Question: Please can you answer this multiple choice question 6 - 17? thank you! 6. Which of the following best describes the par value of common

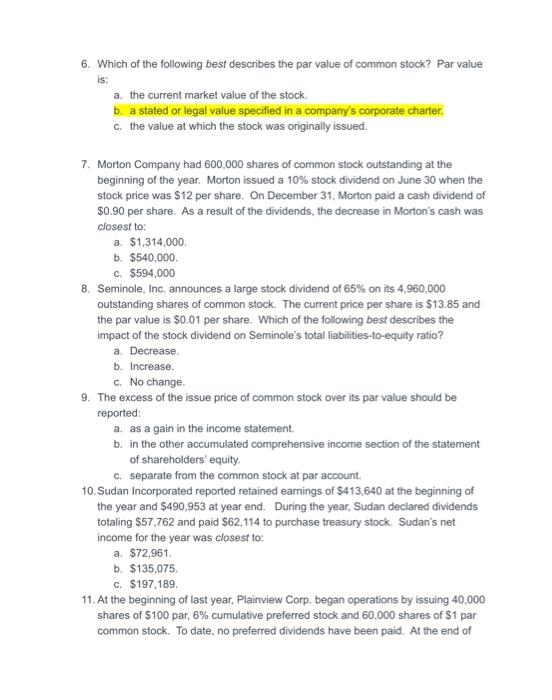

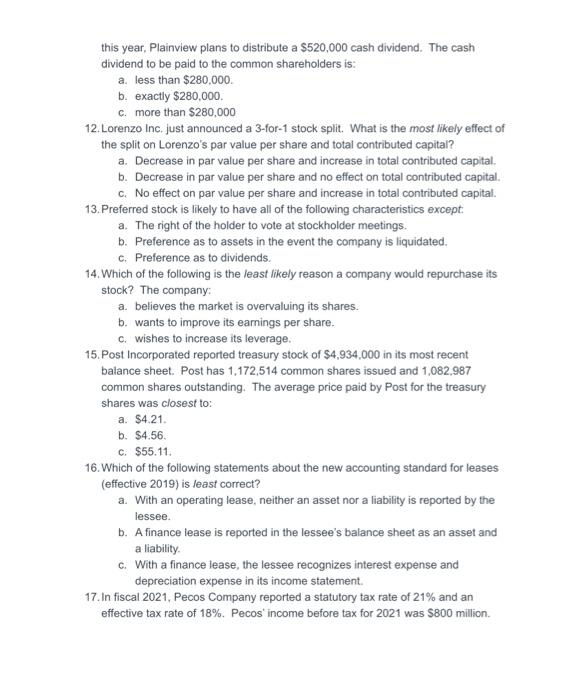

6. Which of the following best describes the par value of common stock? Par value is: a the current market value of the stock. b. a stated or legal value specified in a company's corporate charter. c. the value at which the stock was originally issued. 7. Morton Company had 600.000 shares of common stock outstanding at the beginning of the year. Morton issued a 10% stock dividend on June 30 when the stock price was $12 per share. On December 31, Morton paid a cash dividend of $0.90 per share. As a result of the dividends, the decrease in Morton's cash was closest to: a $1,314,000 b. $540,000 c. $594,000 8. Seminole, Inc. announces a large stock dividend of 65% on its 4,960,000 outstanding shares of common stock. The current price per share is $13.85 and the par value is $0.01 per share. Which of the following best describes the impact of the stock dividend on Seminole's total liabilities-to-equity ratio? a Decrease. b. Increase c. No change 9. The excess of the issue price of common stock over its par value should be reported: a as again in the income statement. b. in the other accumulated comprehensive income section of the statement of shareholders' equity C. separate from the common stock at par account 10. Sudan Incorporated reported retained earnings of $413,540 at the beginning of the year and $490,953 at year end. During the year, Sudan declared dividends totaling $57.762 and paid $62,114 to purchase treasury stock. Sudan's net income for the year was closest to: a $72,961. b. $135,075 C. $197.189 11. At the beginning of last year, Plainview Corp, began operations by issuing 40,000 shares of $100 par, 6% cumulative preferred stock and 60,000 shares of $1 par common stock. To date, no preferred dividends have been paid. At the end of this year, Plainview plans to distribute a $520,000 cash dividend. The cash dividend to be paid to the common shareholders is: a less than $280,000 b. exactly $280,000 c. more than $280,000 12. Lorenzo Inc. just announced a 3-for-1 stock split. What is the most likely effect of the split on Lorenzo's par value per share and total contributed capital? a. Decrease in par value per share and increase in total contributed capital. b. Decrease in par value per share and no effect on total contributed capital. c. No effect on par value per share and increase in total contributed capital 13. Preferred stock is likely to have all of the following characteristics except: a. The right of the holder to vote at stockholder meetings. b. Preference as to assets in the event the company is liquidated. c. Preference as to dividends. 14.Which of the following is the least likely reason a company would repurchase its stock? The company: a. believes the market is overvaluing its shares. b. wants to improve its earnings per share. c. wishes to increase its leverage. 15. Post Incorporated reported treasury stock of $4,934.000 in its most recent balance sheet. Post has 1,172,514 common shares issued and 1,082.987 common shares outstanding. The average price paid by Post for the treasury shares was closest to: a. $4.21 b. $4.56. C. $55.11. 16. Which of the following statements about the new accounting standard for leases (effective 2019) is least correct? a. With an operating lease, neither an asset nor a liability is reported by the lessee. b. A finance lease is reported in the lessee's balance sheet as an asset and a liability, c. With a finance lease, the lessee recognizes interest expense and depreciation expense in its income statement 17. In fiscal 2021, Pecos Company reported a statutory tax rate of 21% and an effective tax rate of 18%. Pecos income before tax for 2021 was $800 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts