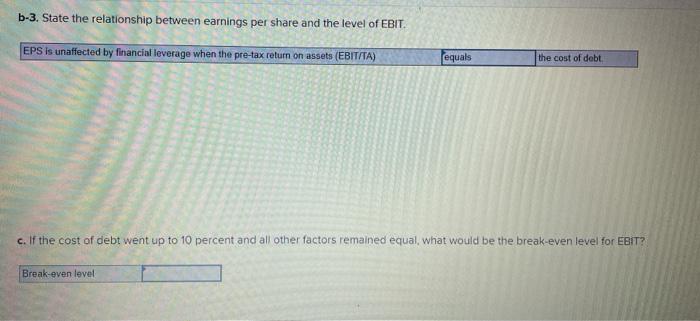

Question: please check and explain part c im at a loss Lenow Drug Stores and Hall Pharmaceuticals are competitors in the discount drug chain store business.

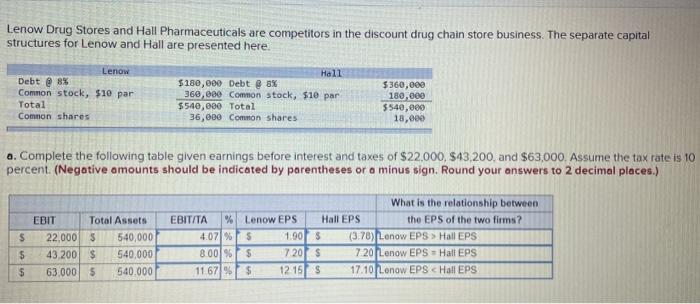

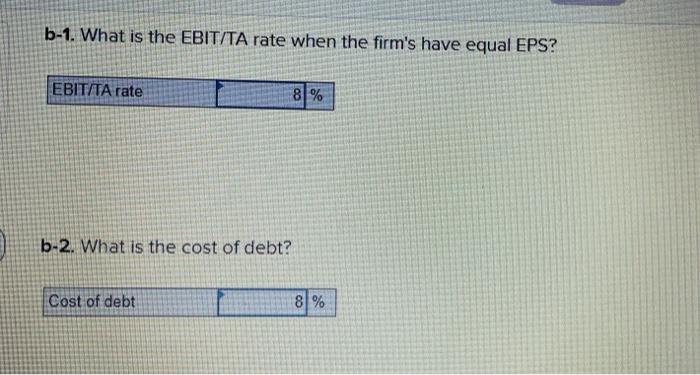

Lenow Drug Stores and Hall Pharmaceuticals are competitors in the discount drug chain store business. The separate capital structures for Lenow and Hall are presented here. Lenow Debt @ 8% Common stock, $10 par Total Common shares Hall $180,000 Debt @ 8% 360,000 Common stock, 510 par $540,000 Total 36,000 Common shares $360,000 180,000 $540,000 18,000 a. Complete the following table given earnings before interest and taxes of $22,000, 543,200, and $63,000. Assume the tax rate is 10 percent. (Negative amounts should be indicated by parentheses or a minus sign. Round your answers to 2 decimal places.) $ $ $ EBIT Total Assets 22.000 $ 540,000 43,200 $ 540,000 63.000 5 540.000 What is the relationship between EBIT/TA % Lenow EPS Hall EPS the EPS of the two firms? 4.07%s 1.90 $ (3.78) Lenow EPS > Hall EPS 8.00 $ 720 $ 7.20 Lenow EPS = Hall EPS 11 67%$ 12 15 $ 17.10 Lenow EPS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts