Question: please can someone fill the information on excel please and sent the solution ncial information for the year ending December 31 2020 for Grace Company

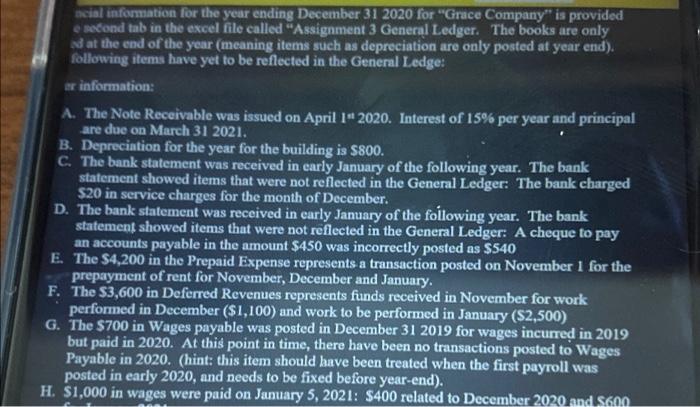

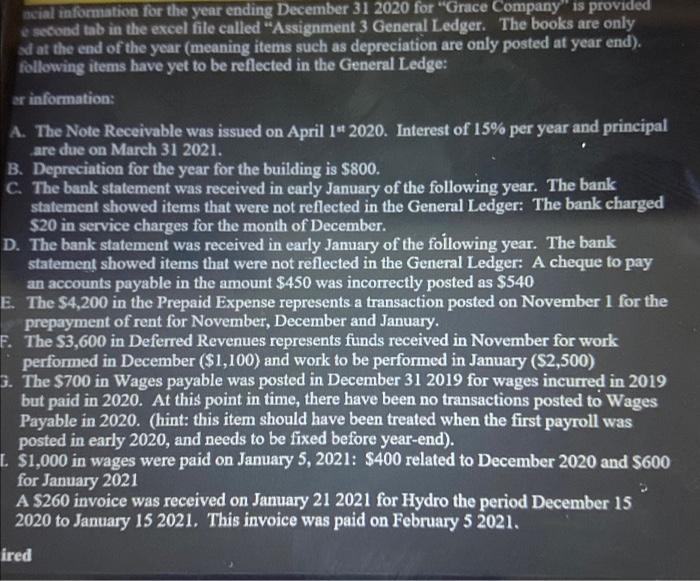

ncial information for the year ending December 31 2020 for "Grace Company is provided e second tab in the excel file called "Assignment 3 General Ledger. The books are only d at the end of the year (meaning items such as depreciation are only posted at year end). following items have yet to be reflected in the General Ledge: information: A. The Note Receivable was issued on April 1" 2020. Interest of 15% per year and principal are due on March 31 2021. B. Depreciation for the year for the building is $800. C. The bank statement was received in early January of the following year. The bank statement showed items that were not reflected in the General Ledger: The bank charged $20 in service charges for the month of December. D. The bank statement was received in early January of the following year. The bank statement showed items that were not reflected in the General Ledger: A cheque to pay an accounts payable in the amount $450 was incorrectly posted as $540 E. The $4,200 in the Prepaid Expense represents a transaction posted on November 1 for the prepayment of rent for November, December and January. F. The $3,600 in Deferred Revenues represents funds received in November for work performed in December ($1,100) and work to be performed in January ($2,500) G. The $700 in Wages payable was posted in December 31 2019 for wages incurred in 2019 but paid in 2020. At this point in time, there have been no transactions posted to Wages Payable in 2020. (hint: this item should have been treated when the first payroll was posted in early 2020, and needs to be fixed before year-end). H. $1,000 in wages were paid on January 5, 2021: $400 related to December 2020 and 5600 cial information for the year ending December 31 2020 for Grace Company is provided second tab in the excel file called "Assignment 3 General Ledger. The books are only d at the end of the year (meaning items such as depreciation are only posted at year end). following items have yet to be reflected in the General Ledge: ar information: A. The Note Receivable was issued on April 1" 2020. Interest of 15% per year and principal are due on March 31 2021. B. Depreciation for the year for the building is $800. C. The bank statement was received in early January of the following year. The bank statement showed items that were not reflected in the General Ledger: The bank charged $20 in service charges for the month of December. D. The bank statement was received in early January of the following year. The bank statement showed items that were not reflected in the General Ledger: A cheque to pay an accounts payable in the amount $450 was incorrectly posted as $540 E. The $4,200 in the Prepaid Expense represents a transaction posted on November 1 for the prepayment of rent for November, December and January. F. The $3,600 in Deferred Revenues represents funds received in November for work performed in December ($1,100) and work to be performed in January ($2,500) 5. The $700 in Wages payable was posted in December 31 2019 for wages incurred in 2019 but paid in 2020. At this point in time, there have been no transactions posted to Wages Payable in 2020. (hint: this item should have been treated when the first payroll was posted in early 2020, and needs to be fixed before year-end). L. $1,000 in wages were paid on January 5, 2021: $400 related to December 2020 and $600 for January 2021 A $260 invoice was received on January 21 2021 for Hydro the period December 15 2020 to January 15 2021. This invoice was paid on February 5 2021. ired

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts