Question: please can you answer both. I'll definitely drop a like for you. thanks 11. A financial intermediary has two assets in its investment portfolio. It

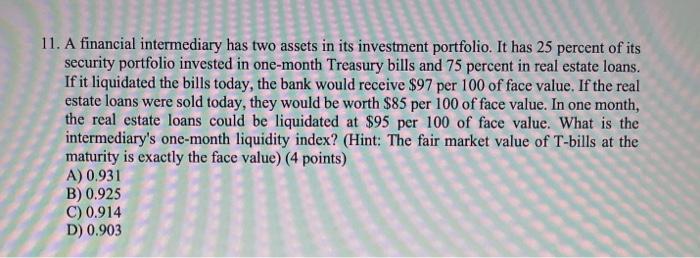

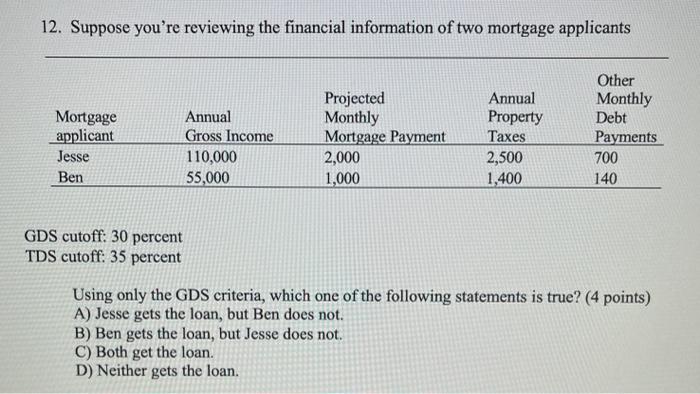

11. A financial intermediary has two assets in its investment portfolio. It has 25 percent of its security portfolio invested in one-month Treasury bills and 75 percent in real estate loans. If it liquidated the bills today, the bank would receive $97 per 100 of face value. If the real estate loans were sold today, they would be worth $85 per 100 of face value. In one month, the real estate loans could be liquidated at $95 per 100 of face value. What is the intermediary's one-month liquidity index? (Hint: The fair market value of T-bills at the maturity is exactly the face value) (4 points) A) 0.931 B) 0.925 C) 0.914 D) 0.903 12. Suppose you're reviewing the financial information of two mortgage applicants Mortgage applicant Jesse Ben Annual Gross Income 110,000 55,000 Projected Monthly Mortgage Payment 2,000 1,000 Annual Property Taxes 2,500 1,400 Other Monthly Debt Payments 700 140 GDS cutoff: 30 percent TDS cutoff: 35 percent Using only the GDS criteria, which one of the following statements is true? (4 points) A) Jesse gets the loan, but Ben does not. B) Ben gets the loan, but Jesse does not C) Both get the loan. D) Neither gets the loan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts