Question: Please can you answer this 5 multiple question. thnk you 12. The risky asset (S&P500 index) has an expected rate of return of 12% and

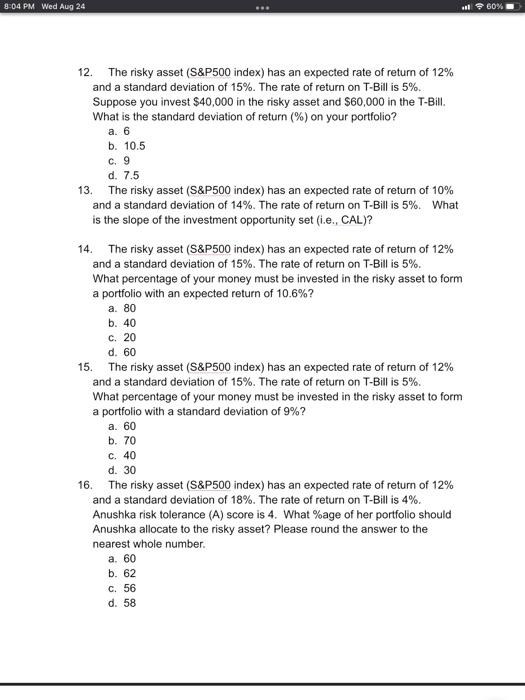

12. The risky asset (S\&P500 index) has an expected rate of return of 12% and a standard deviation of 15%. The rate of return on T-Bill is 5%. Suppose you invest $40,000 in the risky asset and $60,000 in the T-Bil. What is the standard deviation of return (%) on your portfolio? a. 6 b. 10.5 c. 9 d. 7.5 13. The risky asset (S\&P500 index) has an expected rate of return of 10% and a standard deviation of 14%. The rate of return on T-Bill is 5%. What is the slope of the investment opportunity set (i.e., CAL)? 14. The risky asset (S\&P500 index) has an expected rate of return of 12% and a standard deviation of 15%. The rate of return on T-Bill is 5%. What percentage of your money must be invested in the risky asset to form a portfolio with an expected return of 10.6% ? a. 80 b. 40 c. 20 d. 60 15. The risky asset (S\&P500 index) has an expected rate of return of 12% and a standard deviation of 15%. The rate of return on T-Bill is 5%. What percentage of your money must be invested in the risky asset to form a portfolio with a standard deviation of 9% ? a. 60 b. 70 c. 40 d. 30 16. The risky asset (S\&P500 index) has an expected rate of return of 12% and a standard deviation of 18%. The rate of return on T-Bill is 4%. Anushka risk tolerance (A) score is 4. What \%age of her portfolio should Anushka allocate to the risky asset? Please round the answer to the nearest whole number. a. 60 b. 62 c. 56 d. 58

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts