Question: Please check and solve these problems according to given information and instructions. 1.(25) Suppose that the current daily volatilities of assets X , Y and

Please check and solve these problems according to given information and instructions.

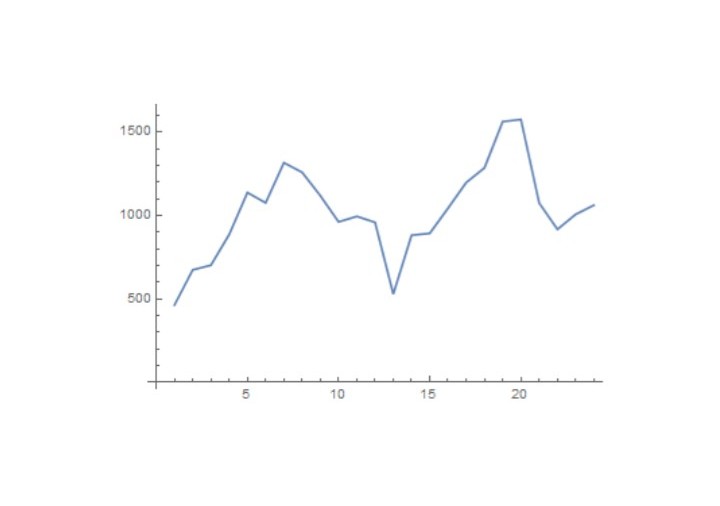

1.(25) Suppose that the current daily volatilities of assets X , Y and Z are 1.ON% , 1.2N% and 1.3N% ,respectively. The prices of the assets at close of trading yesterday were $2N. $3N and $4N. Covariances are cov( X, Y) = 0.6. cov( X, Z) = 0.8, cov(Y, Z) = 0.9 Correlations and volatilities are updated using Risk Metrics EWMA model. with A = 0.9N (where N is the last digit of your student number). If the prices of the three, assets at close of trading today are $25 , $35 and $45, forecast the correlation coefficients for today. 2. (30) Consider the quarterly sales data: datal = {10, 31, 43, 16, 11, 33, 45, 17, 14, 46, 50, 21, 19, 41, 55, 25}. Forecast the volatility for the next quarter a) using EWMA with A = 0.9N (where / is the last digit of your student number) b) using GARCH(1,1) with w = 0.000002 ,a = 0.04 and 8 = 0.9N. c) comment on your results by comparing a) and B) Proportional change will be taken as return , that is (Anti - An)/An. 3. Monthly electricity consumption data for two years is given by data2={464, 675, 703, 887, 1139, 1077, 1318, 1260, 1120, 963, 996, 960, 530, 883, 894, 1045, 1199, 1287, 1565, 1577, 1076, 918, 1008. 106N} and it is plotted in figure below. Forecast the next years (monthly) electricity consumption by employing an appropriate Holt-Winters method. Let a = 0.2 8 = 0.1 y = 0.1. Determine the initial values for level, trend and seasonality. / is the last digit of your student number. Do not USE EXCELL seasonal forecasting commands. Show your intermediate results.\f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts