Question: Please check my work. If it is incorrect, provide solution and show work. 1. Express Revenues in real terms. Then, using the information on the

Please check my work. If it is incorrect, provide solution and show work.

1. Express "Revenues" in real terms. Then, using the information on the growth rate and the rate of return, compute the present value (PV) of revenues.

Revenues = 270,000/(1.06) = 254,716.9811/.11-.04 = 3,638,814.01571

2. Express "Labor costs" in real terms. Then, using the information on the growth rate and the rate of return, compute the present value (PV) of labor costs.

Labor costs = 190,000/(1.06) = 179,245.2830/.11-.03 = 2,240,566.0375

3. Express "Other costs" in real terms. Then, using the information on the growth rate and the rate of return, compute the present value (PV) of other costs.

Other costs = 60,000/(1.06) = 56,603.7735/.11-(-.01) = 471,698.1125

4. Express "Leasing Payments" in real terms. Then, using the information on the growth rate and the rate of return, compute the present value (PV) of leasing payments.

Leasing Payments = 95,000/(1.06) = 89,622.64/.11+.06 = 527,192

5. Calculate the projects NPV. Show your work.

NPV = Revenues + Labor costs + Other costs + Leasing Payments = 6,878,270.16571

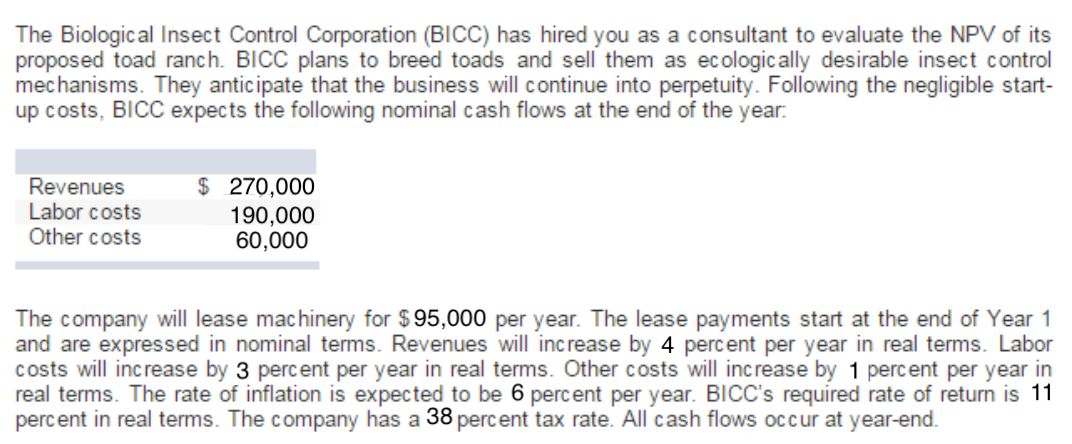

The Biological Insect Control Corporation (BICC) has hired you as a consultant to evaluate the NPV of its proposed toad ranch. BICC plans to breed toads and sell them as ecologically desirable insect control mechanisms. They anticipate that the business will continue into perpetuity. Following the negligible start- up costs, BICC expects the following nominal cash flows at the end of the year. Revenues Labor costs Other costs $ 270,000 190,000 60,000 The company will lease machinery for $ 95,000 per year. The lease payments start at the end of Year 1 and are expressed in nominal terms. Revenues will increase by 4 percent per year in real terms. Labor costs will increase by 3 percent per year in real terms. Other costs will increase by 1 percent per year in real terms. The rate of inflation is expected to be 6 percent per year. BICC's required rate of return is 11 percent in real terms. The company has a 38 percent tax rate. All cash flows occur at year-end. The Biological Insect Control Corporation (BICC) has hired you as a consultant to evaluate the NPV of its proposed toad ranch. BICC plans to breed toads and sell them as ecologically desirable insect control mechanisms. They anticipate that the business will continue into perpetuity. Following the negligible start- up costs, BICC expects the following nominal cash flows at the end of the year. Revenues Labor costs Other costs $ 270,000 190,000 60,000 The company will lease machinery for $ 95,000 per year. The lease payments start at the end of Year 1 and are expressed in nominal terms. Revenues will increase by 4 percent per year in real terms. Labor costs will increase by 3 percent per year in real terms. Other costs will increase by 1 percent per year in real terms. The rate of inflation is expected to be 6 percent per year. BICC's required rate of return is 11 percent in real terms. The company has a 38 percent tax rate. All cash flows occur at year-end

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts