Question: Please can you answer these 1- 20 multiple choice questions? Thank you! 1. Anushka purchased 200 shares of Apple stock at $250. One year later,

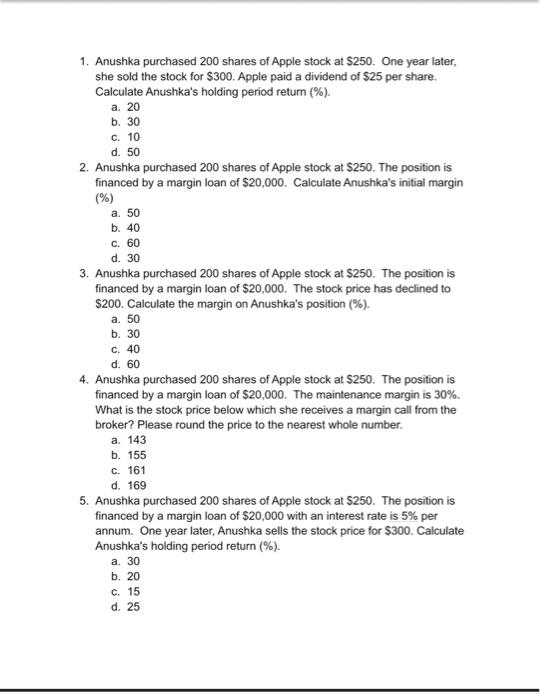

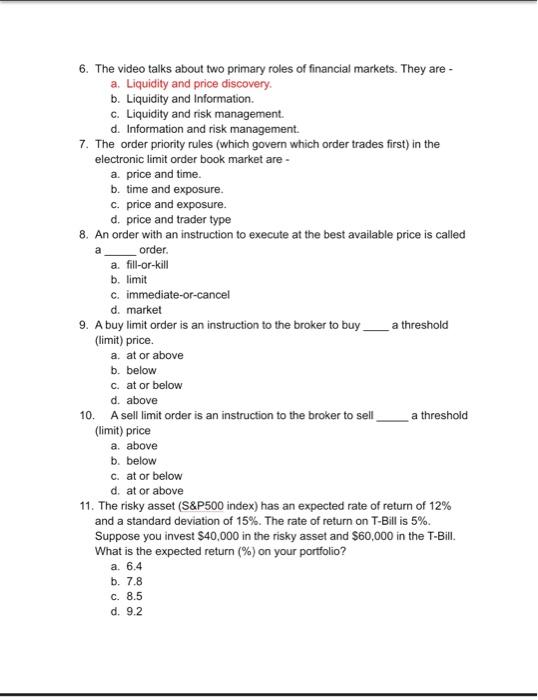

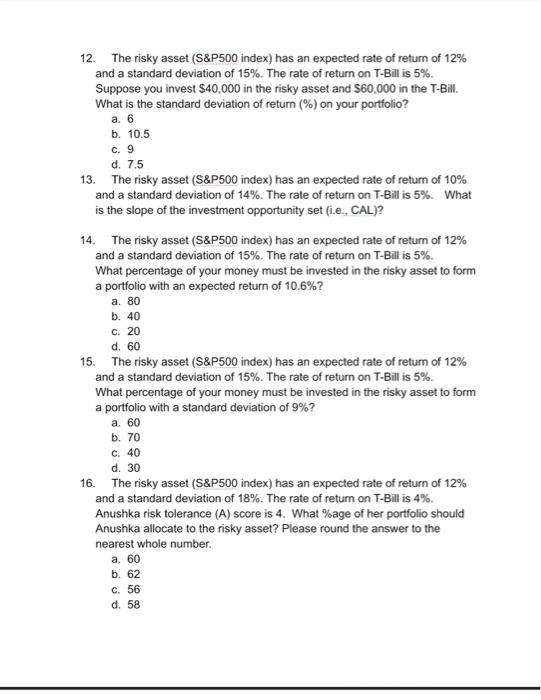

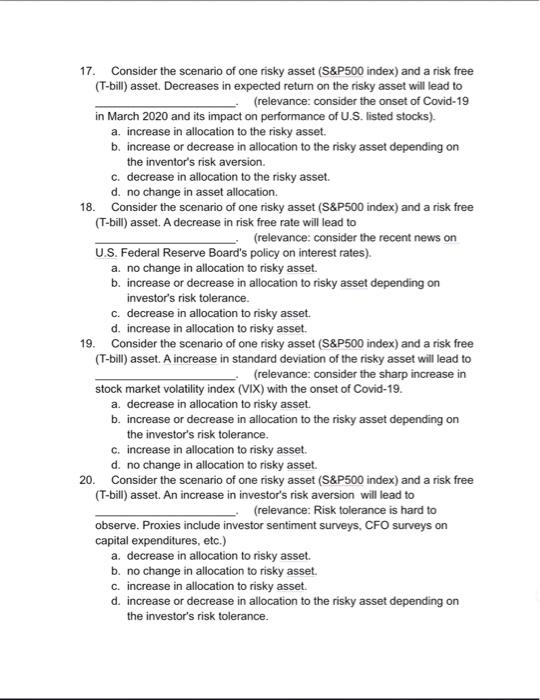

1. Anushka purchased 200 shares of Apple stock at $250. One year later, she sold the stock for $300. Apple paid a dividend of $25 per share. Calculate Anushka's holding period return (\%). a. 20 b. 30 c. 10 d. 50 2. Anushka purchased 200 shares of Apple stock at $250. The position is financed by a margin loan of $20,000. Calculate Anushka's initial margin (\%) a. 50 b. 40 c. 60 d. 30 3. Anushka purchased 200 shares of Apple stock at $250. The position is financed by a margin loan of $20,000. The stock price has declined to $200. Calculate the margin on Anushka's position (\%). a. 50 b. 30 c. 40 d. 60 4. Anushka purchased 200 shares of Apple stock at $250. The position is financed by a margin loan of $20,000. The maintenance margin is 30%. What is the stock price below which she receives a margin call from the broker? Please round the price to the nearest whole number. a. 143 b. 155 c. 161 d. 169 5. Anushka purchased 200 shares of Apple stock at \$250. The position is financed by a margin loan of $20,000 with an interest rate is 5% per annum. One year later, Anushka sells the stock price for $300. Calculate Anushka's holding period return (\%). a. 30 b. 20 c. 15 d. 25 6. The video talks about two primary roles of financial markets. They are - a. Liquidity and price discovery. b. Liquidity and Information. c. Liquidity and risk management. d. Information and risk management. 7. The order priority rules (which govern which order trades first) in the electronic limit order book market are - a. price and time. b. time and exposure. c. price and exposure. d. price and trader type 8. An order with an instruction to execute at the best available price is called a order. a. fill-or-kill b. limit c. immediate-or-cancel d. market 9. A buy limit order is an instruction to the broker to buy a threshold (limit) price. a. at or above b. below c. at or below d. above 10. A sell limit order is an instruction to the broker to sell a threshold (limit) price a. above b. below c. at or below d. at or above 11. The risky asset (S\&P500 index) has an expected rate of return of 12% and a standard deviation of 15%. The rate of return on T-Bill is 5%. Suppose you invest $40,000 in the risky asset and $60,000 in the T-Bill. What is the expected return (\%) on your portfolio? a. 6.4 b. 7.8 c. 8.5 d. 9.2 12. The risky asset (S\&P500 index) has an expected rate of return of 12% and a standard deviation of 15%. The rate of return on T-Bill is 5%. Suppose you invest $40,000 in the risky asset and $60,000 in the T-Bill. What is the standard deviation of return (\%) on your portfolio? a. 6 b. 10.5 c. 9 d. 7.5 13. The risky asset (S\&P500 index) has an expected rate of return of 10% and a standard deviation of 14%. The rate of return on T-Bill is 5%. What is the slope of the investment opportunity set (i.e., CAL)? 14. The risky asset (S\&P500 index) has an expected rate of return of 12% and a standard deviation of 15%. The rate of return on T-Bill is 5%. What percentage of your money must be invested in the risky asset to form a portfolio with an expected return of 10.6% ? a. 80 b. 40 c. 20 d. 60 15. The risky asset (S\&P500 index) has an expected rate of return of 12% and a standard deviation of 15%. The rate of return on T-Bill is 5%. What percentage of your money must be invested in the risky asset to form a portfolio with a standard deviation of 9% ? a. 60 b. 70 c. 40 d. 30 16. The risky asset (S\&P500 index) has an expected rate of return of 12% and a standard deviation of 18%. The rate of return on T-Bill is 4%. Anushka risk tolerance (A) score is 4. What \%age of her portfolio should Anushka allocate to the risky asset? Please round the answer to the nearest whole number. a. 60 b. 62 c. 56 d. 58 17. Consider the scenario of one risky asset (S\&P500 index) and a risk free (T-bill) asset. Decreases in expected return on the risky asset will lead to (relevance: consider the onset of Covid-19 in March 2020 and its impact on performance of U.S. listed stocks). a. increase in allocation to the risky asset. b. increase or decrease in allocation to the risky asset depending on the inventor's risk aversion. c. decrease in allocation to the risky asset. d. no change in asset allocation. 18. Consider the scenario of one risky asset (S\&P500 index) and a risk free (T-bili) asset. A decrease in risk free rate will lead to (relevance: consider the recent news on U.S. Federal Reserve Board's policy on interest rates). a. no change in allocation to risky asset. b. increase or decrease in allocation to risky asset depending on investor's risk tolerance. c. decrease in allocation to risky asset. d. increase in allocation to risky asset. 19. Consider the scenario of one risky asset (S\&P500 index) and a risk free (T-bill) asset. A increase in standard deviation of the risky asset will lead to (relevance: consider the sharp increase in stock market volatility index (VIX) with the onset of Covid-19. a. decrease in allocation to risky asset. b. increase or decrease in allocation to the risky asset depending on the investor's risk tolerance. c. increase in allocation to risky asset. d. no change in allocation to risky asset. 20. Consider the scenario of one risky asset (S\&P500 index) and a risk free (T-bill) asset. An increase in investor's risk aversion will lead to (relevance: Risk tolerance is hard to observe. Proxies include investor sentiment surveys, CFO surveys on capital expenditures, etc.) a. decrease in allocation to risky asset. b. no change in allocation to risky asset. c. increase in allocation to risky asset. d. increase or decrease in allocation to the risky asset depending on the investor's risk tolerance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts