Question: Please calculate the external financing twice (1st pass only) There is a tremendous amount of calculator work with thls practlce set. For part B, it

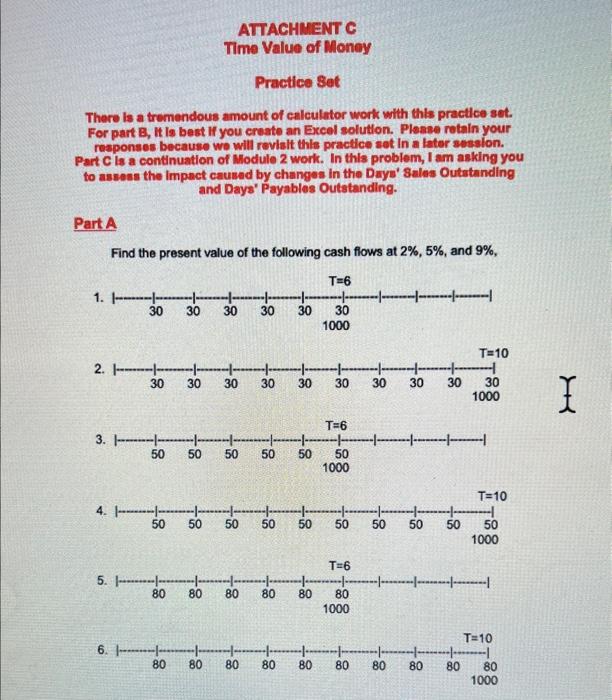

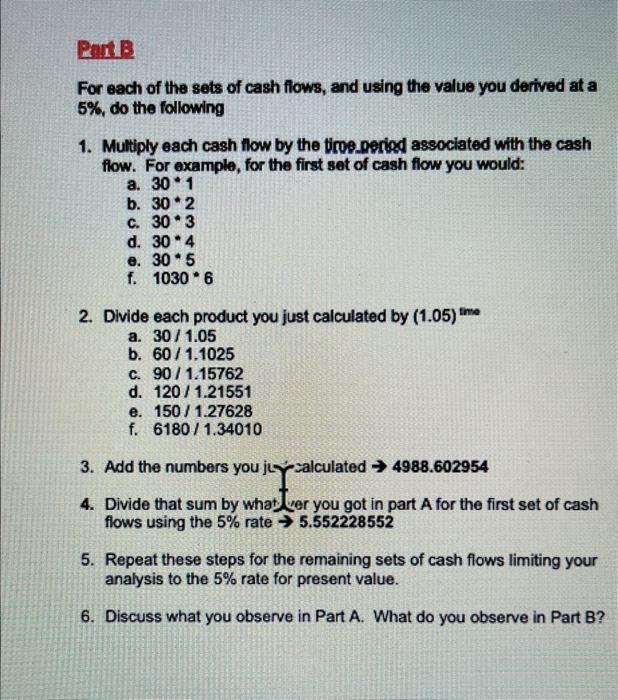

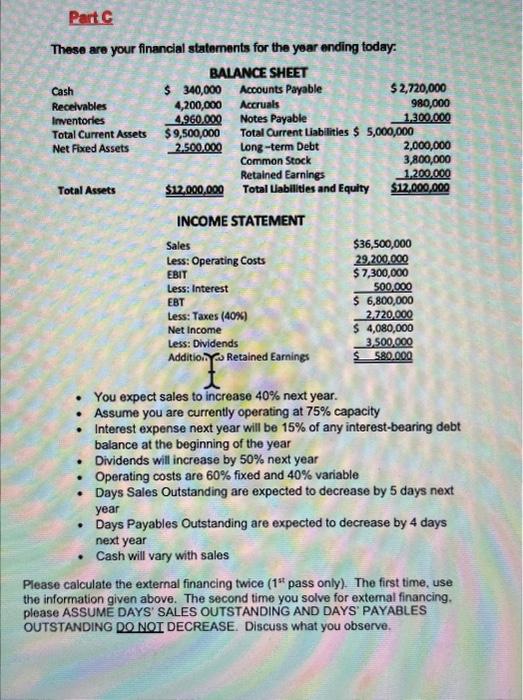

There is a tremendous amount of calculator work with thls practlce set. For part B, it ls best if you create an Excel solution. Please retain your responses because wo will revialt thls practice sot in a later session. Part C is a continuation of Module 2 work. In this problem, 1 am asking you to assess the Impact caused by changes in the Days' 3 ales Outatanding and Days' Payables Outstanding. Part A Find the present value of the following cash flows at 2%,5%, and 9%, For each of the sets of cash flows, and using the value you derived at a 5%, do the following 1. Multiply each cash flow by the tiroe.neriod associated with the cash flow. For example, for the first set of cash flow you would: a. 301 b. 302 c. 303 d. 304 e. 305 f. 10306 2. Divide each product you just calculated by (1.05)tms a. 30/1.05 b. 60/1.1025 c. 90/1.15762 d. 120/1.21551 e. 150/1.27628 f. 6180/1.34010 3. Add the numbers you ji y yalculated 4988.602954 4. Divide that sum by what yer you got in part A for the first set of cash flows using the 5% rate 5.552228552 5. Repeat these steps for the remaining sets of cash flows limiting your analysis to the 5% rate for present value. 6. Discuss what you observe in Part A. What do you observe in Part B? These are your financial staternents for the year ending foday: INCOME STATEMENT - You expect sales to increase 40% next year. - Assume you are currently operating at 75% capacity - Interest expense next year will be 15% of any interest-bearing debt balance at the beginning of the year - Dividends will increase by 50% next year - Operating costs are 60% fixed and 40% variable - Days Sales Outstanding are expected to decrease by 5 days next year - Days Payables Outstanding are expected to decrease by 4 days next year - Cash will vary with sales Please calculate the external financing twice ( 1st pass only). The first time, use the information given above. The second time you solve for external financing. please ASSUME DAYS' SALES OUTSTANDING AND DAYS' PAYABLES OUTSTANDING DO NOI DECREASE. Discuss what you observe

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts