Question: Please can you solve the questions ?! the course is Financial Management & Control Question No: 01 Nasir Furniture Company, is a manufacturer, wholesaler and

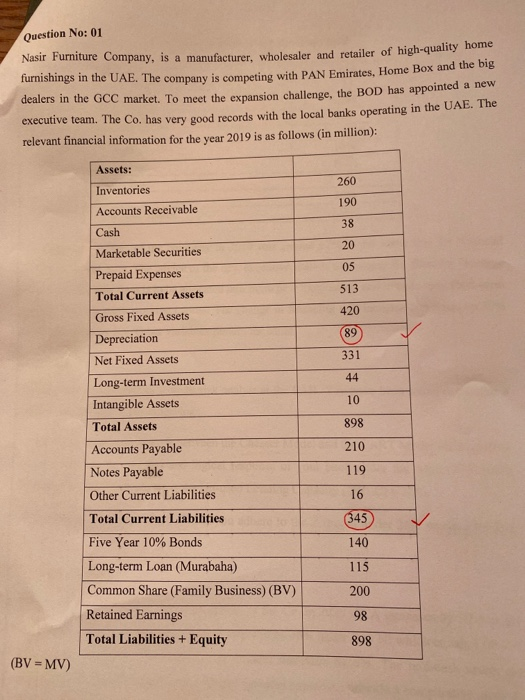

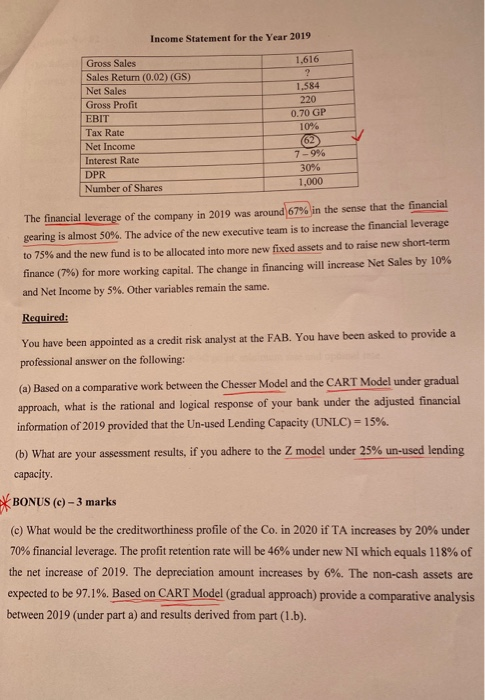

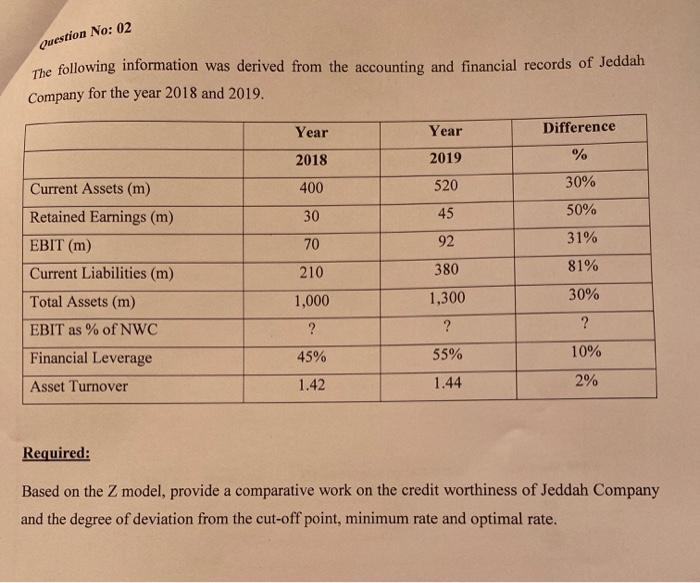

Question No: 01 Nasir Furniture Company, is a manufacturer, wholesaler and retailer of high-qua arer, wholesaler and retailer of high-quality home furnishings in the UAE. The comnany is camneting with PAN Emirates, Home Box and the big dealers in the GCC market. To meet the exnansion challenge, the BOD has appointed a new executive team. The Co. has very good records with the local banks operating in the UAE. The relevant financial information for the year 2019 is as follows (in million); 260 420 331 44 10 Assets: Inventories Accounts Receivable Cash Marketable Securities Prepaid Expenses Total Current Assets Gross Fixed Assets Depreciation Net Fixed Assets Long-term Investment Intangible Assets Total Assets Accounts Payable Notes Payable Other Current Liabilities Total Current Liabilities Five Year 10% Bonds Long-term Loan (Murabaha) Common Share (Family Business) (BV) Retained Earnings Total Liabilities + Equity 898 210 119 16 345) 140 115 200 98 898 (BV = MV) Income Statement for the Year 2019 1,616 0 Gross Sales Sales Return (0.02) (GS) Net Sales Gross Profit EBIT Tax Rate Net Income Interest Rate DPR Number of Shanes 1,584 220 .70 GP 10% 62 7-9% 30% 1.000 The financial leverage of the company in 2019 was around 67% in the sense that the financial gearing is almost 50%. The advice of the new executive team is to increase the financial leverage to 75% and the new fund is to be allocated into more new fixed assets and to raise new short-term finance (7%) for more working capital. The change in financing will increase Net Sales by 10% and Net Income by 5%. Other variables remain the same. Required: You have been appointed as a credit risk analyst at the FAB. You have been asked to provide a professional answer on the following: (a) Based on a comparative work between the Chesser Model and the CART Model under gradual approach, what is the rational and logical response of your bank under the adjusted financial information of 2019 provided that the Un-used Lending Capacity (UNLC) -15%. (b) What are your assessment results, if you adhere to the Z model under 25% un-used lending capacity BONUS (C)- 3 marks (c) What would be the creditworthiness profile of the Co. in 2020 if TA increases by 20% under 70% financial leverage. The profit retention rate will be 46% under new NI which equals 118% of the net increase of 2019. The depreciation amount increases by 6%. The non-cash assets are expected to be 97.1%. Based on CART Model (gradual approach) provide a comparative analysis between 2019 (under part a) and results derived from part (1.b). Question No: 02 The following information was derived from the accounting and financial records of Jeddah Company for the year 2018 and 2019. Year Year Difference 2019 2018 400 30% 50% Current Assets (m) Retained Earnings (m) EBIT (m) Current Liabilities (m) Total Assets (m) EBIT as % of NWC Financial Leverage Asset Turnover 31% 520 45 92 380 1,300 70 210 1,000 81% 30% ? 45% 55% 1.44 10% 2% 1.42 Required: Based on the Z model, provide a comparative work on the credit worthiness of Jeddah Company and the degree of deviation from the cut-off point, minimum rate and optimal rate. Question No: 01 Nasir Furniture Company, is a manufacturer, wholesaler and retailer of high-qua arer, wholesaler and retailer of high-quality home furnishings in the UAE. The comnany is camneting with PAN Emirates, Home Box and the big dealers in the GCC market. To meet the exnansion challenge, the BOD has appointed a new executive team. The Co. has very good records with the local banks operating in the UAE. The relevant financial information for the year 2019 is as follows (in million); 260 420 331 44 10 Assets: Inventories Accounts Receivable Cash Marketable Securities Prepaid Expenses Total Current Assets Gross Fixed Assets Depreciation Net Fixed Assets Long-term Investment Intangible Assets Total Assets Accounts Payable Notes Payable Other Current Liabilities Total Current Liabilities Five Year 10% Bonds Long-term Loan (Murabaha) Common Share (Family Business) (BV) Retained Earnings Total Liabilities + Equity 898 210 119 16 345) 140 115 200 98 898 (BV = MV) Income Statement for the Year 2019 1,616 0 Gross Sales Sales Return (0.02) (GS) Net Sales Gross Profit EBIT Tax Rate Net Income Interest Rate DPR Number of Shanes 1,584 220 .70 GP 10% 62 7-9% 30% 1.000 The financial leverage of the company in 2019 was around 67% in the sense that the financial gearing is almost 50%. The advice of the new executive team is to increase the financial leverage to 75% and the new fund is to be allocated into more new fixed assets and to raise new short-term finance (7%) for more working capital. The change in financing will increase Net Sales by 10% and Net Income by 5%. Other variables remain the same. Required: You have been appointed as a credit risk analyst at the FAB. You have been asked to provide a professional answer on the following: (a) Based on a comparative work between the Chesser Model and the CART Model under gradual approach, what is the rational and logical response of your bank under the adjusted financial information of 2019 provided that the Un-used Lending Capacity (UNLC) -15%. (b) What are your assessment results, if you adhere to the Z model under 25% un-used lending capacity BONUS (C)- 3 marks (c) What would be the creditworthiness profile of the Co. in 2020 if TA increases by 20% under 70% financial leverage. The profit retention rate will be 46% under new NI which equals 118% of the net increase of 2019. The depreciation amount increases by 6%. The non-cash assets are expected to be 97.1%. Based on CART Model (gradual approach) provide a comparative analysis between 2019 (under part a) and results derived from part (1.b). Question No: 02 The following information was derived from the accounting and financial records of Jeddah Company for the year 2018 and 2019. Year Year Difference 2019 2018 400 30% 50% Current Assets (m) Retained Earnings (m) EBIT (m) Current Liabilities (m) Total Assets (m) EBIT as % of NWC Financial Leverage Asset Turnover 31% 520 45 92 380 1,300 70 210 1,000 81% 30% ? 45% 55% 1.44 10% 2% 1.42 Required: Based on the Z model, provide a comparative work on the credit worthiness of Jeddah Company and the degree of deviation from the cut-off point, minimum rate and optimal rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts