Question: please check if answes are correct Consider a lump sum of $13,000 to be received 8 years from now (t=8). What is its present value

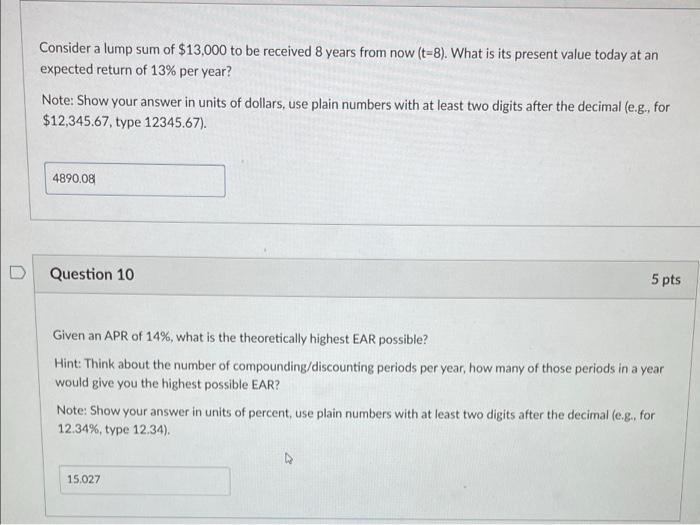

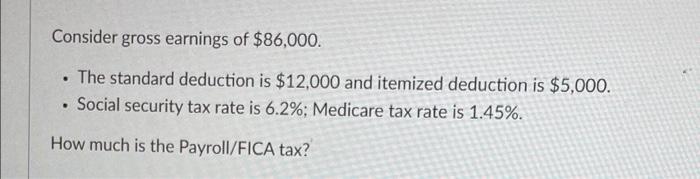

Consider a lump sum of $13,000 to be received 8 years from now (t=8). What is its present value today at an expected return of 13% per year? Note: Show your answer in units of dollars, use plain numbers with at least two digits after the decimal (e.g., for $12,345.67, type 12345.67). 4890.08 D Question 10 5 pts Given an APR of 14%, what is the theoretically highest EAR possible? Hint: Think about the number of compounding/discounting periods per year, how many of those periods in a year would give you the highest possible EAR? Note: Show your answer in units of percent, use plain numbers with at least two digits after the decimal (e.g., for 12.34%, type 12.34). 15.027 Consider gross earnings of $86,000. . The standard deduction is $12,000 and itemized deduction is $5,000. Social security tax rate is 6.2%; Medicare tax rate is 1.45%. . How much is the Payroll/FICA tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts