Question: Please, can someone help to solve this assignment? Thank Tax Preparation (Chapter 3) You are to prepare a Federal Income Tax Return assuming the following

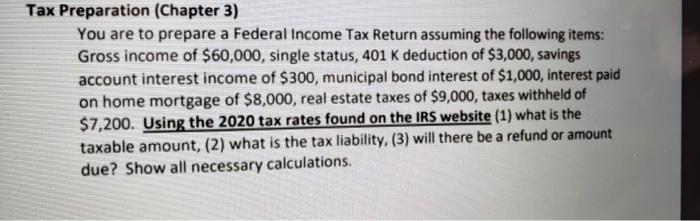

Tax Preparation (Chapter 3) You are to prepare a Federal Income Tax Return assuming the following items: Gross income of $60,000, single status, 401 K deduction of $3,000, savings account interest income of $300, municipal bond interest of $1,000, interest paid on home mortgage of $8,000, real estate taxes of $9,000, taxes withheld of $7,200. Using the 2020 tax rates found on the IRS website (1) what is the taxable amount, (2) what is the tax liability, (3) will there be a refund or amount due? Show all necessary calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts