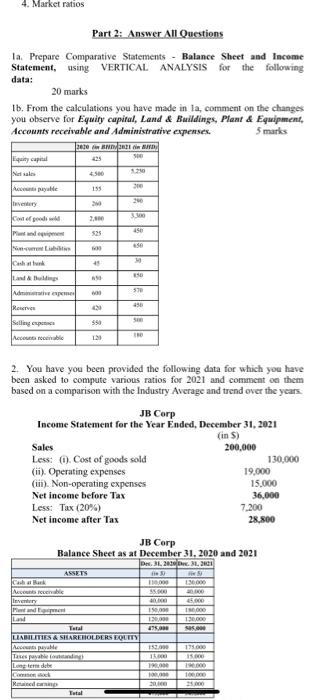

Question: please .. Can you solve this question please 4. Market ratios Part 2: Answer All Questions la Prepare Comparative Statements - Balance Sheet and Income

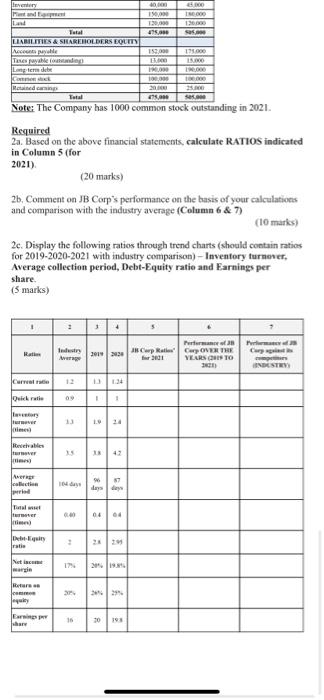

4. Market ratios Part 2: Answer All Questions la Prepare Comparative Statements - Balance Sheet and Income Statement, using VERTICAL ANALYSIS for the following data: 20 marks 1b. From the calculations you have made in la, comment on the changes you observe for Equity capital, Land & Buildings, Plant & Equipment, Accounts receivable and Administrative expenses. 5 marks 2070 BYBEL in den Equity capital 500 Ne sal 4500 155 he Ayude 2. 310 Celodi 450 525 es Cat 45 390 and Building wa 570 450 RTV Sex 950 | Acress reemas | 1.21 2. You have you been provided the following data for which you have been asked to compute various ratios for 2021 and comment on them based on a comparison with the Industry Average and trend over the years JB Corp Income Statement for the Year Ended, December 31, 2021 (in ) Sales 200,000 Less: 0. Cost of goods sold 130,000 (ii). Operating expenses 19,000 (in). Non-operating expenses 15.000 Net income before Tax 36,000 Less: Tax (20%) 7.200 Net income after Tax 28.800 JB Corp Balance Sheef as at December 31, 2020 and 2021 Des. 3. 2030. 31. 21 130.000 Cash Necesible Invey 1. 150,00 120.000 95.000 Land Total LIABILITIES & STAREHOLDERS ROLLY Avale Tases and Los dibe 1537 1 1. 200 Total every 40 19.00 130.00 15.00 IND 136 Sos. Total LIABILITIES & SHAREHOLDERS EQUITY Apyle Tenes uvable de Le debe 159.000 BO 11.00 ISO 0.00 sex.com Retained in Note: The Company has 1000 common stock outstanding in 2021. Required 2. Based on the above financial statements, calculate RATIOS indicated in Column 5 (for 2021) (20 marks) 2b. Comment on JB Corp's performance on the basis of your calculations and comparison with the industry average (Column 6 & 7) (10 marks) 2c. Display the following ratios through trend charts (should contain ratios for 2019-2020-2021 with industry comparison) - Inventory turnerer, Average collection period, Debt-Equity ratio and Earnings per share (5 marks) 1 Ram Industry 2012 IKCwp RC OVER THE YEARS ORS TO Curre i rutie 13 24 Revelables 13 42 inimese AMERE Aalaattam pred days rever J) 04 ratie retic margin 16 2018 4. Market ratios Part 2: Answer All Questions la Prepare Comparative Statements - Balance Sheet and Income Statement, using VERTICAL ANALYSIS for the following data: 20 marks 1b. From the calculations you have made in la, comment on the changes you observe for Equity capital, Land & Buildings, Plant & Equipment, Accounts receivable and Administrative expenses. 5 marks 2070 BYBEL in den Equity capital 500 Ne sal 4500 155 he Ayude 2. 310 Celodi 450 525 es Cat 45 390 and Building wa 570 450 RTV Sex 950 | Acress reemas | 1.21 2. You have you been provided the following data for which you have been asked to compute various ratios for 2021 and comment on them based on a comparison with the Industry Average and trend over the years JB Corp Income Statement for the Year Ended, December 31, 2021 (in ) Sales 200,000 Less: 0. Cost of goods sold 130,000 (ii). Operating expenses 19,000 (in). Non-operating expenses 15.000 Net income before Tax 36,000 Less: Tax (20%) 7.200 Net income after Tax 28.800 JB Corp Balance Sheef as at December 31, 2020 and 2021 Des. 3. 2030. 31. 21 130.000 Cash Necesible Invey 1. 150,00 120.000 95.000 Land Total LIABILITIES & STAREHOLDERS ROLLY Avale Tases and Los dibe 1537 1 1. 200 Total every 40 19.00 130.00 15.00 IND 136 Sos. Total LIABILITIES & SHAREHOLDERS EQUITY Apyle Tenes uvable de Le debe 159.000 BO 11.00 ISO 0.00 sex.com Retained in Note: The Company has 1000 common stock outstanding in 2021. Required 2. Based on the above financial statements, calculate RATIOS indicated in Column 5 (for 2021) (20 marks) 2b. Comment on JB Corp's performance on the basis of your calculations and comparison with the industry average (Column 6 & 7) (10 marks) 2c. Display the following ratios through trend charts (should contain ratios for 2019-2020-2021 with industry comparison) - Inventory turnerer, Average collection period, Debt-Equity ratio and Earnings per share (5 marks) 1 Ram Industry 2012 IKCwp RC OVER THE YEARS ORS TO Curre i rutie 13 24 Revelables 13 42 inimese AMERE Aalaattam pred days rever J) 04 ratie retic margin 16 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts