Question: Please can you answer question 1-5? thank you! 1. Which of the following is not a component of contributed capital? a Convertible preferred stock. b.

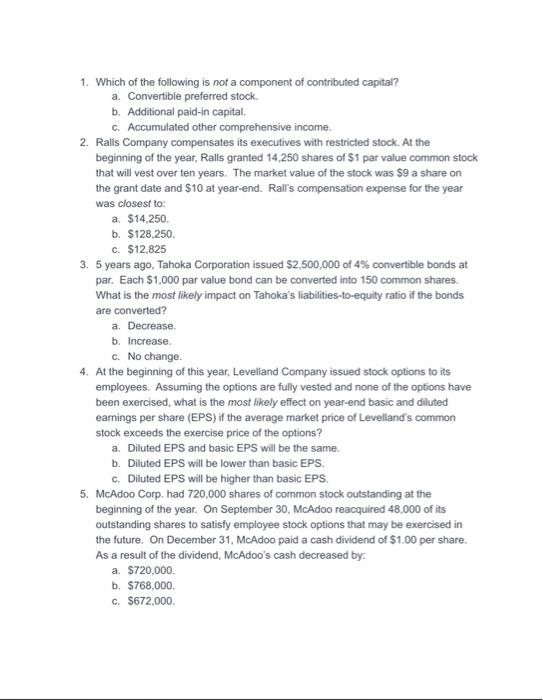

1. Which of the following is not a component of contributed capital? a Convertible preferred stock. b. Additional paid-in capital. c. Accumulated other comprehensive income. 2. Ralls Company compensates its executives with restricted stock. At the beginning of the year, Ralls granted 14.250 shares of $1 par value common stock that will vest over ten years. The market value of the stock was $9 a share on the grant date and $10 at year-end. Rall's compensation expense for the year was closest to: a $14,250 b. $128,250. c. $12,825 3. 5 years ago, Tahoka Corporation issued $2,500,000 of 4% convertible bonds at par. Each $1,000 par value bond can be converted into 150 common shares. What is the most likely impact on Tahoka's liabilities-to-equity ratio if the bonds are converted? a. Decrease b. Increase c. No change. 4. At the beginning of this year, Levelland Company issued stock options to its employees. Assuming the options are fully vested and none of the options have been exercised, what is the most likely effect on year-end basic and diluted earnings per share (EPS) if the average market price of Levelland's common stock exceeds the exercise price of the options? a. Diluted EPS and basic EPS will be the same. b. Diluted EPS will be lower than basic EPS. c. Diluted EPS will be higher than basic EPS 5. McAdoo Corp, had 720,000 shares of common stock outstanding at the beginning of the year. On September 30, McAdoo reacquired 48,000 of its outstanding shares to satisfy employee stock options that may be exercised in the future. On December 31, McAdoo paid a cash dividend of $1.00 per share. As a result of the dividend, McAdoo's cash decreased by: a. $720,000. b. $768,000 c. $672,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts