 each year (Ignore negative taxes). - Balance sheet information as at 31 st December 2022 is as follows: Add total costs of production + Beginning Finished goods - Ending Finished goods Inventory. - Interest of on loans is paid in total at the end of the year and is a fixed cost. Alignment: A1 A 3 Sales Budget 4 Production Budget Cost of Ending Inventory of Direct materials 31st december 2023: \begin{tabular}{|c|l|l|l|l|l|l|} 4 & \multicolumn{3}{|c|}{ Direct Labour Budget } \\ \cline { 3 - 6 } 5 & \multicolumn{1}{|c|}{ Quarter } & 1 & 2 & 3 & 4 & \multicolumn{1}{|c|}{ Year } \\ \hline 6 & Production Units & & & \\ 7 & Labour per unit & & & \\ 8 & Total labour needs & & & \\ 9 & Labour Rates Paid & & & \\ 10 & Total Direct Labour cost: $ & & & \\ 11 & & & & \\ 12 & & & & \\ \hline \end{tabular} 12 13 14 15 16 \begin{tabular}{c|l|l|l|l|l|l|} \hline 4 & \multicolumn{5}{c|}{ Manufacturing Overhead Budget } \\ \cline { 2 - 7 } 5 & & 1 & 2 & 3 & 4 & Year \\ \hline 6 & Budeted Production units & & & & & \\ \hline 7 & Machine hours per unit & & & & & \\ \hline 8 & Total Budeted Machine hours & & & & & \\ \hline & & & & & & \\ \hline 10 & Budgeted Manufacturing Overhead & & & & & \\ \hline \end{tabular} Predetermined Overhead Rate: Estimated Manufacturing Overhead Machine Hours = =$ per machine hour \begin{tabular}{|l|l|l|l|} \hline \multicolumn{1}{|c|}{ Ending Finished Goods Inventory Budget P100 } \\ \hline \multicolumn{1}{|c|}{ Cost Element } & Quantity & Cost & Total \\ \hline Direct Materials & & & \\ \hline + Direct Labour & & & \\ \hline + Manufacturing Overhead & & & \\ \hline = Product Cost Per Unit & & & \\ \hline X Ending Inventory in Units & & & \\ \hline Ending Finished Goods Inventory & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|} \hline \multicolumn{3}{|c|}{ Ending Finished Goods Inventory Budget P200 } \\ \hline 1 & \multicolumn{1}{|c|}{ Cost Element } & Quantity & Cost & Total \\ \hline 2 & Direct Materials & & \\ \hline 13 & + Direct Labour & & \\ \hline 14 & + Manufacturing Overhead & & \\ \hline 15 & = Product Cost Per Unit & & \\ \hline 16 & X Ending Inventory in Units & & \\ \hline & Ending Finished Goods Inventory & & \\ \hline \end{tabular} 18 19 \begin{tabular}{|l|l|l|} \hline 1 & \multicolumn{1}{c|}{ A } & \multicolumn{1}{c|}{ Cost of Goods Sold } \\ \hline 2 & Direct materials Used \\ 3 & Direct labour costs \\ \hline 4 & Manufacturing Overhead Costs \\ 5 & Total Costs of Manufacture: \\ 6 & Beginning Finished Goods Inventory \\ 7 & Less: Ending Finished Goods Inventory \\ 8 & Cost of Goods Sold \\ 9 & \\ 10 & \\ 11 & \\ 12 & \\ 13 & \\ 14 & \\ 15 & \\ 16 & \\ 17 & \end{tabular} Selling and Administrative Expense Budget Total Cash Expense per quarter: Note: Deduct Depreciation to compute the cash expense. Alternatively: . ... Cost of Ending Finished Invento Cost of Goods Sold Notes: Minimum cash balance: $10,000 Interest on loans to be paid in Quarter 4 Taxation amount taken from the Income Statement Check result with Income Statement: Schedule of receipts from customers \begin{tabular}{l} 13 Cash Sales \% \\ 14 Credit Sales \% \\ 15 Collection of Credit sales in the quarter of the sales \\ 16 Collection of Credit sales in the following quarter \% \\ 17 Schedule of expected payments for Direct materials \\ \hline 18 \end{tabular} 28 Purchases paid in cash in the same quarter \% 29 Purchases paid in the following quarter \% 39 Recreated from information provided: - Fine Office Company produces two products P100 and P200 - Sales price per P100 is - Sales price per P200 is - Direct Labour costs \$ machine hours and - Fine Office Company allocates manufacturing overhead costs based on the estimated machine - For each quarter, it is estimated that of sales will be cash and will be credit sales. Of the credit sales, 80% pay in the quarter of the sale and 20% pay in the following quarter. Credit sales from Q4 2022 were $13,00,000 - Direct labour costs and manufacturing overhead costs are paid for in cash in the quarter they occurred. - Each product requires machine hours and per direct labour hour. - Fine Office Company allocates manufacturing overhead costs based on the estimated machine hours. Estimated manufacturing overhead cost for 2023 are ___ and are all variable. - For each quarter, it is estimated that bof sales will be cash and will be credit sales. Of the credit sales, 80% pay in the quarter of the sale and 20% pay in the following quarter. Credit sales from 042022 were - Direct labour costs and manufacturing overhead costs are paid for in cash in the quarter they occurred. - Assume operating expenses occur evenly throughout the year and are all paid in cash. - For each quarter, the purchase and \begin{tabular}{|r|l} \hline 70% & of material purchases are paid for in cash in the quarter of \\ \hline 30% & are paid in the following quarter. Purchases of materials from \\ \cline { 1 - 2 } & $15,00,000 \\ \hline \end{tabular} Q4 2022 were - Fine Office Company will purchase a new machine on 1/1/2023 worth and will make two equal payments. The first payment will be in Q1 and the second in Q4. Assume the machine was purchased at the beginning of the year. - Taxation is on taxable income and paid at the end of Q4 each year (Ignore negative taxes). - Balance sheet information as at 31 st December 2022 is as follows: Add total costs of production + Beginning Finished goods - Ending Finished goods Inventory. - Interest of on loans is paid in total at the end of the year and is a fixed cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts