Question: please can i get help with this question for my tax accounting class? On January 10, 2020, Kyle purchased stock in Orange Corporation (the stock

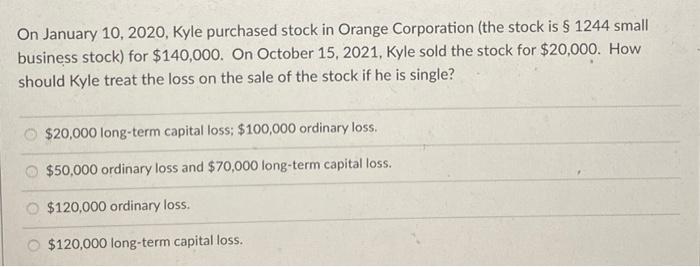

On January 10, 2020, Kyle purchased stock in Orange Corporation (the stock is $ 1244 small business stock) for $140,000. On October 15, 2021, Kyle sold the stock for $20,000. How should Kyle treat the loss on the sale of the stock if he is single? $20,000 long-term capital loss: $100,000 ordinary loss. $50,000 ordinary loss and $70,000 long-term capital loss. $120,000 ordinary loss. $120,000 long-term capital loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts