Question: Please can I have help with this problem. P1-41 (a,b,c,d,e) (1,2,3,4). I need help please. Thank you Computing Return on Equity Starbucks reports net income

Please can I have help with this problem. P1-41 (a,b,c,d,e) (1,2,3,4). I need help please.

Thank you

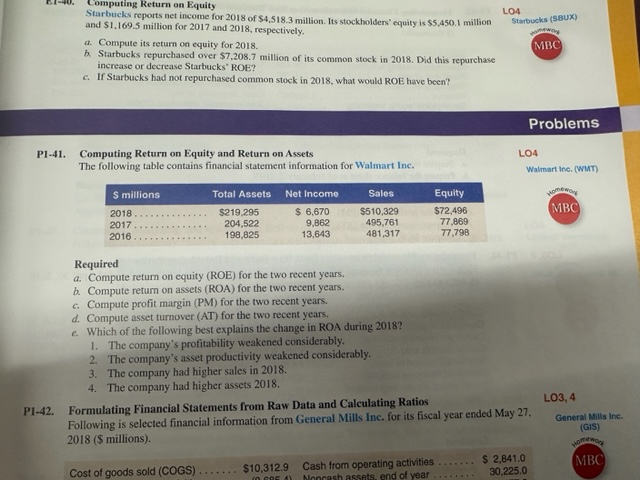

Computing Return on Equity Starbucks reports net income for 2018 of $4,518.3 million. Its stockholders' equity is $5,450.1 million LO4 and $1,169.5 million for 2017 and 2018 , respectively. Starbucks (SBUX) a. Compute its return on equity for 2018. b. Starbucks repurchased over $7,208.7 million of its common stock in 2018. Did this repurchase increase or decrease Starbucks' ROE? c. If Starbucks had not repurchased common stock in 2018, what would ROE have been? Problems P1-41. Computing Return on Equity and Return on Assets The following table contains financial statement information for Walmart Ine. LO4 Walmart ine. (WMT) Required a. Compute return on equity (ROE) for the two recent years. b. Compute return on assets (ROA) for the two recent years. c. Compute profit margin (PM) for the two recent years. d. Compute asset turnover (AT) for the two recent years. e. Which of the following best explains the change in ROA during 2018? 1. The company's profitability weakened considerably. 2. The company's asset productivity weakened considerably. 3. The company had higher sales in 2018 . 4. The company had higher assets 2018 . 1-42. Formulating Financial Statements from Raw Data and Calculating Ratios Following is selected financial information from General Mills Inc. for its fiscal year ended May 27, LO3, 4 2018 (\$ millions). General Mills (Gis) Cost of goods sold (COGS) $10,312.9 Cash from operating activities $2,841.0 30.225 .0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts