Question: please can i get help with this? also can you please show the workings? On December 31, 2020, Faital Company acquired a computer (equipment) from

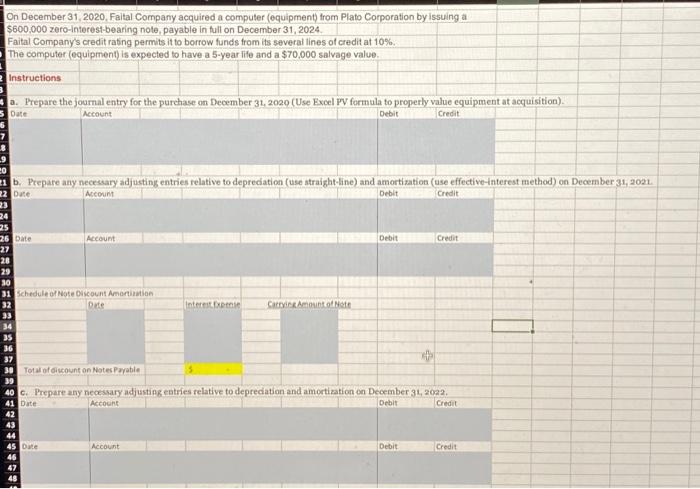

On December 31, 2020, Faital Company acquired a computer (equipment) from Plato Corporation by Issuing a $600,000 zero-Interest-bearing note payable in full on December 31, 2024. Faital Company's credit rating permits it to borrow funds from its several lines of credit at 10%. The computer (equipment) is expected to have a 5-year life and a $70,000 salvage value. Instructions . Prepare the journal entry for the purchase on December 31, 2020 (Use Excel PV formula to properly value equipment at acquisition) Date Account Debit Credit -9 20 1b. Prepare any necessary adjusting entries relative to depreciation (use straight-line) and amortization (use effective-interest method) on December 31, 2021 ACCOUNT Credit 22 Date Debit 24 25 26 Date Account Debit Credit 27 28 29 SO 31 Schedule of Note Discount Amortization 32 De Interest Expl Carrier Amount of Note 33 34 35 36 37 30 Total of discount on Notes Payable 39 40. Prepare any necessary adjusting entries relative to depreciation and amortization on December 31, 2022. 41 Date Account Debit Credit 42 43 44 45 Date Account Debit Credit 46 47 49

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts