Question: Please check my answer to be sure it is correct, thank you! A company reports pretax accounting income of $8 million, but because of a

Please check my answer to be sure it is correct, thank you!

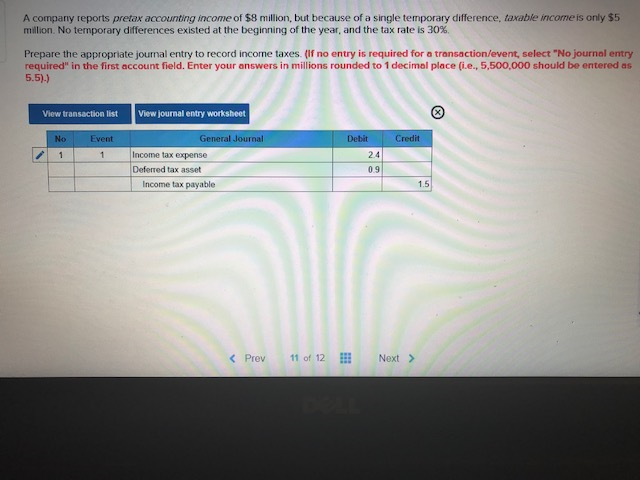

A company reports pretax accounting income of $8 million, but because of a single temporary difference, taxable income is only $5 million. No temporary differences existed at the beginning of the year, and the tax rate is 30%. Prepare the appropriate journal entry to record income taxes. (if no entry is required for a transaction/eventselect "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (ie, 5,500,000 should be entered as 5.5)) View transaction list View journal entry worksheet Event General Journal Debit Credit Income tax expense Deferred tax asset Income tax payable 09 15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts