Question: Please check my solutions!! Practice problems (Chapter 6) What is the value of a stock that is expected to pay a constant dividend of $2

Please check my solutions!!

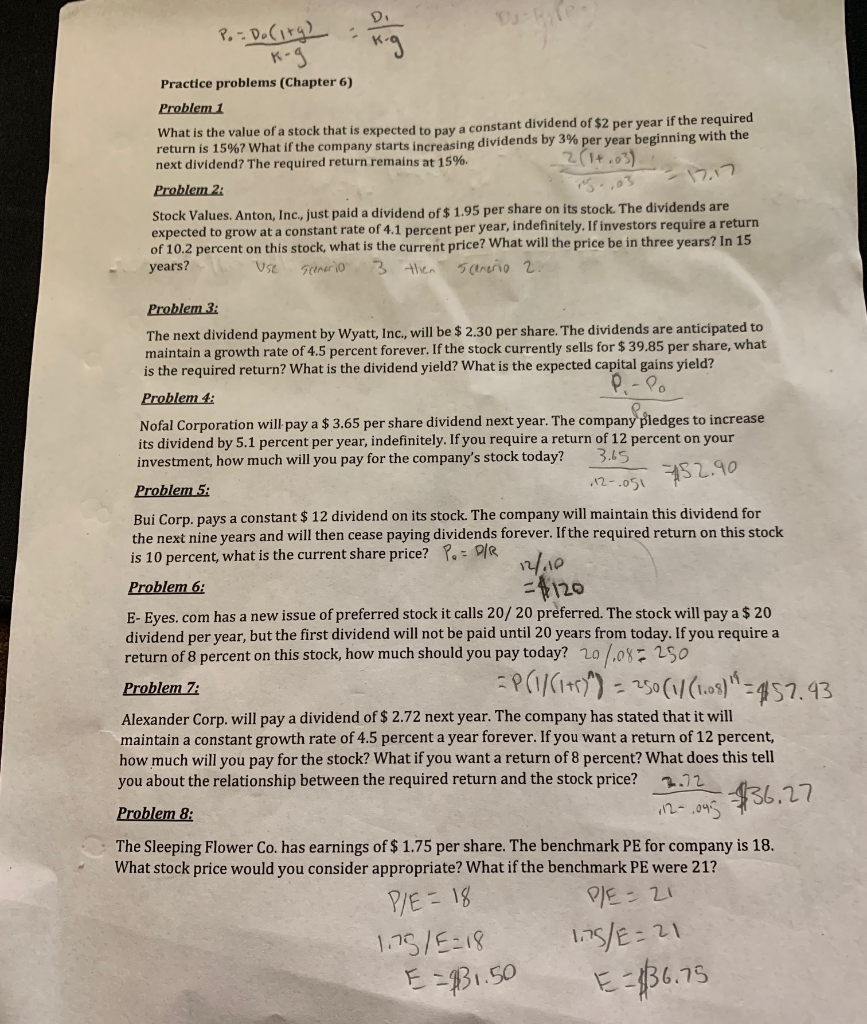

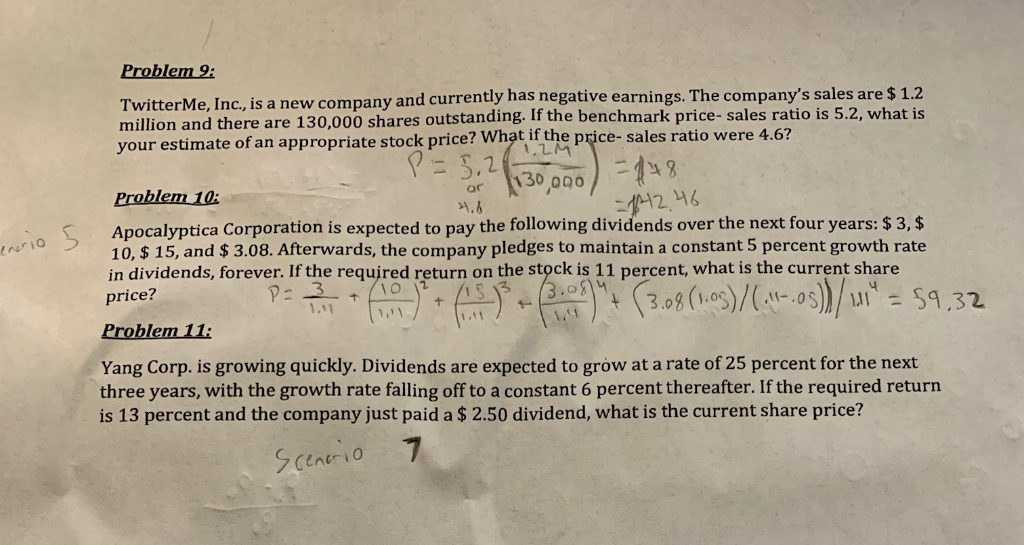

Practice problems (Chapter 6) What is the value of a stock that is expected to pay a constant dividend of $2 per year if the required return is 15%? wh at if the company starts increasing dividends by 3% per year beginning with the next dividend? The required return remains at 15%. Stock Values. Anton, Inc, just paid a dividend of $ 1.95 per share on its stock. The dividends expected to grow at a constant rate of 4.1 percent per year, indefinitely. If investors require a return of 10.2 percent on this stock, what is the current price? What will the price be in three yea years? rs? In 15 The next dividend payment by Wyatt, Inc, will be $ 2.30 per share. The dividends are anticipated to maintain a growth rate of 4.5 percent forever. If the stock currently sells for $ 39.85 per share, what is the required return? What is the dividend yield? What is the expected capital gains yield? Nofal Corporation will pay a $ 3.65 per share dividend next year. The company pledges to increase its dividend by 5.1 percent per year, indefinitely. If you require a return of 12 percent on your investment, how much will you pay for the company's stock today? 345 Problem5 SL 12-.05 Bui Corp. pays a constant $ 12 dividend on its stock. The company will maintain this dividend for the next nine years and will then cease paying dividends forever. If the required return on this stock is 10 percent, what is the current share price?,- PR Problem6 -120 E- Eyes. com has a new issue of preferred stock it calls 20/ 20 preferred. The stock will pay a $ 20 dividend per year, but the first dividend will not be paid until 20 years from today. If you requirea return of 8 percent on this stock, how much should you pay today? oos 150 Problem Z: Alexander Corp. will pay a dividend of $ 2.72 next year. The company has stated that it will maintain a constant growth rate of 4.5 percent a year forever. If you want a return of 12 percent, how much will you pay for the stock? What if you want a return of 8 percent? What does this tell you about the relationship between the required return and the stock price? .12 The Sleeping Flower Co. has earnings of $1.75 per share. The benchmark PE for company is 18. What stock price would you consider appropriate? What if the benchmark PE were 21? Problem 9 e, Inc, is a new company and currently has negative earnings. The company's sales are $ 1.2 - sales ratio is 5.2, what is TwitterMe million and there are 130,000 shares outstanding. If the benchmark price your estimate of an appropriate stock price? What if the price- sales ratio or 130,000 Problem 10 Apocalyptica Corporation is expected to pay the following dividends over the next four years: $ 3,$ 10, $ 15, and $ 3.08. Afterwards, the company pledges to maintain a constant 5 percent growth rate in dividends, forever. If the required return on the stock is 11 percent, what is the current share :/ 12. % -5131 price? Problem11: Yang Corp. is growing quickly. Dividends are expected to grow at a rate of 25 percent for the next three years, with the growth rate falling off to a constant 6 percent thereafter. If the required return is 13 percent and the company just paid a $ 2.50 dividend, what is the current share price? Cinti

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts