Question: Please can someone help me with this question .Please explain how you got the answer . not excel .I would appreciate it Table 1 shows

Please can someone help me with this question .Please explain how you got the answer . not excel .I would appreciate it

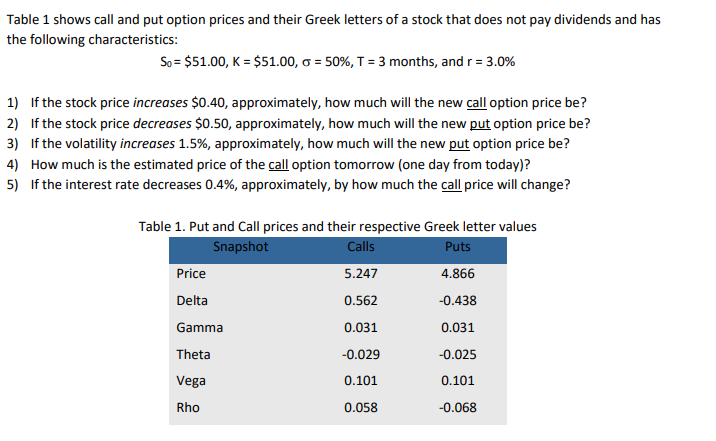

Table 1 shows call and put option prices and their Greek letters of a stock that does not pay dividends and has the following characteristics: So = $51.00, K = $51.00, 0 = 50%, T = 3 months, and r = 3.0% 1) if the stock price increases $0.40, approximately, how much will the new call option price be? 2) If the stock price decreases $0.50, approximately, how much will the new put option price be? 3) If the volatility increases 1.5%, approximately, how much will the new put option price be? 4) How much is the estimated price of the call option tomorrow (one day from today)? 5) If the interest rate decreases 0.4%, approximately, by how much the call price will change? Table 1. Put and Call prices and their respective Greek letter values Snapshot Calls Puts Price 4.866 Delta -0.438 Gamma 0.031 5.247 0.562 0.031 -0.029 0.101 0.058 Theta -0.025 0.101 Vega Rho -0.068

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts