Question: Please check comment Assignment 1: Case Analysis Assignment instructions Word Limit: 1750 to 2000 words Should use APA format Use at least 5 external academic

Please check comment

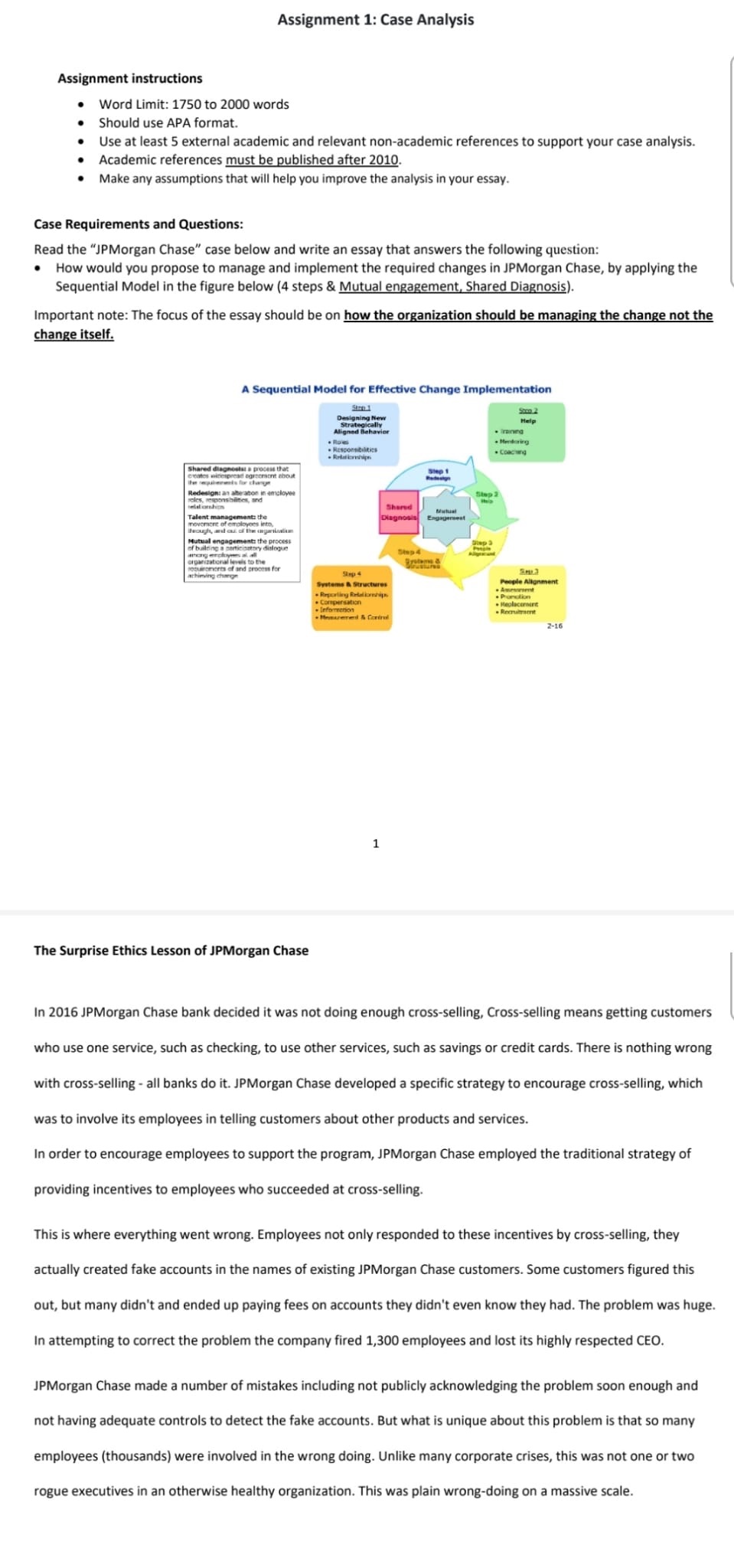

Assignment 1: Case Analysis Assignment instructions Word Limit: 1750 to 2000 words Should use APA format Use at least 5 external academic and relevant non-academic references to support your case analysis. Academic references must be published after 2010. Make any assumptions that will help you improve the analysis in your essay. Case Requirements and Questions: Read the "JPMorgan Chase" case below and write an essay that answers the following question: How would you propose to manage and implement the required changes in JPMorgan Chase, by applying the Sequential Model in the figure below (4 steps & Mutual engagement, Shared Diagnosis). Important note: The focus of the essay should be on how the organization should be managing the change not the change itself. A Sequential Model for Effective Change Implementation Designing New Aligned Behavior . Training . Responsibilities . Coaching fred diagnostat a process that ales, responshilter and Shared novemacre of employees into ment: the process of baling a perticastory dialogue arizational levels to the quimoments of and process for shining change Systems & Structures People Allonment 7-16 The Surprise Ethics Lesson of JPMorgan Chase In 2016 JPMorgan Chase bank decided it was not doing enough cross-selling, Cross-selling means getting customers who use one service, such as checking, to use other services, such as savings or credit cards. There is nothing wrong with cross-selling - all banks do it. JPMorgan Chase developed a specific strategy to encourage cross-selling, which was to involve its employees in telling customers about other products and services. In order to encourage employees to support the program, JPMorgan Chase employed the traditional strategy of providing incentives to employees who succeeded at cross-selling. This is where everything went wrong. Employees not only responded to these incentives by cross-selling, they actually created fake accounts in the names of existing JPMorgan Chase customers. Some customers figured this out, but many didn't and ended up paying fees on accounts they didn't even know they had. The problem was huge. In attempting to correct the problem the company fired 1,300 employees and lost its highly respected CEO. JPMorgan Chase made a number of mistakes including not publicly acknowledging the problem soon enough and not having adequate controls to detect the fake accounts. But what is unique about this problem is that so many employees (thousands) were involved in the wrong doing. Unlike many corporate crises, this was not one or two rogue executives in an otherwise healthy organization. This was plain wrong-doing on a massive scale

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts