Question: please can you solve it. Exercise Al-2 Calculating payroll deductions and recording the payroll LO2 The following information as to earnings and deductions for the

please can you solve it.

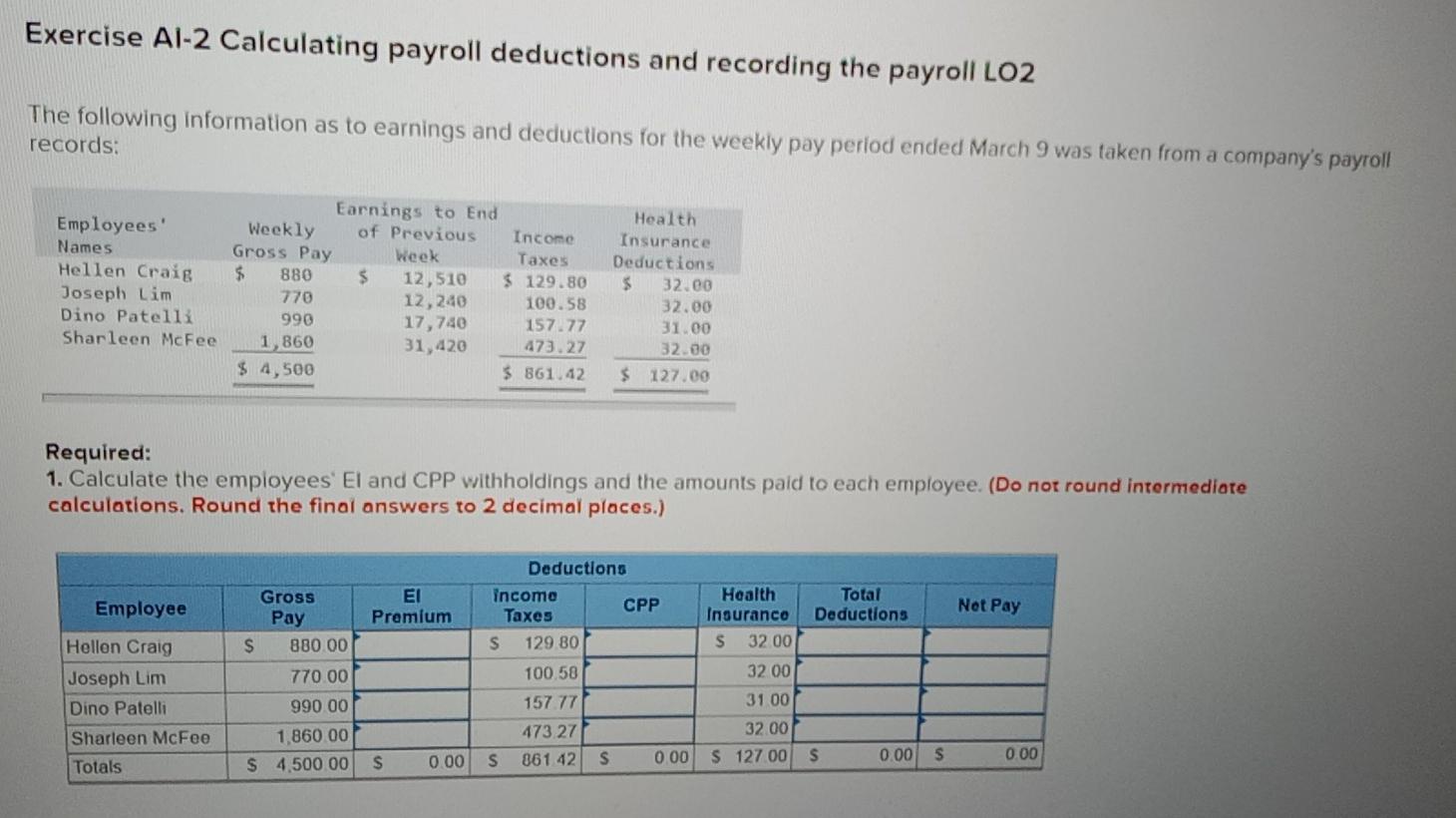

Exercise Al-2 Calculating payroll deductions and recording the payroll LO2 The following information as to earnings and deductions for the weekly pay period ended March 9 was taken from a company's payroll records: Employees' Names Hellen Craig Joseph Lim Dino Patelli Sharleen McFee Earnings to End Weekly of Previous Income Gross Pay Week Taxes $ 880 $ 12,510 $ 129.80 770 12,240 100.58 990 17,740 157.77 1,860 31,420 473.27 $ 4,500 $ 861.42 Health Insurance Deductions $ 32.00 32.00 31.00 32.00 $ 127.00 Required: 1. Calculate the employees' El and CPP withholdings and the amounts paid to each employee. (Do not round intermediate calculations. Round the final answers to 2 decimal places.) Employee Gross Pay $ 880.00 Premium Net Pay Hellen Craig Joseph Lim Dino Patelli Sharleen McFee Totals Deductions income Health CPP Total Taxes Insurance Deductions s 129.80 S 32.00 100.58 32 00 157.77 3100 473 27 32.00 S 861 42 S 000 S 127.00 S 0.00 770.00 990.00 1,860.00 $ 4.500 00 s 0.00 S 0.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts