Question: Please can you help me solve this. You can also use your own LBO model. thank you Question 8 1 pts Pinder Co is planning

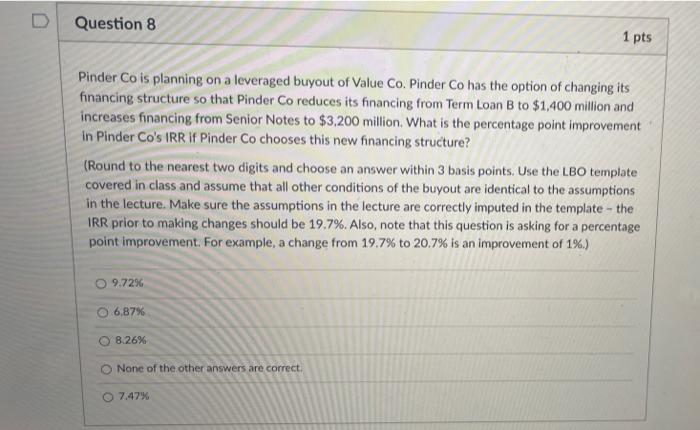

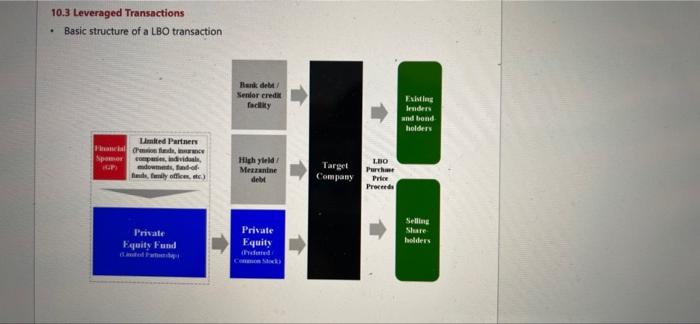

Question 8 1 pts Pinder Co is planning on a leveraged buyout of Value Co. Pinder Co has the option of changing its financing structure so that Pinder Co reduces its financing from Term Loan B to $1,400 million and increases financing from Senior Notes to $3,200 million. What is the percentage point improvement in Pinder Co's IRR if Pinder Co chooses this new financing structure? (Round to the nearest two digits and choose an answer within 3 basis points. Use the LBO template covered in class and assume that all other conditions of the buyout are identical to the assumptions in the lecture. Make sure the assumptions in the lecture are correctly imputed in the template - the IRR prior to making changes should be 19.7%. Also, note that this question is asking for a percentage point improvement. For example, a change from 19.7% to 20.7% is an improvement of 1%.) O 9.72% 6,87% 8.26% None of the other answers are correct. 7.47% 10.3 Leveraged Transactions Basic structure of a LBO transaction Bank debat Senior cred facility ENIRE Irudens and bond holders Limited Partner CE Spomer companies individ HU dows dely affem.) High yield Mezzanine debt Target Company LBO Parche Price Proceeds Private Equity Fund Private Equity Selling Share folders 1 Valusco Corporation Laww.ged By Analysis TIR V C Val Year TE HUF Year PIR 11 F 18 TER CATA N de Free NA Les Les WHO Crew 4 Ewige OD Tabwe Tuu SAN INTI DA DAG TO NA ETA T38 x fx le De Praat Perma Year Year 2 21 Year 2016 Year 2016 Years You 7 1 Toer 10 Yew Year 292 PwCIBOR One Oslo Osting Active Glow rosie 30 Cash Awal for et payment Tor My 12 Com 33 Cash Ave for Optional Data e 10 Text 2 45 Radio da 17 LIBOR 19 23 Come on the Portion 21 22 MB 21 www 20 Ening Bence IS! 2n Exper OR 25 A les Terme By 33 34 LIBOR 25 Tem 36 Suretu Per A, B al My ! BB Many a 40 OR Eing 43 In Rate 4 40 BA Tam 55 De SER Erding 55 Question 8 1 pts Pinder Co is planning on a leveraged buyout of Value Co. Pinder Co has the option of changing its financing structure so that Pinder Co reduces its financing from Term Loan B to $1,400 million and increases financing from Senior Notes to $3,200 million. What is the percentage point improvement in Pinder Co's IRR if Pinder Co chooses this new financing structure? (Round to the nearest two digits and choose an answer within 3 basis points. Use the LBO template covered in class and assume that all other conditions of the buyout are identical to the assumptions in the lecture. Make sure the assumptions in the lecture are correctly imputed in the template - the IRR prior to making changes should be 19.7%. Also, note that this question is asking for a percentage point improvement. For example, a change from 19.7% to 20.7% is an improvement of 1%.) O 9.72% 6,87% 8.26% None of the other answers are correct. 7.47% 10.3 Leveraged Transactions Basic structure of a LBO transaction Bank debat Senior cred facility ENIRE Irudens and bond holders Limited Partner CE Spomer companies individ HU dows dely affem.) High yield Mezzanine debt Target Company LBO Parche Price Proceeds Private Equity Fund Private Equity Selling Share folders 1 Valusco Corporation Laww.ged By Analysis TIR V C Val Year TE HUF Year PIR 11 F 18 TER CATA N de Free NA Les Les WHO Crew 4 Ewige OD Tabwe Tuu SAN INTI DA DAG TO NA ETA T38 x fx le De Praat Perma Year Year 2 21 Year 2016 Year 2016 Years You 7 1 Toer 10 Yew Year 292 PwCIBOR One Oslo Osting Active Glow rosie 30 Cash Awal for et payment Tor My 12 Com 33 Cash Ave for Optional Data e 10 Text 2 45 Radio da 17 LIBOR 19 23 Come on the Portion 21 22 MB 21 www 20 Ening Bence IS! 2n Exper OR 25 A les Terme By 33 34 LIBOR 25 Tem 36 Suretu Per A, B al My ! BB Many a 40 OR Eing 43 In Rate 4 40 BA Tam 55 De SER Erding 55

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts