Question: Please can you answer this question, thank you File 2 - Cottingham Trading Ltd Cottingham Trading Ltd is located in East Hull has the following

Please can you answer this question, thank you

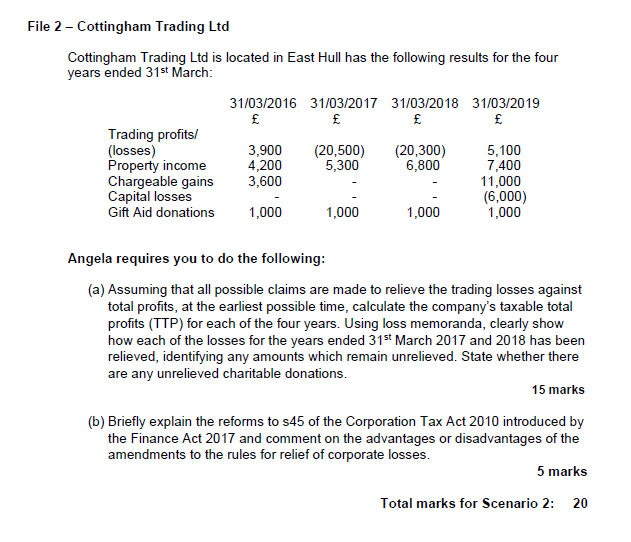

File 2 - Cottingham Trading Ltd Cottingham Trading Ltd is located in East Hull has the following results for the four years ended 31st March: 31/03/2016 31/03/2017 31/03/2018 31/03/2019 f f Trading profits/ (losses) 3,900 (20,500) (20,300) 5,100 Property income 4,200 5,300 6,800 7,400 Chargeable gains 3,600 11,000 Capital losses (6,000) Gift Aid donations 1,000 1,000 1,000 1,000 Angela requires you to do the following: (a) Assuming that all possible claims are made to relieve the trading losses against total profits, at the earliest possible time, calculate the company's taxable total profits (TTP) for each of the four years. Using loss memoranda, clearly show how each of the losses for the years ended 31st March 2017 and 2018 has been relieved, identifying any amounts which remain unrelieved. State whether there are any unrelieved charitable donations. 15 marks (b) Briefly explain the reforms to s45 of the Corporation Tax Act 2010 introduced by the Finance Act 2017 and comment on the advantages or disadvantages of the amendments to the rules for relief of corporate losses. 5 marks Total marks for Scenario 2: 20 File 2 - Cottingham Trading Ltd Cottingham Trading Ltd is located in East Hull has the following results for the four years ended 31st March: 31/03/2016 31/03/2017 31/03/2018 31/03/2019 f f Trading profits/ (losses) 3,900 (20,500) (20,300) 5,100 Property income 4,200 5,300 6,800 7,400 Chargeable gains 3,600 11,000 Capital losses (6,000) Gift Aid donations 1,000 1,000 1,000 1,000 Angela requires you to do the following: (a) Assuming that all possible claims are made to relieve the trading losses against total profits, at the earliest possible time, calculate the company's taxable total profits (TTP) for each of the four years. Using loss memoranda, clearly show how each of the losses for the years ended 31st March 2017 and 2018 has been relieved, identifying any amounts which remain unrelieved. State whether there are any unrelieved charitable donations. 15 marks (b) Briefly explain the reforms to s45 of the Corporation Tax Act 2010 introduced by the Finance Act 2017 and comment on the advantages or disadvantages of the amendments to the rules for relief of corporate losses. 5 marks Total marks for Scenario 2: 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts