Question: Please can you just answer question C Section C - Answer TWO (2) of the three questions in this section. You should show your full

Please can you just answer question C

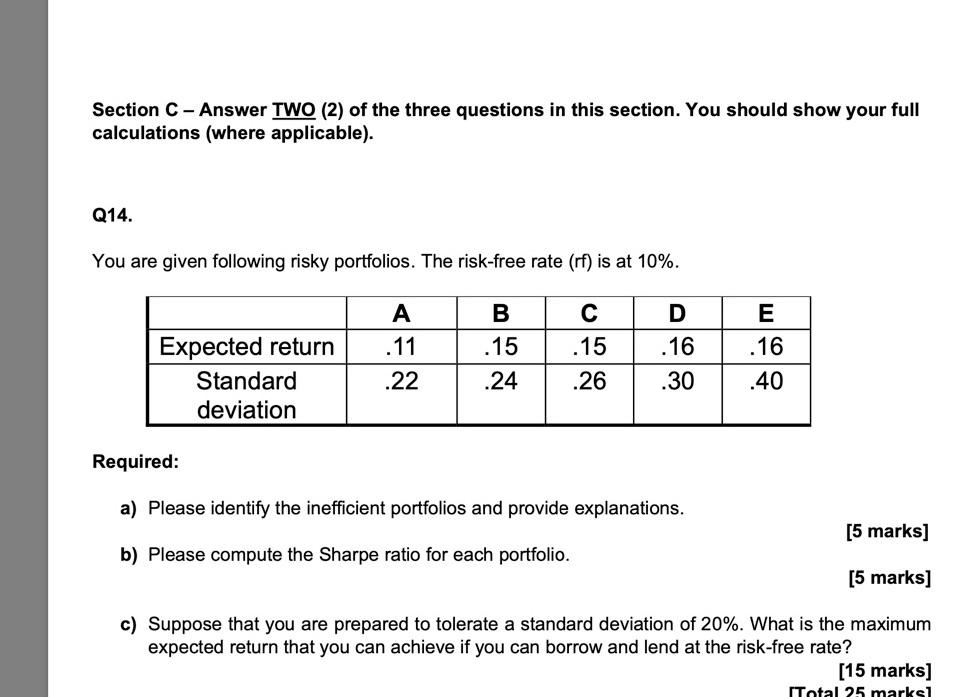

Section C - Answer TWO (2) of the three questions in this section. You should show your full calculations (where applicable). Q14. You are given following risky portfolios. The risk-free rate (rf) is at 10%. E Expected return Standard deviation A .11 .22 B .15 .24 C .15 .26 D .16 .30 .16 .40 Required: a) Please identify the inefficient portfolios and provide explanations. [5 marks] b) Please compute the Sharpe ratio for each portfolio. [5 marks] c) Suppose that you are prepared to tolerate a standard deviation of 20%. What is the maximum expected return that you can achieve if you can borrow and lend at the risk-free rate? [15 marks] ITotal 25 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts