Question: Please check and explain Schedule 1 and Schedule 4, Schedule SE, and Schedule C from Form 1040 for 2018 completed copies are attached. Thanks so

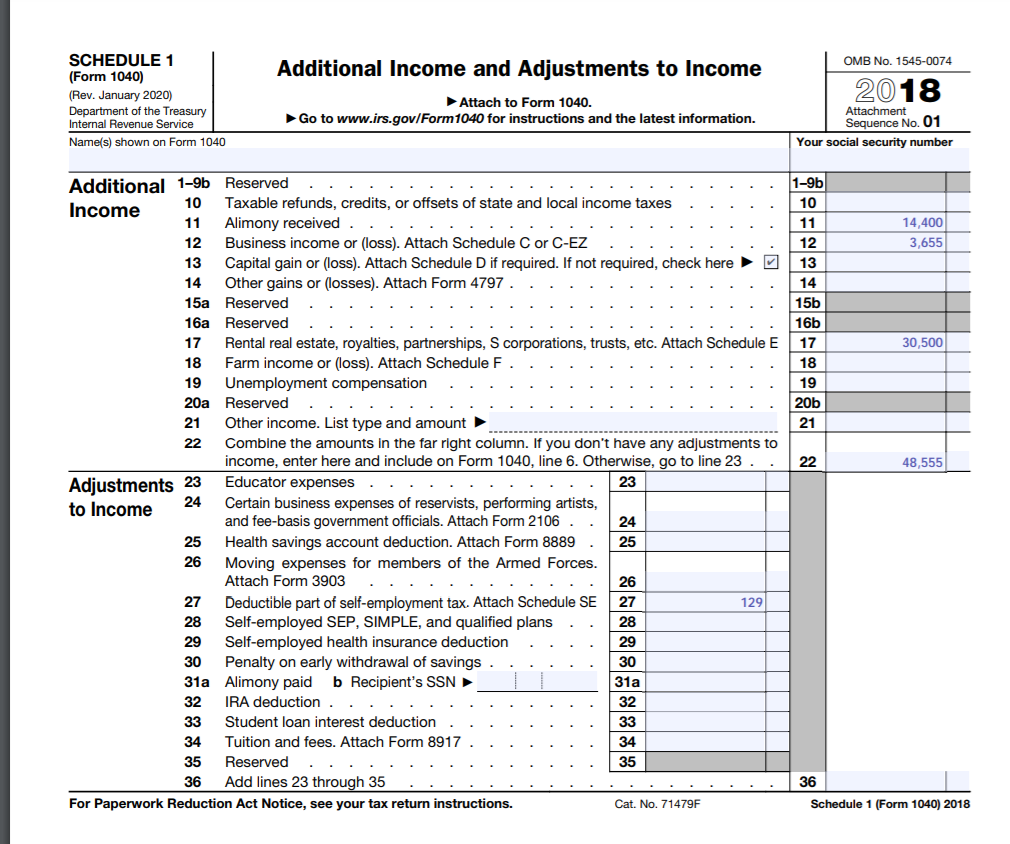

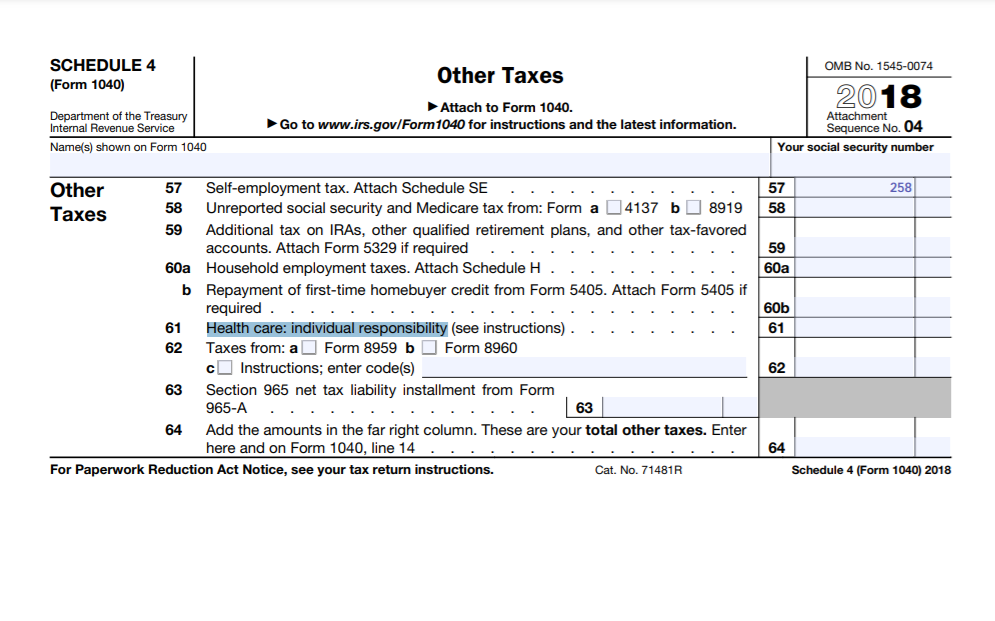

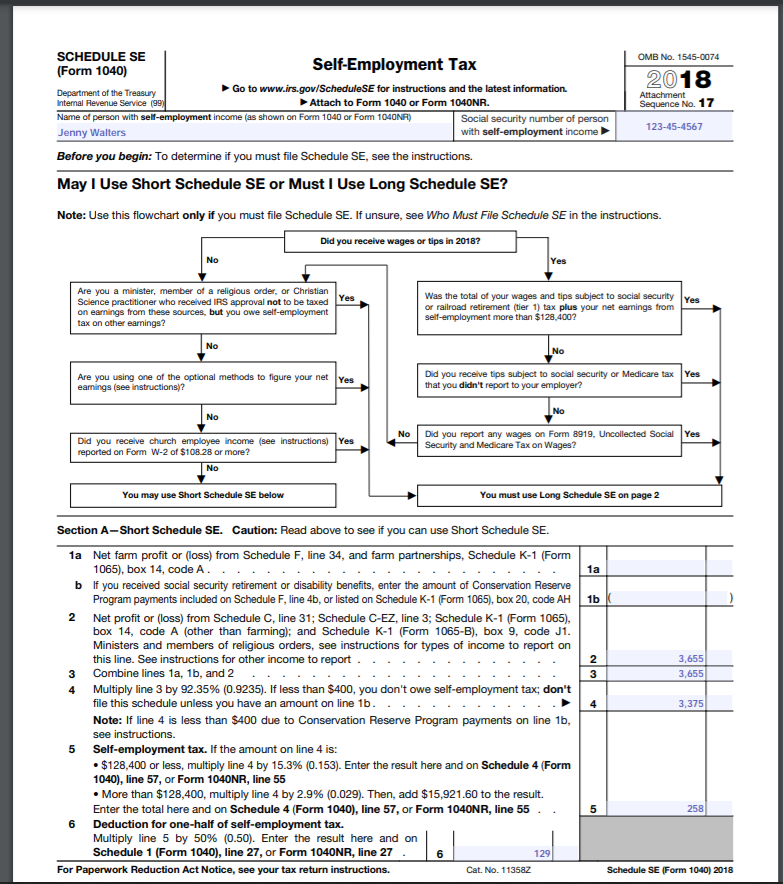

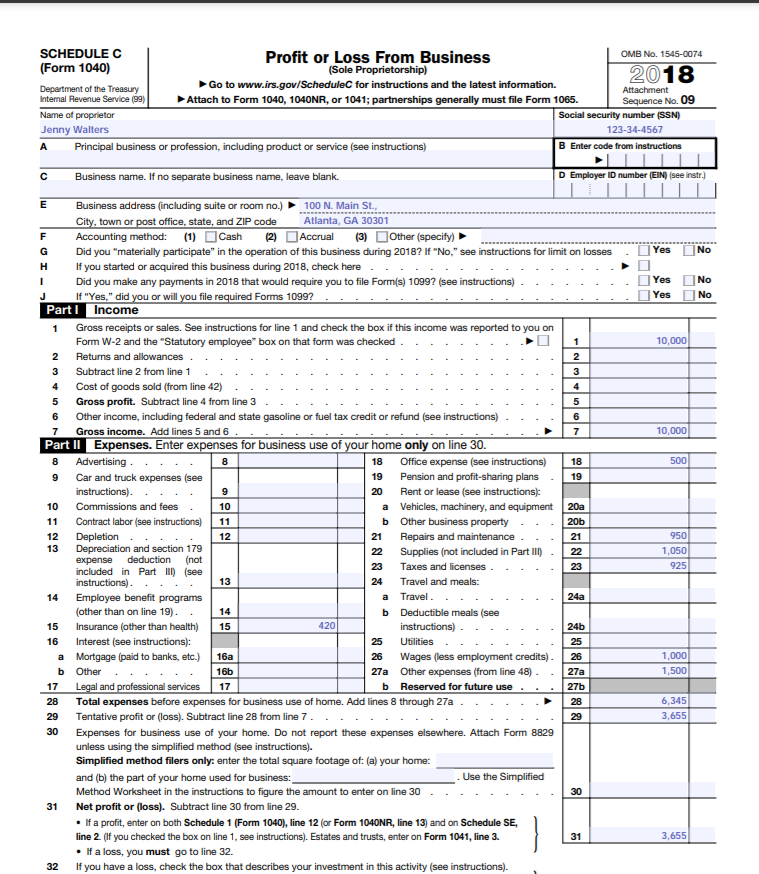

Please check and explain Schedule 1 and Schedule 4, Schedule SE, and Schedule C from Form 1040 for 2018 completed copies are attached. Thanks so much!!! Please point out what is incorrect and why.

especially, please explain 57 Self-employment tax and 61 Health care: individual responsibility from Form 1040.

Jenny Walters is a marketing assistant and earned $38,000 in 2018. She is 42 years old and has been divorced for five years. Jenny will claim head of household for 2018. She has a daughter, Julia, who is 20 years old. Julia is a full-time student. Here are some more tax facts:

- Jenny's SSN is 123-34-4567 and Julia's is 654-32-1234.

- Jenny's address is 100 N. Main St., Atlanta, GA 30301.

- Jenny receives $1,200 per month in alimony from her ex-husband.

- Jenny owns a rental property with the following financial data:

- Rental Revenue - $50,000

- Expenses:

Insurance - $5,000

Repairs - $10,500

Depreciation - $4,000

- Jenny has interest income from corporate bonds of $2,200 and interest from municipal bonds of $1,000.

- Jenny also paid the following expenses: State income taxes of $5,800, charitable contributions of $12,500, and medical expenses of $5,795 for insurance premiums; $1,100 for medical care expenses; $350 for prescription medicine; $100 for nonprescription medicine; and $200 for new contact lenses for Julia.

- Jenny received disability insurance payments of $1,200.

- Jenny runs a small business from her home giving piano lessons to kids on weekends. She had the following transactions from it: total revenue $10,000; office supplies $500; teaching materials and supplies $1050; concerts and field shows $1500; repairs and maintenance of pianos $950; wages to a teaching assistant $1000; payroll taxes $765; business insurance $420; occupational taxes and license $160.

OMB No. 1545-0074 SCHEDULE 1 (Form 1040) (Rev. January 2020) Department of the Treasury Internal Revenue Service Name(s) shown on Form 1040 Additional Income and Adjustments to Income Attach to Form 1040. Go to www.irs.gov/Form 1040 for instructions and the latest information. 2018 Attachment Sequence No. 01 Your social security number 1-9b 10 11 14,400 3,655 12 13 14 15b 16b 17 30,500 18 19 20b 21 22 48,555 Additional 1-9b Reserved 10 Taxable refunds, credits, or offsets of state and local income taxes Income 11 Alimony received 12 Business income or (loss). Attach Schedule C or C-EZ 13 Capital gain or (loss). Attach Schedule D if required. If not required, check here 14 Other gains or losses). Attach Form 4797 15a Reserved 16a Reserved 17 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E 18 Farm income or (loss). Attach Schedule F 19 Unemployment compensation 20a Reserved 21 Other income. List type and amount 22 Combine the amounts in the far right column. If you don't have any adjustments to income, enter here and include on Form 1040, line 6. Otherwise, to line 23. . Adjustments 23 Educator expenses 23 24 to Income Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 . 24 25 Health savings account deduction. Attach Form 8889 . 25 26 Moving expenses for members of the Armed Forces. Attach Form 3903 26 27 Deductible part of self-employment tax. Attach Schedule SE 27 129 28 Self-employed SEP, SIMPLE, and qualified plans 28 29 Self-employed health insurance deduction 29 30 Penalty on early withdrawal of savings 30 31a Alimony paid b Recipient's SSN 31a 32 IRA deduction. 32 33 Student loan interest deduction 33 34 Tuition and fees. Attach Form 8917 34 35 Reserved 35 36 Add lines 23 through 35 For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 71479F 36 Schedule 1 (Form 1040) 2018 OMB No. 1545-0074 SCHEDULE 4 (Form 1040) Other Taxes 2018 Department of the Treasury Internal Revenue Service Name(s) shown on Form 1040 Attach to Form 1040. Go to www.irs.gov/Form1040 for instructions and the latest information. Attachment Sequence No. 04 Your social security number 258 57 58 59 60a Other 57 Self-employment tax. Attach Schedule SE Taxes 58 Unreported social security and Medicare tax from: Form a 4137 b8919 59 Additional tax on IRAs, other qualified retirement plans, and other tax-favored accounts. Attach Form 5329 if required 60a Household employment taxes. Attach Schedule H b Repayment of first-time homebuyer credit from Form 5405. Attach Form 5405 if required 61 Health care: individual responsibility (see instructions) 62 Taxes from: a Form 8959 b Form 8960 c Instructions; enter code(s) 63 Section 965 net tax liability installment from Form 965-A 63 64 Add the amounts in the far right column. These are your total other taxes. Enter here and on Form 1040, line 14 For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 71481R 60b 61 62 64 Schedule 4 (Form 1040) 2018 Attachment 123-45-4567 SCHEDULE SE OMB No. 1545-0074 (Form 1040) Self-Employment Tax 2018 Department of the Treasury Go to www.irs.gov/ScheduleSE for instructions and the latest information Internal Revenue Service (99) Attach to Form 1040 or Form 1040NR. Sequence No. 17 Name of person with self-employment income (as shown on Form 1040 or Form 1040NA) Social security number of person Jenny Walters with self-employment income Before you begin: To determine if you must file Schedule SE, see the instructions. May I Use Short Schedule SE or Must I Use Long Schedule SE? Note: Use this flowchart only if you must file Schedule SE. If unsure, see Who Must File Schedule SE in the instructions. Did you receive wages or tips in 2018? No Yes Yes Are you a minister, member of a religious order, or Christian Science practitioner who received IRS approval not to be taxed on earnings from these sources, but you owe self-employment tax on other earnings? Was the total of your wages and tips subject to social security Yes or railroad retirement (tier 1) tax plus your net earnings from self-employment more than $128.400? No No Are you using one of the optional methods to figure your net Yes eamings (see instructions)? Did you receive tips subject to social security or Medicare tax Yes that you didn't report to your employer? No No No Did you report any wages on Form 1919, Uncollected Social Yes Security and Medicare Tax on Wages? Did you receive church employee income see instructions) Yes reported on Form W-2 of $108.28 or more? No You may use Short Schedule SE below You must use Long Schedule SE on page 2 1a 1b 3,655 2 3 3,655 Section A-Short Schedule SE. Caution: Read above to see if you can use Short Schedule SE. 1a Net farm profit or loss) from Schedule F, line 34, and farm partnerships, Schedule K-1 (Form 1065), box 14, code A... b If you received social security retirement or disability benefits, enter the amount of Conservation Reserve Program payments included on Schedule F, line 4b, or listed on Schedule K-1 (Form 1065), box 20, code AH 2 Net profit or loss) from Schedule C, line 31; Schedule C-EZ, line 3; Schedule K-1 (Form 1065), box 14, code A (other than farming); and Schedule K-1 (Form 1065-B), box 9, code Ji. Ministers and members of religious orders, see instructions for types of income to report on this line. See instructions for other income to report. 3 Combine lines 1a, 1b, and 2 4 Multiply line 3 by 92.35% (0.9235). If less than $400, you don't owe self-employment tax, don't file this schedule unless you have an amount on line 1b.. Note: If line 4 is less than $400 due to Conservation Reserve Program payments on line 1b, see instructions. 5 Self-employment tax. If the amount on line 4 is: $128,400 or less, multiply line 4 by 15.3% (0.153). Enter the result here and on Schedule 4 (Form 1040), line 57, or Form 1040NR, line 55 . More than $128,400, multiply line 4 by 2.9% (0.029). Then, add $15,921.60 to the result. Enter the total here and on Schedule 4 (Form 1040), line 57, or Form 1040NR, line 55 6 Deduction for one-half of self-employment tax. Multiply line 5 by 50% (0.50). Enter the result here and on Schedule 1 (Form 1040), line 27, or Form 1040NR, line 27 For Paperwork Reduction Act Notice, see your tax return instructions. 4 3,375 5 258 6 129 Cat. No. 113582 Schedule SE (Form 1040) 2018 Yes No 2 5 6 7 7 SCHEDULEC Profit or Loss From Business OMB No. 1545-0074 (Form 1040) (Sole Proprietorship) 2018 Department of the Treasury Go to www.irs.gov/Schedule for instructions and the latest information. Attachment Internal Revenue Service (99) Attach to Form 1040, 1040NR, or 1041; partnerships generally must file Form 1065. Sequence No. 09 Name of proprietor Social security number (SSN) Jenny Walters 123-34-4567 A Principal business or profession, including product or service (see instructions) B Enter code from instructions Business name. If no separate business name, leave blank D Employer ID number (EN) (see instr.) E Business address (including suite or room no.) 100 N. Main St., City, town or post office, state, and ZIP code Atlanta, GA 30301 F Accounting method: (1) Cash (2) Accrual (3) Other (specify) G Did you "materially participate in the operation of this business during 2018? If "No," see instructions for limit on losses Yes No H If you started or acquired this business during 2018, check here I Did you make any payments in 2018 that would require you to file Form(s) 1099? (see instructions) Yes No If "Yes," did you or will you file required Forms 10992 Partl Income 1 Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on Form W-2 and the "Statutory employee" box on that form was checked 1 10,000 2 Returns and allowances. 3 Subtract line 2 from line 1 3 4 Cost of goods sold (from line 42) 4 5 Gross profit. Subtract line 4 from line 3 6 Other income, including federal and state gasoline or fuel tax credit or refund (see instructions) Gross income. Add lines 5 and 6. 10,000 Part II Expenses. Enter expenses for business use of your home only on line 30. 8 Advertising 18 Office expense (see instructions) 500 9 Car and truck expenses (see 19 Pension and profit-sharing plans instructions): 20 Rent or lease (see instructions): 10 Commissions and fees 10 a Vehicles, machinery, and equipment 20a 11 Contract labor (see instructions) b Other business property 20b 12 Depletion. 12 21 Repairs and maintenance. 21 950 13 Depreciation and section 179 22 Supplies (not included in Part II 1,050 expense deduction (not 23 23 Taxes and licenses. 925 included in Part I) (see instructions) 24 Travel and meals: Employee benefit programs a Travel 24a (other than on line 19). b Deductible meals (see Insurance (other than health) instructions) Interest (see instructions): 25 Utilities a Mortgage (paid to banks, etc.) 16a Wages (less employment credits) 1,000 b Other 16b 27a Other expenses (from line 48) - 27a 1,500 17 Legal and professional services 17 b Reserved for future use 27b 28 Total expenses before expenses for business use of home. Add lines 8 through 27a 6,345 29 Tentative profit or loss). Subtract line 28 from line 7. 29 3,655 30 Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829 unless using the simplified method (see instructions). Simplified method filers only: enter the total square footage of: (a) your home: and (b) the part of your home used for business: Use the Simplified Method Worksheet in the instructions to figure the amount to enter on line 30 30 31 Net profit or loss). Subtract line 30 from line 29. . If a profit, enter on both Schedule 1 (Form 1040), line 12 (or Form 1040NR, line 13) and on Schedule SE, line 2 (if you checked the box on line 1, see instructions). Estates and trusts, enter on Form 1041, line 3. 31 3,655 If a loss, you must go to line 32. 32 If you have a loss, check the box that describes your investment in this activity (see instructions). 8 18 19 9 11 22 13 14 14 15 420 15 16 24b 25 26 26 28

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts