Question: Please can someone explain what happens in this table step by step. $15,000 (new equip) for the equipment plus $16,800 for (software) . Assume that

Please can someone explain what happens in this table step by step.

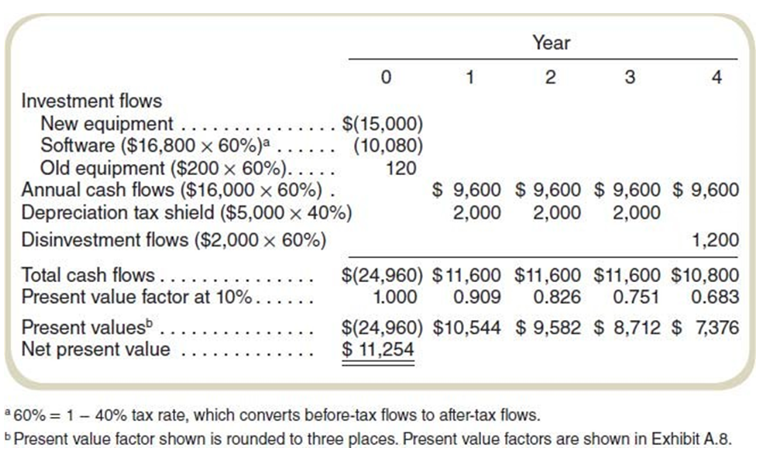

$15,000 (new equip) for the equipment plus $16,800 for (software).

Assume that the equipment can be depreciated over 3 years as follows: year 1, $5,000; year 2, $5,000; year 3, $5,000. (Depreciation tax shield).

The software can be written off immediately for tax purposes. The company expects to use the new machine for four years and to use straight-line depreciation.

The market for used computer systems is such that Michele could sell the equipment for $2,000 at the end of four years. The software would have no salvage value at that time. (Disinvestment flow).

Depreciated for tax purposes. It can be sold for an estimated $200 (Old Equip) but would have no salvage value in four years. If Michele does not buy the new equipment, it would continue to use the old graphics system for four more years.

Management believes that it will realize improvements in operations and benefits from the computer system worth $16,000 per year before taxes. (Annual Cash Flows)

Michele uses a 10% discount rate for this investment and has a marginal income tax rate of 40%.

a. Prepare a schedule showing the relevant cash flows for the project.

Please can someone explain what happens in this table step by step.

a60%=140% tax rate, which converts before-tax flows to after-tax flows. b Present value factor shown is rounded to three places. Present value factors are shown in Exhibit A.8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts