Question: please can i get help with both questions? Question 5 1 pts One year ago, XYZ Co. issued 13-year bonds at par. The bonds have

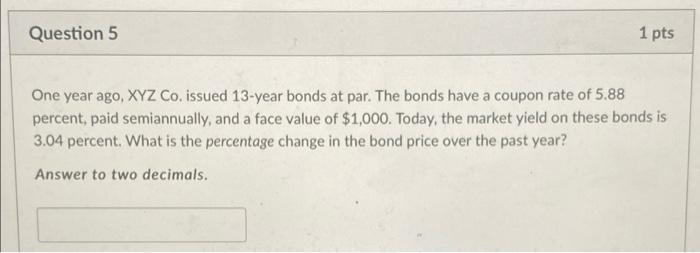

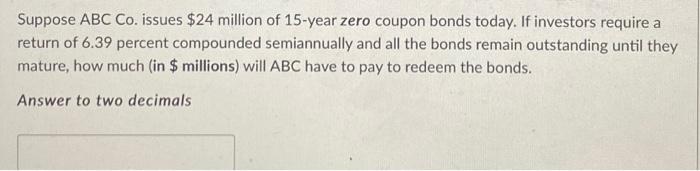

Question 5 1 pts One year ago, XYZ Co. issued 13-year bonds at par. The bonds have a coupon rate of 5.88 percent, paid semiannually, and a face value of $1,000. Today, the market yield on these bonds is 3.04 percent. What is the percentage change in the bond price over the past year? Answer to two decimals. Suppose ABC Co. issues $24 million of 15-year zero coupon bonds today. If investors require a return of 6.39 percent compounded semiannually and all the bonds remain outstanding until they mature, how much (in $ millions) will ABC have to pay to redeem the bonds. Answer to two decimals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts