Question: please can you do question 1.1 and 1.2 please don't forget about the income statement! thanks so much 4. 5. The business sublets a portion

please can you do question 1.1 and 1.2 please don't forget about the income statement! thanks so much

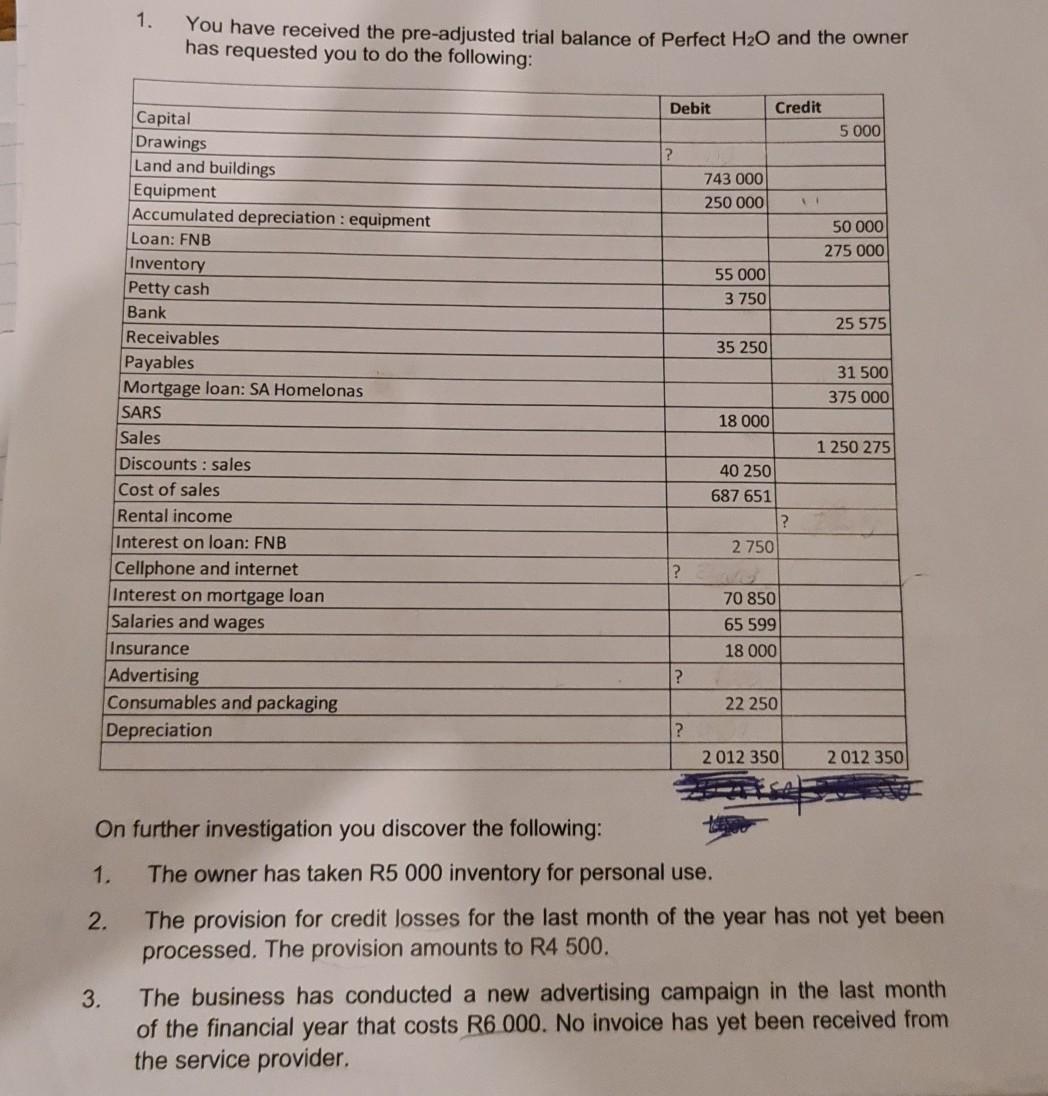

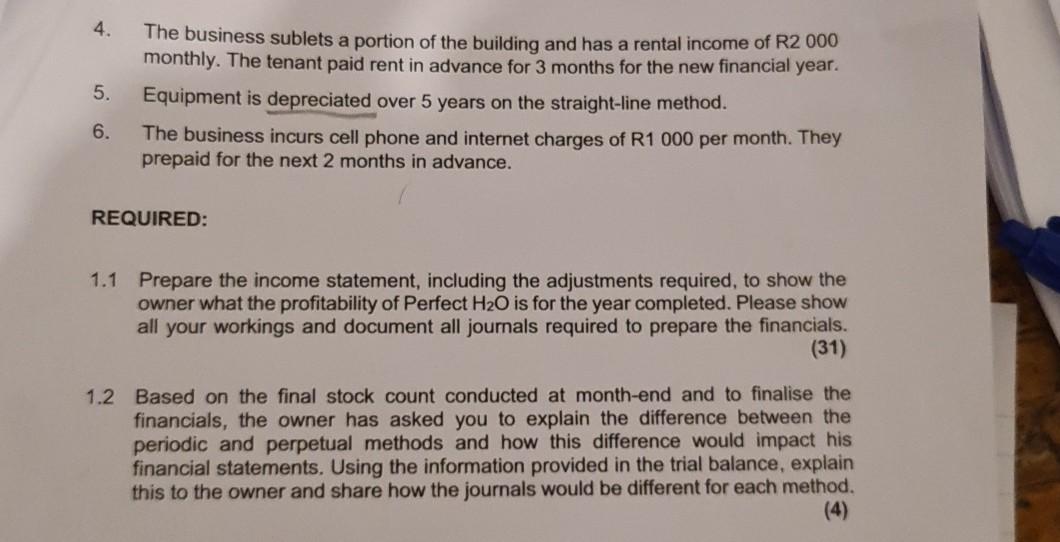

4. 5. The business sublets a portion of the building and has a rental income of R2 000 monthly. The tenant paid rent in advance for 3 months for the new financial year. Equipment is depreciated over 5 years on the straight-line method. The business incurs cell phone and internet charges of R1 000 per month. They prepaid for the next 2 months in advance. 6. REQUIRED: 1.1 Prepare the income statement, including the adjustments required, to show the owner what the profitability of Perfect H2O is for the year completed. Please show all your workings and document all journals required to prepare the financials. (31) 1.2 Based on the final stock count conducted at month-end and to finalise the financials, the owner has asked you to explain the difference between the periodic and perpetual methods and how this difference would impact his financial statements. Using the information provided in the trial balance, explain this to the owner and share how the journals would be different for each method. 4. 5. The business sublets a portion of the building and has a rental income of R2 000 monthly. The tenant paid rent in advance for 3 months for the new financial year. Equipment is depreciated over 5 years on the straight-line method. The business incurs cell phone and internet charges of R1 000 per month. They prepaid for the next 2 months in advance. 6. REQUIRED: 1.1 Prepare the income statement, including the adjustments required, to show the owner what the profitability of Perfect H2O is for the year completed. Please show all your workings and document all journals required to prepare the financials. (31) 1.2 Based on the final stock count conducted at month-end and to finalise the financials, the owner has asked you to explain the difference between the periodic and perpetual methods and how this difference would impact his financial statements. Using the information provided in the trial balance, explain this to the owner and share how the journals would be different for each method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts