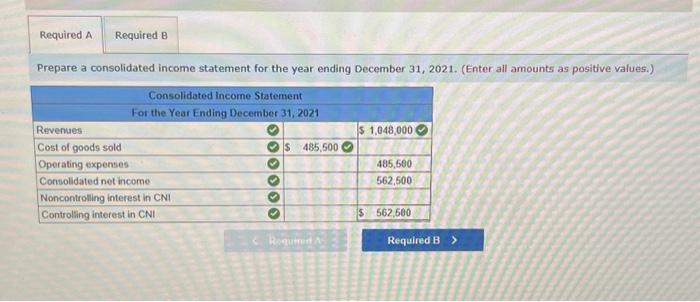

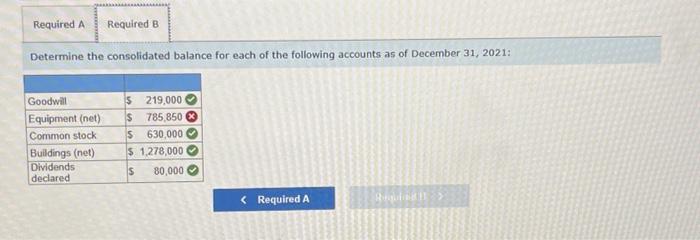

Question: please can you explain me Required A : Operating Expenses and Noncontrolling interest in CNI Please help me (Required B) Equipment (net) Following are the

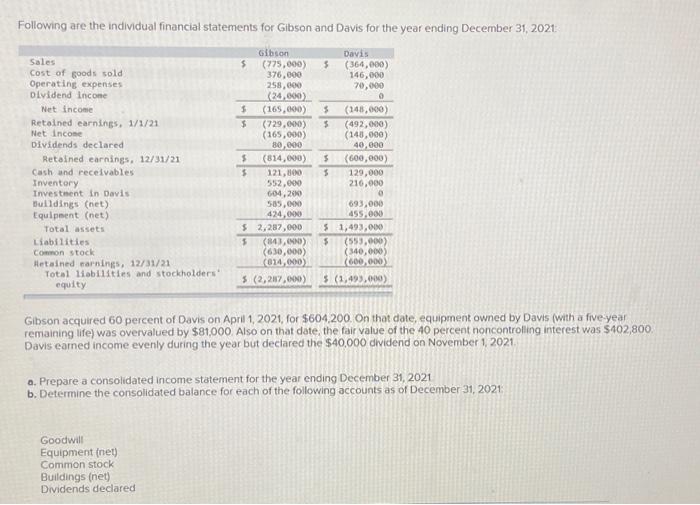

Following are the individual financial statements for Gibson and Davis for the year ending December 31, 2021 Gibson acquired 60 percent of Davis on April 1, 2021, for $604,200. On that date, equipment owned by Davis (with a five-yeat remaining life) was overvalued by $81,000. Also on that date, the fair value of the 40 percent noncontrolling interest was $402,800. Davis eamed income evenly during the year but dectared the $40,000 dwidend on November 1, 2021. a. Prepare a consolidated income statement for the year ending December 31,2021 b. Determine the consolidated balance for each of the following accounts as of December 31,2021 Following are the individual financial statements for Gibson and Davis for the year ending December 31, 2021 Gibson acquired 60 percent of Davis on April 1, 2021, for $604,200. On that date, equipment owned by Davis (with a five-yeat remaining life) was overvalued by $81,000. Also on that date, the fair value of the 40 percent noncontrolling interest was $402,800. Davis eamed income evenly during the year but dectared the $40,000 dwidend on November 1, 2021. a. Prepare a consolidated income statement for the year ending December 31,2021 b. Determine the consolidated balance for each of the following accounts as of December 31,2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts