Question: Please can I get help with this question for my tax class. A Form 1040-SR, Schedule D and Form 8949 is needed for this assignment.

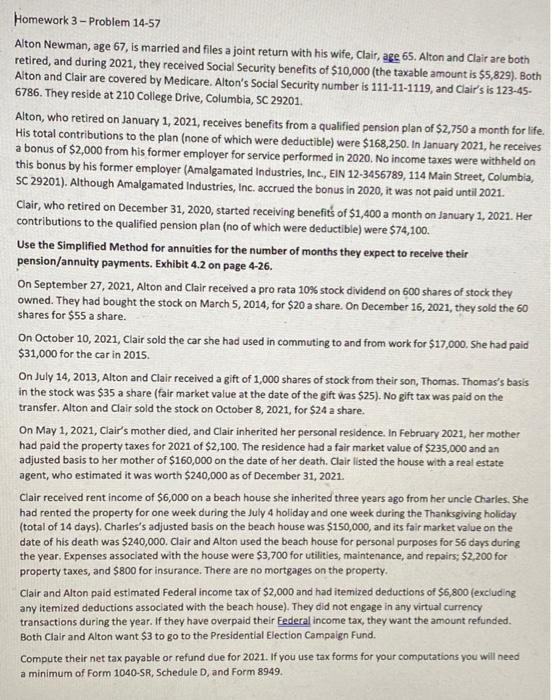

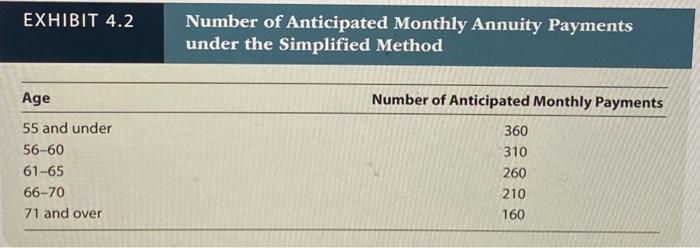

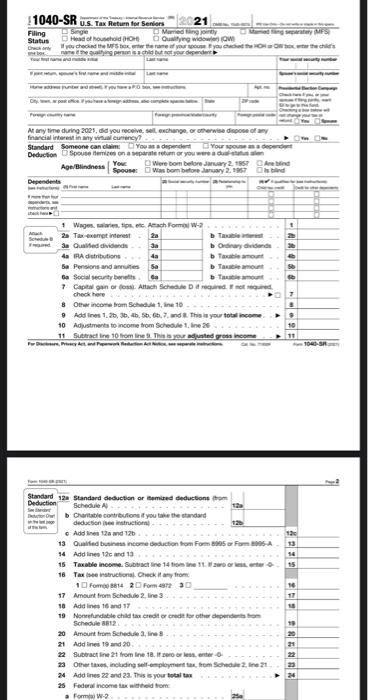

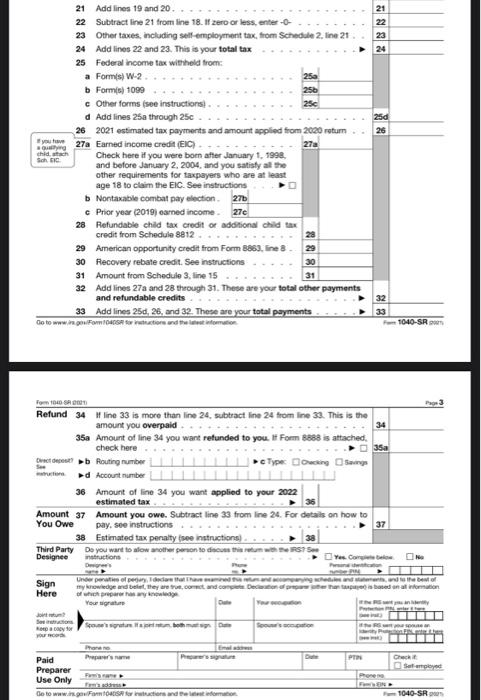

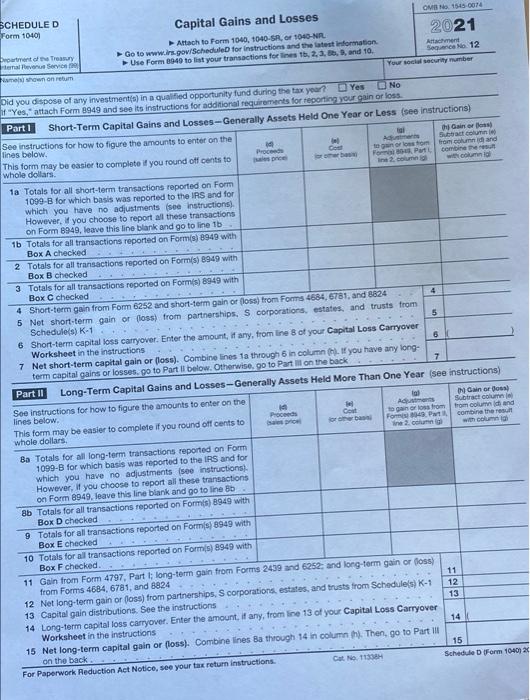

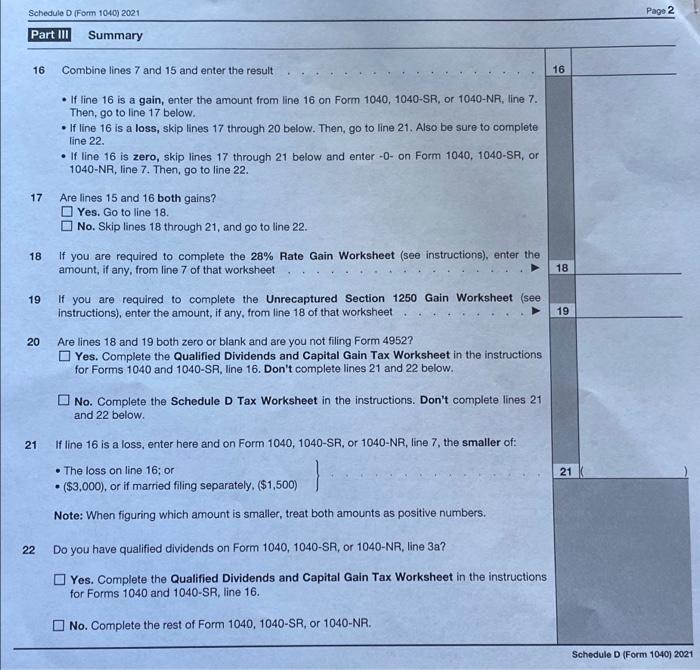

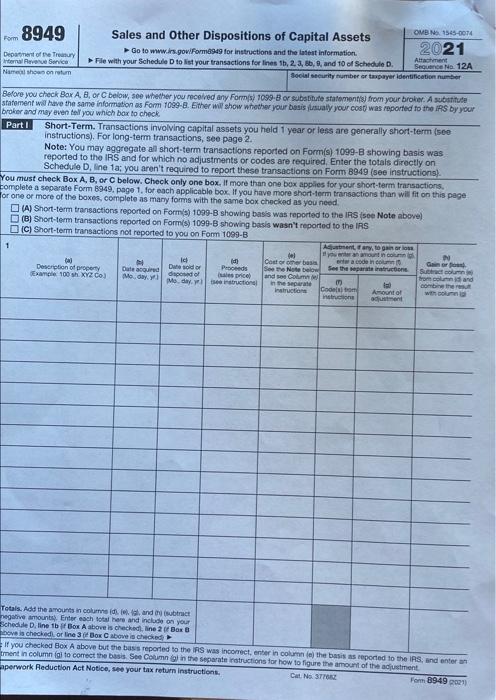

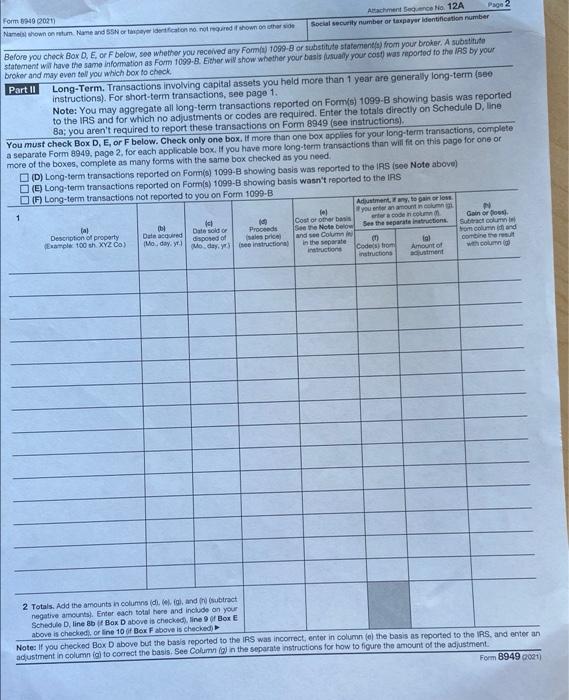

EXHIBIT 4.2 Age 55 and under 56-60 61-65 66-70 71 and over Number of Anticipated Monthly Annuity Payments under the Simplified Method Number of Anticipated Monthly Payments 360 310 260 210 160 1040-SR US Tax Return for Seniors 21 Filing Status Mamed fing jointly Qualifying widower) (QW Head of household (HOH checked the HO Ch checked the MFS box, enter th qualifying person is a c Your name portretum, spune's first name and t PO At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency? Standard Someone can claim: You as a dependent Your spouse Deduction Spouse itemizes on a separate return or you were a dual status alen Age/Blindness Your Spouse: Were bom before January 2, 1957 Was bom before January 2, 1967 Dependents 1 Wages, sales, tips, etc. Amach FormW-2 Ac S 2a 2a Tax-exempt interest 3a Qualified dividends b. Taxable interest b Ordinary dividends Ja 4a IRA distributions. 4a b Taxable amount Sa Pensions and annuites Sa b Taxable amount Ga Social security benefits b Taxable amount 7 Capital gain or (ossi. Attach Schedule D if required. If not required check here 8 Other income from Schedule 1, in 10- 9 This is your total Add lines 1, 2b, 36, 4b. Sb. 66, 7, and Adjustments to income from Schedule 1, line 26 10 11 Subtract line 10 from line 9 This is your adjusted gross in For y Act, and Pon Act par Standard 12 Standard deduction or itemized deductions from Deduction Schedule A S Ob Charitable contributions if you take the standard deduction is instructions) Add lines 12 and 12b. 13 Qualified business income deduction from Fom 8905 or Form 8996-A 14 Add lines 12 and 13. 15 Taxable income. Subtract line 14 tiom line 1 16 Tax(see instructional. Check it any from 10 Fo8814 20 Form 4972 30 17 Amount from Schedule 2 line 3 18 Add lines 16 and 17 19 Nonrefundable child tax credit Schedule 8812 20 Amount from Schedule 3, line 8 21 Add lines 19 and 20. 22 Subtract line 21 from line 18. If zero or less enter 23 Other taxes, including self-employment tax, from Schedule 2 Ine 21 24 Addnes 22 and 23. This is your total tax 25 Federal income tax withheld from a FormW-2 Are blind is blind 2 FREE ECE FRENRE 120 14 20 1040-S 21 Add lines 19 and 20. 22 Subtract line 21 from line 18. If zero or less, enter-0- 23 Other taxes, including self-employment tax, from Schedule 2, line 21 24 Add lines 22 and 23. This is your total tax 25 Federal income tax withheld from: a Form(s) W-2. b Form(s) 1099 25b 25c c Other forms (see instructions) d Add lines 25a through 25c. 26 2021 estimated tax payments and amount applied from 2020 return 27a Earned income credit (EIC). 27a Check here if you were born after January 1, 1998, and before January 2, 2004, and you satisfy all the other requirements for taxpayers who are at least age 18 to claim the EIC. See instructions 0 b Nontaxable combat pay election. 27b c Prior year (2019) earned income. 27c 28 Refundable child tax credit or additional child tax credit from Schedule 8812.. 29 American opportunity credit from Form 8863, line 8 29 30 Recovery rebate credit. See instructions 31 Amount from Schedule 3, line 15 32 Add lines 27a and 28 through 31. These are your total other payments and refundable credits. 32 33 Add lines 25d, 26, and 32. These are your total payments 33 Go to www.in.gov/Form1040GR for inductions and the latest information Form 1040 SA 2001) Refund 34 If line 33 is more than line 24, subtract line 24 from line 33. This is the amount you overpaid 34 35a Amount of line 34 you want refunded to you. If Form 8888 is attached, check here 35a Oect depostb Routing number Type: Ocking Savings Se ructiona d Account number 36 Amount of line 34 you want applied to your 2022 estimated tax Amount 37 You Owe Amount you owe. Subtract line 33 from line 24. For details on how to pay, see instructions 38 Estimated tax penalty (see instructions). with the RST Third Party Designee Do you want to allow another person to discuss this instructions Yes. Como Designer's Sign Here Under penaties of peary, I declare that I have exam my knowledge and belet, they are true, comect and com of which preparer has any knowledge statements, and to the best of Declaration of proper han taxpaye is based on all information Your secution Your signature Joint Structions Kepay for Spouse's signature ajotun both mus Spouse's soupation Fathe Phone no Preparer's name Preparer's signatur Date PTN Paid Preparer Sat-employed F's a Use Only Go to www.in.gov/FotoS for instructions and the latest information you have Qualifying chid atach Sch IC Email address 2885 30 21 22 23 24 25d 26 31 F1040-SR Phone n FON Check it Page 3 F1040-SR p SCHEDULE D Form 1040) OMB No 1545-0074 Capital Gains and Losses 2021 Attach to Form 1040, 1040-5R, or 1040-NFL Go to www.irs.gov/Scheduled for instructions and the latest information. Use Form 8949 to list your transactions for lines 1b, 2, 3, 8, 9, and 10. Attachment Department of the Treasury temal Revenue Service Namels) shown on retur Sequence No. 12 Your social security number Did you dispose of any investment(s) in a qualified opportunity fund during the tax year? Yes No If "Yes," attach Form 8949 and see its instructions for additional requirements for reporting your gain or loss. Part 1 Short-Term Capital Gains and Losses-Generally Assets Held One Year or Less (see instructions) See instructions for how to figure the amounts to enter on the lines below. tal This form may be easier to complete if you round off cents to whole dollars. Proceeds ales price (0) Cost for other bas Adjustments to gain or loss from Formal 8048 Part L Ine 2 column ig Gain or loss) Subtract column (e) from column (d) and combine the resu with column ial 1a Totals for all short-term transactions reported on Form 1099-B for which basis was reported to the IRS and for which you have no adjustments (see instructions). However, if you choose to report all these transactions on Form 8949, leave this line blank and go to line 1b 1b Totals for all transactions reported on Form(s) 8949 with Box A checked 2 Totals for all transactions reported on Form(s) 8949 with Box B checked 3 Totals for all transactions reported on Form(s) 8949 with Box C checked 4 Short-term gain from Form 6252 and short-term gain or (loss) from Forms 4684, 6781, and 8824 4 5 Net short-term gain or (loss) from partnerships. S corporations, estates, and trusts from Schedule(s) K-1 5 6 Short-term capital loss carryover. Enter the amount, if any, from line 8 of your Capital Loss Carryover Worksheet in the instructions 6 7 Net short-term capital gain or (loss). Combine lines 1a through 6 in column (h). If you have any long- term capital gains or losses, go to Part Il below. Otherwise, go to Part ill on the back. 7 Part II Long-Term Capital Gains and Losses-Generally Assets Held More Than One Year (see instructions) lal See instructions for how to figure the amounts to enter on the lines below. 14 IN) Gain or Joss) Subtract column ( from column (d) and combine the result Cost Proceeds sales price for other basis Adjustments to gain or loss from Forms 8049 Part ine 2 column (g This form may be easier to complete if you round off cents to whole dollars. with column ig 8a Totals for all long-term transactions reported on Form 1099-B for which basis was reported to the IRS and for which you have no adjustments (see instructions). However, if you choose to report all these transactions on Form 8949, leave this line blank and go to line 8b 8b Totals for all transactions reported on Form(s) 8949 with Box D checked 9 Totals for all transactions reported on Form(s) 8949 with Box E checked 10 Totals for all transactions reported on Form(s) 8949 with Box F checked. 11 Gain from Form 4797, Part 1; long-term gain from Forms 2439 and 6252; and long-term gain or loss) from Forms 4684, 6781, and 8824 12 Net long-term gain or (loss) from partnerships, S corporations, estates, and trusts from Schedule(s) K-1 13 Capital gain distributions. See the instructions 14 Long-term capital loss carryover. Enter the amount, if any, from line 13 of your Capital Loss Carryover Worksheet in the instructions 15 Net long-term capital gain or (loss). Combine lines Ba through 14 in column (h). Then, go to Part Ill on the back. 15 For Paperwork Reduction Act Notice, see your tax return instructions. Cat No. 11338H Schedule D (Form 1040) 20 11 === 12 13 14 Schedule D (Form 1040) 2021 Part III Summary 16 Combine lines 7 and 15 and enter the result 16 If line 16 is a gain, enter the amount from line 16 on Form 1040, 1040-SR, or 1040-NR, line 7. Then, go to line 17 below. If line 16 is a loss, skip lines 17 through 20 below. Then, go to line 21. Also be sure to complete line 22. If line 16 is zero, skip lines 17 through 21 below and enter -0- on Form 1040, 1040-SR, or 1040-NR, line 7. Then, go to line 22. 17 Are lines 15 and 16 both gains? Yes. Go to line 18. No. Skip lines 18 through 21, and go to line 22. 18 If you are required to complete the 28% Rate Gain Worksheet (see instructions), enter the amount, if any, from line 7 of that worksheet 18 19 If you are required to complete the Unrecaptured Section 1250 Gain Worksheet (see instructions), enter the amount, if any, from line 18 of that worksheet 19 20 Are lines 18 and 19 both zero or blank and are you not filing Form 4952? Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and 1040-SR, line 16. Don't complete lines 21 and 22 below. No. Complete the Schedule D Tax Worksheet in the instructions. Don't complete lines 21 and 22 below. 21 If line 16 is a loss, enter here and on Form 1040, 1040-SR, or 1040-NR, line 7, the smaller of: The loss on line 16; or } 21 . ($3,000), or if married filing separately, ($1,500) Note: When figuring which amount is smaller, treat both amounts as positive numbers. 22 Do you have qualified dividends on Form 1040, 1040-SR, or 1040-NR, line 3a? Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and 1040-SR, line 16. No. Complete the rest of Form 1040, 1040-SR, or 1040-NR. Page 2 Schedule D (Form 1040) 2021 OMB No 1545-0074 Form 8949 Sales and Other Dispositions of Capital Assets 2021 Department of the Treasury Internal Revenue Service Namel shown on return Go to www.irs.gov/Form8949 for instructions and the latest information. File with your Schedule D to list your transactions for lines 1b, 2, 3, 8b, 9, and 10 of Schedule D. Social security number or taxpayer identification number Attachment Sequence No. 12A Before you check Box A, B, or C below, see whether you received any Form(s) 1099-B or substitute statement(s) from your broker. A substitute statement will have the same information as Form 1099-8. Either will show whether your basis usually your cost) was reported to the IRS by your broker and may even tell you which box to check Part I Short-Term. Transactions involving capital assets you held 1 year or less are generally short-term (see instructions). For long-term transactions, see page 2. Note: You may aggregate all short-term transactions reported on Form(s) 1099-B showing basis was reported to the IRS and for which no adjustments or codes are required. Enter the totals directly on Schedule D, line 1a; you aren't required to report these transactions on Form 8949 (see instructions). You must check Box A, B, or C below. Check only one box. If more than one box applies for your short-term transactions. complete a separate Form 8949, page 1. for each applicable box. If you have more short-term transactions than will fit on this page for one or more of the boxes, complete as many forms with the same box checked as you need. (A) Short-term transactions reported on Form(s) 1099-B showing basis was reported to the IRS (see Note above) (B) Short-term transactions reported on Form(s) 1099-8 showing basis wasn't reported to the IRS (C) Short-term transactions not reported to you on Form 1099-B 1 Adjustment, if any, to gain or loss you enter an amount in column enter a code in co See the separate instructions N (a) Description of property Example 100 sh XYZ Co) A Date acquired Mo, day, y le Date sold or disposed of Moday. (d) Proceeds les price) se instructions) Cost or other basis See the Note below and see Columne in the separate instructions Gain or pos Subtract column from column i and combine the resu M Code(s) from instructions Amount of adjustment Totals. Add the amounts in columne (d), (el (al, and the subtract negative amounts). Enter each total here and include on your Schedule D, line 1b if Box A above is checked), line 2 of Box B bove is checked), or line 3 ( Box C above is checked If you checked Box A above but the basis reported to the IRS was incomect, enter in column (e) the basis as reported to the IRS, and enter an tment in column (g) to comect the basis. See Column (g) in the separate instructions for how to figure the amount of the adjustment aperwork Reduction Act Notice, see your tax return instructions. Form 8949 2021) Cat No. 377682 Page 2 Form 8949 (2021) Namels shown on retum. Name and SSN or taxpayer identification no. not required if shown on other side Attachment Sequence No. 12A Social security number or taxpayer identification number Before you check Box D, E, or F below, see whether you received any Form(s) 1099-8 or substitute statement(s) from your broker. A substitute statement will have the same information as Form 1099-8. Either will show whether your basis (usually your cost) was reported to the IRS by your broker and may even tell you which box to check Part II Long-Term. Transactions involving capital assets you held more than 1 year are generally long-term (see instructions). For short-term transactions, see page 1. Note: You may aggregate all long-term transactions reported on Form(s) 1099-B showing basis was reported. to the IRS and for which no adjustments or codes are required. Enter the totals directly on Schedule D, line Ba; you aren't required to report these transactions on Form 8949 (see instructions). You must check Box D, E, or F below. Check only one box. If more than one box applies for your long-term transactions, complete a separate Form 8949, page 2, for each applicable box. If you have more long-term transactions than will fit on this page for one or more of the boxes, complete as many forms with the same box checked as you need. (D) Long-term transactions reported on Form(s) 1099-B showing basis was reported to the IRS (see Note above) (E) Long-term transactions reported on Form(s) 1099-B showing basis wasn't reported to the IRS (F) Long-term transactions not reported to you on Form 1099-B 1 (0) Adjustment, if any, to gain or loss. you enter an amount in column enter a code in column ( See the separate instructions. (a) Description of property (Example 100 sh. XYZ CO) (b) Date acquired (Mo, day, yr.) (1) Proceeds Date sold or (sales price) disposed of (Mo, day, yr) (see instructions) Cost or other basis See the Note below and see Column in in the separate instructions N Gain or loss). Subtract column from column (d) and combine the result with column (g) (1) Code(s) from Amount of instructions adjustment 2 Totals. Add the amounts in columns (d), (e), fal, and (h) (subtract negative amounts). Enter each total here and include on your Schedule D, line 8b (f Box D above is checked), line 9 of Box E above is checked), or line 10 of Box F above is checked) Note: If you checked Box D above but the basis reported to the IRS was incorrect, enter in column (e) the basis as reported to the IRS, and enter an adjustment in column (g) to correct the basis. See Column (g) in the separate instructions for how to figure the amount of the adjustment Form 8949 (2021) EXHIBIT 4.2 Age 55 and under 56-60 61-65 66-70 71 and over Number of Anticipated Monthly Annuity Payments under the Simplified Method Number of Anticipated Monthly Payments 360 310 260 210 160 1040-SR US Tax Return for Seniors 21 Filing Status Mamed fing jointly Qualifying widower) (QW Head of household (HOH checked the HO Ch checked the MFS box, enter th qualifying person is a c Your name portretum, spune's first name and t PO At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency? Standard Someone can claim: You as a dependent Your spouse Deduction Spouse itemizes on a separate return or you were a dual status alen Age/Blindness Your Spouse: Were bom before January 2, 1957 Was bom before January 2, 1967 Dependents 1 Wages, sales, tips, etc. Amach FormW-2 Ac S 2a 2a Tax-exempt interest 3a Qualified dividends b. Taxable interest b Ordinary dividends Ja 4a IRA distributions. 4a b Taxable amount Sa Pensions and annuites Sa b Taxable amount Ga Social security benefits b Taxable amount 7 Capital gain or (ossi. Attach Schedule D if required. If not required check here 8 Other income from Schedule 1, in 10- 9 This is your total Add lines 1, 2b, 36, 4b. Sb. 66, 7, and Adjustments to income from Schedule 1, line 26 10 11 Subtract line 10 from line 9 This is your adjusted gross in For y Act, and Pon Act par Standard 12 Standard deduction or itemized deductions from Deduction Schedule A S Ob Charitable contributions if you take the standard deduction is instructions) Add lines 12 and 12b. 13 Qualified business income deduction from Fom 8905 or Form 8996-A 14 Add lines 12 and 13. 15 Taxable income. Subtract line 14 tiom line 1 16 Tax(see instructional. Check it any from 10 Fo8814 20 Form 4972 30 17 Amount from Schedule 2 line 3 18 Add lines 16 and 17 19 Nonrefundable child tax credit Schedule 8812 20 Amount from Schedule 3, line 8 21 Add lines 19 and 20. 22 Subtract line 21 from line 18. If zero or less enter 23 Other taxes, including self-employment tax, from Schedule 2 Ine 21 24 Addnes 22 and 23. This is your total tax 25 Federal income tax withheld from a FormW-2 Are blind is blind 2 FREE ECE FRENRE 120 14 20 1040-S 21 Add lines 19 and 20. 22 Subtract line 21 from line 18. If zero or less, enter-0- 23 Other taxes, including self-employment tax, from Schedule 2, line 21 24 Add lines 22 and 23. This is your total tax 25 Federal income tax withheld from: a Form(s) W-2. b Form(s) 1099 25b 25c c Other forms (see instructions) d Add lines 25a through 25c. 26 2021 estimated tax payments and amount applied from 2020 return 27a Earned income credit (EIC). 27a Check here if you were born after January 1, 1998, and before January 2, 2004, and you satisfy all the other requirements for taxpayers who are at least age 18 to claim the EIC. See instructions 0 b Nontaxable combat pay election. 27b c Prior year (2019) earned income. 27c 28 Refundable child tax credit or additional child tax credit from Schedule 8812.. 29 American opportunity credit from Form 8863, line 8 29 30 Recovery rebate credit. See instructions 31 Amount from Schedule 3, line 15 32 Add lines 27a and 28 through 31. These are your total other payments and refundable credits. 32 33 Add lines 25d, 26, and 32. These are your total payments 33 Go to www.in.gov/Form1040GR for inductions and the latest information Form 1040 SA 2001) Refund 34 If line 33 is more than line 24, subtract line 24 from line 33. This is the amount you overpaid 34 35a Amount of line 34 you want refunded to you. If Form 8888 is attached, check here 35a Oect depostb Routing number Type: Ocking Savings Se ructiona d Account number 36 Amount of line 34 you want applied to your 2022 estimated tax Amount 37 You Owe Amount you owe. Subtract line 33 from line 24. For details on how to pay, see instructions 38 Estimated tax penalty (see instructions). with the RST Third Party Designee Do you want to allow another person to discuss this instructions Yes. Como Designer's Sign Here Under penaties of peary, I declare that I have exam my knowledge and belet, they are true, comect and com of which preparer has any knowledge statements, and to the best of Declaration of proper han taxpaye is based on all information Your secution Your signature Joint Structions Kepay for Spouse's signature ajotun both mus Spouse's soupation Fathe Phone no Preparer's name Preparer's signatur Date PTN Paid Preparer Sat-employed F's a Use Only Go to www.in.gov/FotoS for instructions and the latest information you have Qualifying chid atach Sch IC Email address 2885 30 21 22 23 24 25d 26 31 F1040-SR Phone n FON Check it Page 3 F1040-SR p SCHEDULE D Form 1040) OMB No 1545-0074 Capital Gains and Losses 2021 Attach to Form 1040, 1040-5R, or 1040-NFL Go to www.irs.gov/Scheduled for instructions and the latest information. Use Form 8949 to list your transactions for lines 1b, 2, 3, 8, 9, and 10. Attachment Department of the Treasury temal Revenue Service Namels) shown on retur Sequence No. 12 Your social security number Did you dispose of any investment(s) in a qualified opportunity fund during the tax year? Yes No If "Yes," attach Form 8949 and see its instructions for additional requirements for reporting your gain or loss. Part 1 Short-Term Capital Gains and Losses-Generally Assets Held One Year or Less (see instructions) See instructions for how to figure the amounts to enter on the lines below. tal This form may be easier to complete if you round off cents to whole dollars. Proceeds ales price (0) Cost for other bas Adjustments to gain or loss from Formal 8048 Part L Ine 2 column ig Gain or loss) Subtract column (e) from column (d) and combine the resu with column ial 1a Totals for all short-term transactions reported on Form 1099-B for which basis was reported to the IRS and for which you have no adjustments (see instructions). However, if you choose to report all these transactions on Form 8949, leave this line blank and go to line 1b 1b Totals for all transactions reported on Form(s) 8949 with Box A checked 2 Totals for all transactions reported on Form(s) 8949 with Box B checked 3 Totals for all transactions reported on Form(s) 8949 with Box C checked 4 Short-term gain from Form 6252 and short-term gain or (loss) from Forms 4684, 6781, and 8824 4 5 Net short-term gain or (loss) from partnerships. S corporations, estates, and trusts from Schedule(s) K-1 5 6 Short-term capital loss carryover. Enter the amount, if any, from line 8 of your Capital Loss Carryover Worksheet in the instructions 6 7 Net short-term capital gain or (loss). Combine lines 1a through 6 in column (h). If you have any long- term capital gains or losses, go to Part Il below. Otherwise, go to Part ill on the back. 7 Part II Long-Term Capital Gains and Losses-Generally Assets Held More Than One Year (see instructions) lal See instructions for how to figure the amounts to enter on the lines below. 14 IN) Gain or Joss) Subtract column ( from column (d) and combine the result Cost Proceeds sales price for other basis Adjustments to gain or loss from Forms 8049 Part ine 2 column (g This form may be easier to complete if you round off cents to whole dollars. with column ig 8a Totals for all long-term transactions reported on Form 1099-B for which basis was reported to the IRS and for which you have no adjustments (see instructions). However, if you choose to report all these transactions on Form 8949, leave this line blank and go to line 8b 8b Totals for all transactions reported on Form(s) 8949 with Box D checked 9 Totals for all transactions reported on Form(s) 8949 with Box E checked 10 Totals for all transactions reported on Form(s) 8949 with Box F checked. 11 Gain from Form 4797, Part 1; long-term gain from Forms 2439 and 6252; and long-term gain or loss) from Forms 4684, 6781, and 8824 12 Net long-term gain or (loss) from partnerships, S corporations, estates, and trusts from Schedule(s) K-1 13 Capital gain distributions. See the instructions 14 Long-term capital loss carryover. Enter the amount, if any, from line 13 of your Capital Loss Carryover Worksheet in the instructions 15 Net long-term capital gain or (loss). Combine lines Ba through 14 in column (h). Then, go to Part Ill on the back. 15 For Paperwork Reduction Act Notice, see your tax return instructions. Cat No. 11338H Schedule D (Form 1040) 20 11 === 12 13 14 Schedule D (Form 1040) 2021 Part III Summary 16 Combine lines 7 and 15 and enter the result 16 If line 16 is a gain, enter the amount from line 16 on Form 1040, 1040-SR, or 1040-NR, line 7. Then, go to line 17 below. If line 16 is a loss, skip lines 17 through 20 below. Then, go to line 21. Also be sure to complete line 22. If line 16 is zero, skip lines 17 through 21 below and enter -0- on Form 1040, 1040-SR, or 1040-NR, line 7. Then, go to line 22. 17 Are lines 15 and 16 both gains? Yes. Go to line 18. No. Skip lines 18 through 21, and go to line 22. 18 If you are required to complete the 28% Rate Gain Worksheet (see instructions), enter the amount, if any, from line 7 of that worksheet 18 19 If you are required to complete the Unrecaptured Section 1250 Gain Worksheet (see instructions), enter the amount, if any, from line 18 of that worksheet 19 20 Are lines 18 and 19 both zero or blank and are you not filing Form 4952? Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and 1040-SR, line 16. Don't complete lines 21 and 22 below. No. Complete the Schedule D Tax Worksheet in the instructions. Don't complete lines 21 and 22 below. 21 If line 16 is a loss, enter here and on Form 1040, 1040-SR, or 1040-NR, line 7, the smaller of: The loss on line 16; or } 21 . ($3,000), or if married filing separately, ($1,500) Note: When figuring which amount is smaller, treat both amounts as positive numbers. 22 Do you have qualified dividends on Form 1040, 1040-SR, or 1040-NR, line 3a? Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and 1040-SR, line 16. No. Complete the rest of Form 1040, 1040-SR, or 1040-NR. Page 2 Schedule D (Form 1040) 2021 OMB No 1545-0074 Form 8949 Sales and Other Dispositions of Capital Assets 2021 Department of the Treasury Internal Revenue Service Namel shown on return Go to www.irs.gov/Form8949 for instructions and the latest information. File with your Schedule D to list your transactions for lines 1b, 2, 3, 8b, 9, and 10 of Schedule D. Social security number or taxpayer identification number Attachment Sequence No. 12A Before you check Box A, B, or C below, see whether you received any Form(s) 1099-B or substitute statement(s) from your broker. A substitute statement will have the same information as Form 1099-8. Either will show whether your basis usually your cost) was reported to the IRS by your broker and may even tell you which box to check Part I Short-Term. Transactions involving capital assets you held 1 year or less are generally short-term (see instructions). For long-term transactions, see page 2. Note: You may aggregate all short-term transactions reported on Form(s) 1099-B showing basis was reported to the IRS and for which no adjustments or codes are required. Enter the totals directly on Schedule D, line 1a; you aren't required to report these transactions on Form 8949 (see instructions). You must check Box A, B, or C below. Check only one box. If more than one box applies for your short-term transactions. complete a separate Form 8949, page 1. for each applicable box. If you have more short-term transactions than will fit on this page for one or more of the boxes, complete as many forms with the same box checked as you need. (A) Short-term transactions reported on Form(s) 1099-B showing basis was reported to the IRS (see Note above) (B) Short-term transactions reported on Form(s) 1099-8 showing basis wasn't reported to the IRS (C) Short-term transactions not reported to you on Form 1099-B 1 Adjustment, if any, to gain or loss you enter an amount in column enter a code in co See the separate instructions N (a) Description of property Example 100 sh XYZ Co) A Date acquired Mo, day, y le Date sold or disposed of Moday. (d) Proceeds les price) se instructions) Cost or other basis See the Note below and see Columne in the separate instructions Gain or pos Subtract column from column i and combine the resu M Code(s) from instructions Amount of adjustment Totals. Add the amounts in columne (d), (el (al, and the subtract negative amounts). Enter each total here and include on your Schedule D, line 1b if Box A above is checked), line 2 of Box B bove is checked), or line 3 ( Box C above is checked If you checked Box A above but the basis reported to the IRS was incomect, enter in column (e) the basis as reported to the IRS, and enter an tment in column (g) to comect the basis. See Column (g) in the separate instructions for how to figure the amount of the adjustment aperwork Reduction Act Notice, see your tax return instructions. Form 8949 2021) Cat No. 377682 Page 2 Form 8949 (2021) Namels shown on retum. Name and SSN or taxpayer identification no. not required if shown on other side Attachment Sequence No. 12A Social security number or taxpayer identification number Before you check Box D, E, or F below, see whether you received any Form(s) 1099-8 or substitute statement(s) from your broker. A substitute statement will have the same information as Form 1099-8. Either will show whether your basis (usually your cost) was reported to the IRS by your broker and may even tell you which box to check Part II Long-Term. Transactions involving capital assets you held more than 1 year are generally long-term (see instructions). For short-term transactions, see page 1. Note: You may aggregate all long-term transactions reported on Form(s) 1099-B showing basis was reported. to the IRS and for which no adjustments or codes are required. Enter the totals directly on Schedule D, line Ba; you aren't required to report these transactions on Form 8949 (see instructions). You must check Box D, E, or F below. Check only one box. If more than one box applies for your long-term transactions, complete a separate Form 8949, page 2, for each applicable box. If you have more long-term transactions than will fit on this page for one or more of the boxes, complete as many forms with the same box checked as you need. (D) Long-term transactions reported on Form(s) 1099-B showing basis was reported to the IRS (see Note above) (E) Long-term transactions reported on Form(s) 1099-B showing basis wasn't reported to the IRS (F) Long-term transactions not reported to you on Form 1099-B 1 (0) Adjustment, if any, to gain or loss. you enter an amount in column enter a code in column ( See the separate instructions. (a) Description of property (Example 100 sh. XYZ CO) (b) Date acquired (Mo, day, yr.) (1) Proceeds Date sold or (sales price) disposed of (Mo, day, yr) (see instructions) Cost or other basis See the Note below and see Column in in the separate instructions N Gain or loss). Subtract column from column (d) and combine the result with column (g) (1) Code(s) from Amount of instructions adjustment 2 Totals. Add the amounts in columns (d), (e), fal, and (h) (subtract negative amounts). Enter each total here and include on your Schedule D, line 8b (f Box D above is checked), line 9 of Box E above is checked), or line 10 of Box F above is checked) Note: If you checked Box D above but the basis reported to the IRS was incorrect, enter in column (e) the basis as reported to the IRS, and enter an adjustment in column (g) to correct the basis. See Column (g) in the separate instructions for how to figure the amount of the adjustment Form 8949 (2021)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts