Question: Please calculate the cost recovery deduction using Section 179 and MACRS. Please show work. On March 20, Phillip moved his business out of the old

Please calculate the cost recovery deduction using Section 179 and MACRS. Please show work.

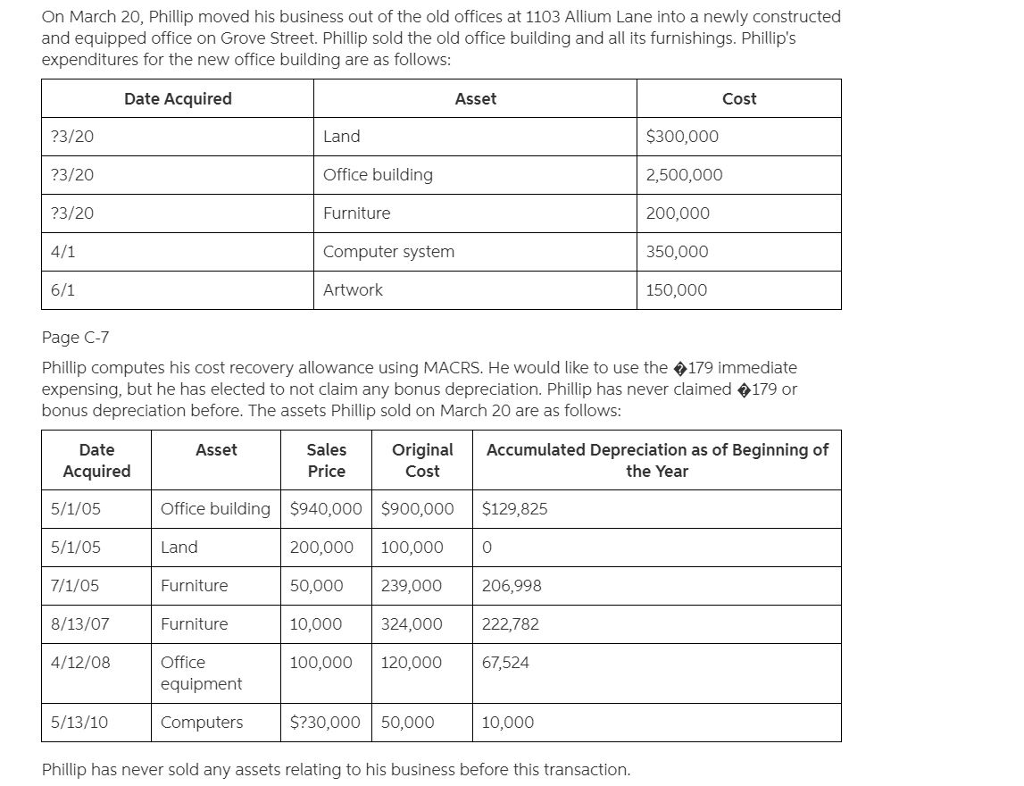

On March 20, Phillip moved his business out of the old offices at 1103 Allium Lane into a newly constructed and equipped office on Grove Street. Philip sold the old office building and all its furnishings. Phillip's expenditures for the new office building are as follows Date Acquired Asset Cost ?3/20 ?3/20 ?3/20 Land Office building Furniture Computer system Artwork S300,000 2,500,000 200,000 350,000 150,000 Page C-7 Phillip computes his cost recovery allowance using MACRS. He would like to use the +179 immediate expensing, but he has elected to not claim any bonus depreciation. Phillip has never claimed 179 or bonus depreciation before. The assets Phillip sold on March 20 are as follows Date Asset Sales Price OriginalAccumulated Depreciation as of Beginning of Acquired 5/1/05 5/1/05 7/1/05 8/13/07 4/12/08 Cost the Year Office building $940,000 $900,000$129,825 Land Furniture Furniture Office equipment Computers $?30,000 50,000 10,000 200,000 100,000 0 239,000 206,998 10,000 324,000 222,782 100,000 120,000 67,524 5/13/10 Phillip has never sold any assets relating to his business before this transaction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts