Question: Please can somebody explain my teachers answer: Why is LIBOR added to the borrow rates to make the total borrow rate? How to find the

Please can somebody explain my teachers answer:

Why is LIBOR added to the borrow rates to make the total borrow rate?

How to find the net Euro's payment of 156,000. I keep getting 87,000 Euros.

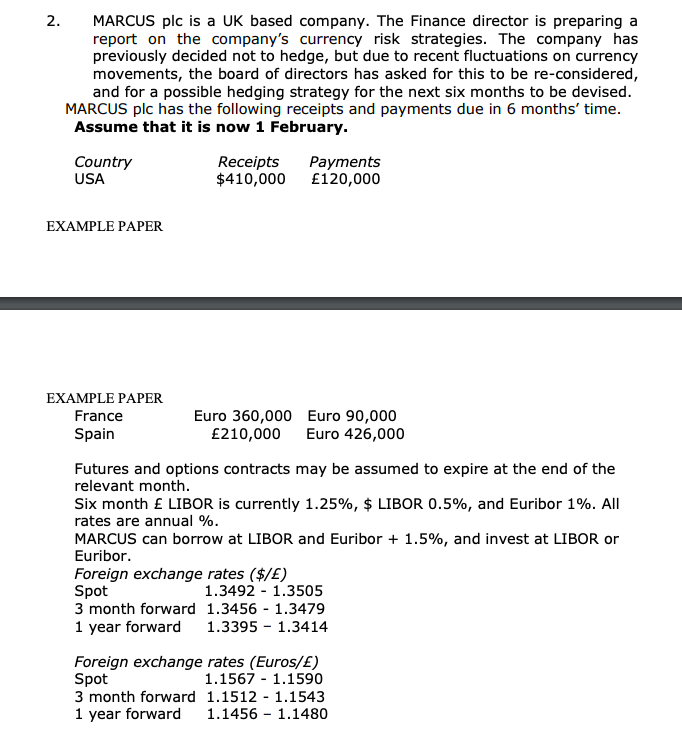

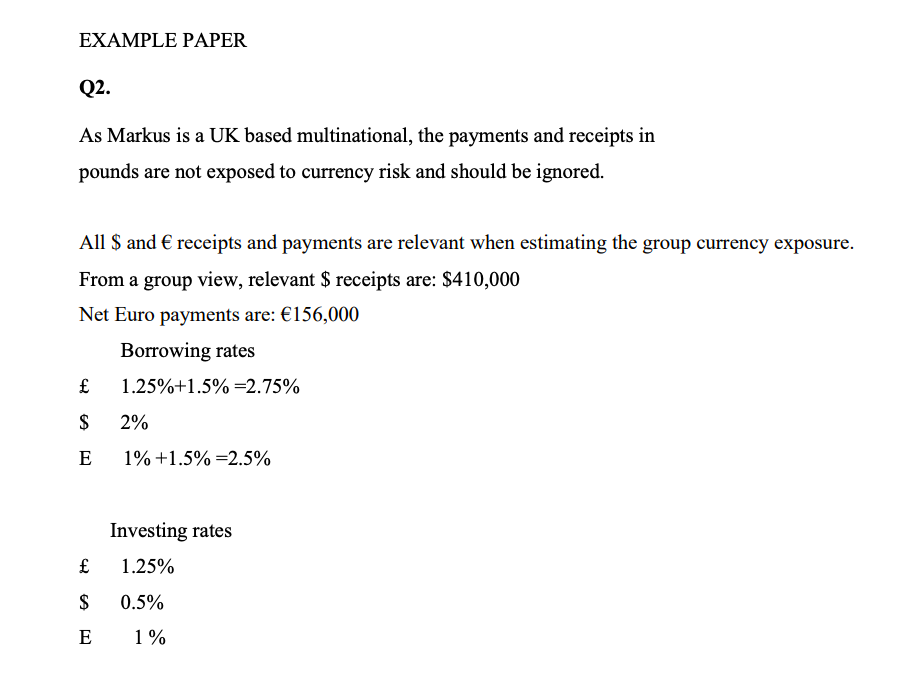

2. MARCUS plc is a UK based company. The Finance director is preparing a report on the company's currency risk strategies. The company has previously decided not to hedge, but due to recent fluctuations on currency movements, the board of directors has asked for this to be re-considered, and for a possible hedging strategy for the next six months to be devised. MARCUS plc has the following receipts and payments due in 6 months' time. Assume that it is now 1 February. Country Receipts Payments USA $410,000 120,000 EXAMPLE PAPER EXAMPLE PAPER France Spain Euro 360,000 Euro 90,000 210,000 Euro 426,000 Futures and options contracts may be assumed to expire at the end of the relevant month. Six month LIBOR is currently 1.25%, $ LIBOR 0.5%, and Euribor 1%. All rates are annual %. MARCUS can borrow at LIBOR and Euribor + 1.5%, and invest at LIBOR or Euribor. Foreign exchange rates ($/L) Spot 1.3492 - 1.3505 3 month forward 1.3456 - 1.3479 1 year forward 1.3395 - 1.3414 Foreign exchange rates (Euros/) Spot 1.1567 - 1.1590 3 month forward 1.1512 - 1.1543 1 year forward 1.1456 - 1.1480 EXAMPLE PAPER Q2. As Markus is a UK based multinational, the payments and receipts in pounds are not exposed to currency risk and should be ignored. All $ and receipts and payments are relevant when estimating the group currency exposure. From a group view, relevant $ receipts are: $410,000 Net Euro payments are: 156,000 Borrowing rates 1.25%+1.5% =2.75% $ 2% E 1% +1.5% =2.5% Investing rates 1.25% $ 0.5% E 1%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts