Question: please can you answer question 1-9 1) When Alfred Nobel died, he left the majority of his estate to fund 5 annual prizes starting one

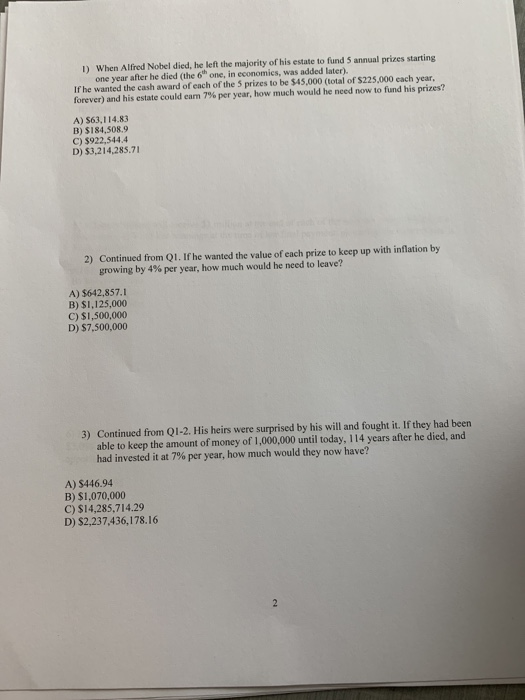

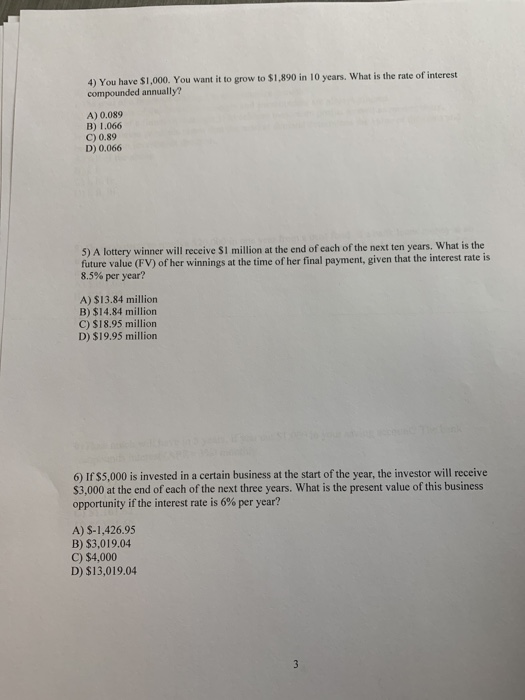

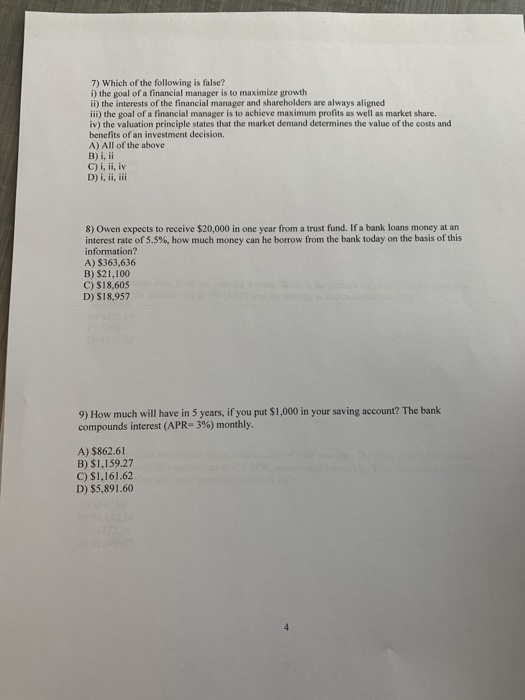

1) When Alfred Nobel died, he left the majority of his estate to fund 5 annual prizes starting one year after he died (the 6 one, in economics, was added later). If he wanted the cash award of each of the prizes to be $45.000 (total of $225.000 each year, forever) and his estate could eam 7% per year, how much would he need now to fund his prizes? A) $61,114.83 B) $184,SOR. C) 5922.544.4 D) $3,214,285.71 2) Continued from Q1. If he wanted the value of each prize to keep up with inflation by growing by 4% per year, how much would he need to leave? A) 5642,857.1 B) SI,125,000 C) $1,500,000 D) $7,500,000 3) Continued from Q1-2. His heirs were surprised by his will and fought it. If they had been able to keep the amount of money of 1,000,000 until today, 114 years after he died, and had invested it at 7% per year, how much would they now have? A) S446.94 B) $1,070,000 C) $14,285,714.29 D) $2,237,436,178.16 4) You have $1,000. You want it to grow to $1.890 in 10 years. What is the rate of interest compounded annually? A) 0.089 B) 1.066 C) 0.89 D) 0.066 5) A lottery winner will receive S1 million at the end of each of the next ten years. What is the future value (FV) of her winnings at the time of her final payment, given that the interest rate is 8.5% per year? A) $13.84 million B) $14.84 million C) $18.95 million D) $19.95 million 6) If $5,000 is invested in a certain business at the start of the year, the investor will receive $3,000 at the end of each of the next three years. What is the present value of this business opportunity if the interest rate is 6% per year? A) S-1,426.95 B) $3,019.04 C) $4,000 D) $13,019.04 7) Which of the following is false? i) the goal of a financial manager is to maximize growth ii) the interests of the financial manager and shareholders are always aligned ill) the goal of a financial manager is to achieve maximum profits as well as market share. iv) the valuation principle states that the market demand determines the value of the costs and benefits of an investment decision. A) All of the above B) ili C) i, ii, iv D) i, ii, iii 8) Owen expects to receive $20,000 in one year from a trust fund. If a bank loans money at an interest rate of 5.5%, how much money can he borrow from the bank today on the basis of this information? A) $363,636 B) $21,100 C) $18.605 D) $18,957 9) How much will have in 5 years, if you put $1,000 in your saving account? The bank compounds interest (APR=3%) monthly. A) $862.61 B) SI.159.27 C) $1,161.62 D) $5,891.60

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts