Question: Please check all numbers calculated for accuracy & help me determine the highlighted sections for trademark & annual amortization. Milani, Inc., acquired 10 percent of

Please check all numbers calculated for accuracy & help me determine the highlighted sections for trademark & annual amortization.

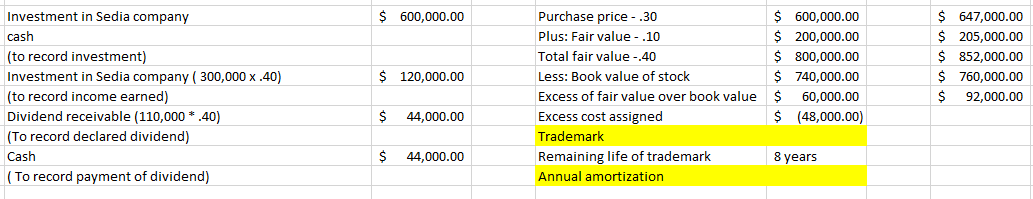

- Milani, Inc., acquired 10 percent of Seida Corporation on January 1, 2020, for $190,000 and appropriately accounted for the investment using the fair-value method. On January 1, 2021, Milani purchased an additional 30 percent of Seida for $600,000 which resulted in significant influence over Seida. On that date, the fair value of Seida's common stock was $2,000,000 in total. Seida's January 1, 2021, book value equaled $1,850,000, although land was undervalued by $120,000. Any additional excess fair value over Seida's book value was attributable to a trademark with an eight-year remaining life. During 2021, Seida reported income of $300,000 and declared and paid dividends of $110,000. Prepare the 2021 journal entries for Milani related to its investment in Seida.

Investment in Sedia company $ 600,000.00 Purchase price - .30 $ 600,000.00 $ 647,000.00 cash Plus: Fair value - .10 $ 200,000.00 $ 205,000.00 (to record investment) Total fair value -.40 $ 800,000.00 S 852,000.00 Investment in Sedia company ( 300,000 x .40) $ 120,000.00 Less: Book value of stock $ 740,000.00 760,000.00 (to record income earned) Excess of fair value over book value S 60,000.00 S 92,000.00 Dividend receivable (110,000 * .40) S 44,000.00 Excess cost assigned $ (48,000.00) (To record declared dividend) Trademark Cash S 44,000.00 Remaining life of trademark 8 years ( To record payment of dividend) Annual amortization

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts