Question: Please can you show work/formulas -> co o 6 A few years ago, the Value Line Investment Survey reported the following market betas for the

Please can you show work/formulas

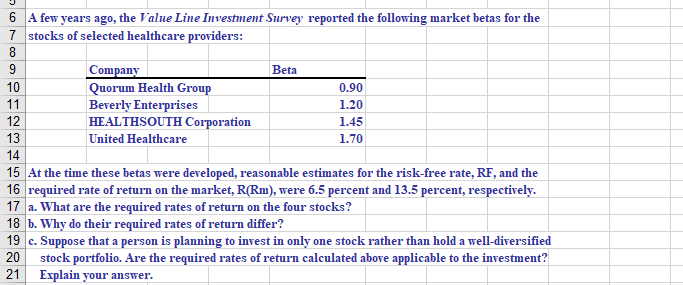

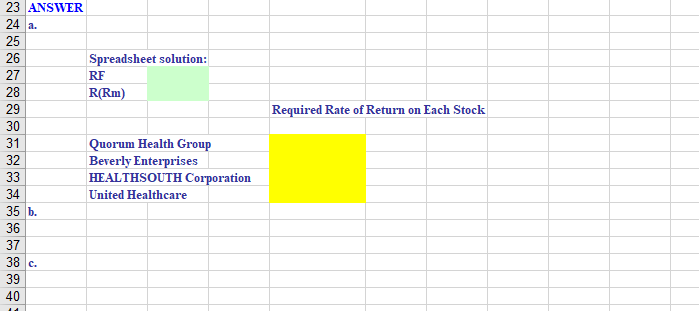

-> co o 6 A few years ago, the Value Line Investment Survey reported the following market betas for the 7 stocks of selected healthcare providers: 8 9 Company Beta 10 Quorum Health Group 0.90 11 Beverly Enterprises 1.20 12 HEALTHSOUTH Corporation 1.45 13 United Healthcare 1.70 14 15 At the time these betas were developed, reasonable estimates for the risk-free rate, RF, and the 16 required rate of return on the market, R(Rm), were 6.5 percent and 13.5 percent, respectively. 17 a. What are the required rates of return on the four stocks? 18 b. Why do their required rates of return differ? 19 c. Suppose that a person is planning to invest in only one stock rather than hold a well-diversified 20 stock portfolio. Are the required rates of return calculated above applicable to the investment? 21 Explain your answer. a a 23 ANSWER 24 a. Spreadsheet solution: RF R(Rm) Required Rate of Return on Each Stock 25 26 27 28 29 30 31 32 33 34 35 b. 36 37 38 C. 39 40 Quorum Health Group Beverly Enterprises HEALTHSOUTH Corporation United Healthcare

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts