Question: Please can you answer these 5 multiple choice questions 6. Consider the case of two risky assets (stocks and bonds) and the risk free asset.

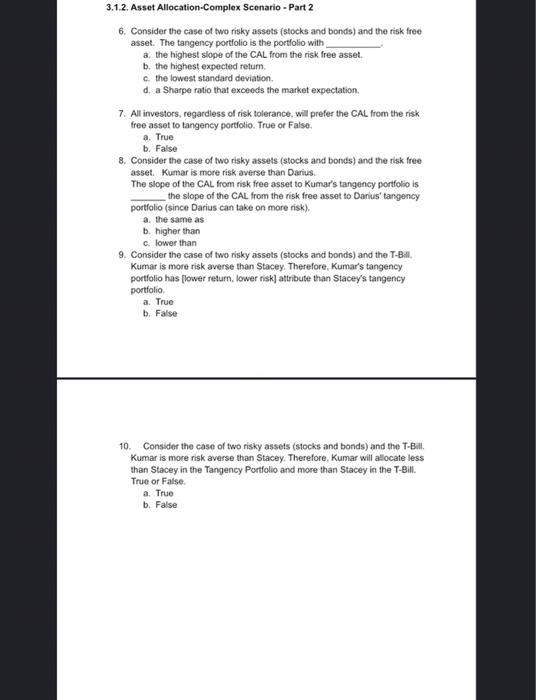

6. Consider the case of two risky assets (stocks and bonds) and the risk free asset. The tangency portfolio is the portfolio with 3. the highest slope of the CAL from the risk free asset. b. the highest expected return. c. the lowest standard deviation. d. a Sharpe fatio that exceeds the market expectation. 7. All investors, regardless of risk tolerance, will prefer the CAL from the risk free asset to tangency portfolio. True or False. a. True b. False 8. Consider the case of two risky assets (stocks and bonds) and the risk free asset. Kumar is more risk averse than Darius. The slope of the CAL. from risk free asset to Kumar's tangency portfolio is the slope of the CAL from the risk free asset to Danius' tangency portfolio (since Darius can take on more risk). a. the same as b. higher than c. Iower than 9. Consider the case of two risky assets (stocks and bonds) and the T-Bil. Kumar is more risk averse than Stacey. Therefore, Kumar's tangency portfolio has [lower return, lower risk] attribute than Stacey's tangency portfolio. a. True b. False 10. Consider the case of two risky assets (stocks and bonds) and the T-Bill. Kumar is more risk averse than Stacey. Therefore, Kumar will allocate less than Stacey in the Tangency Portfolio and more than Stacey in the T-Bill. True or False. a. True b. False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts